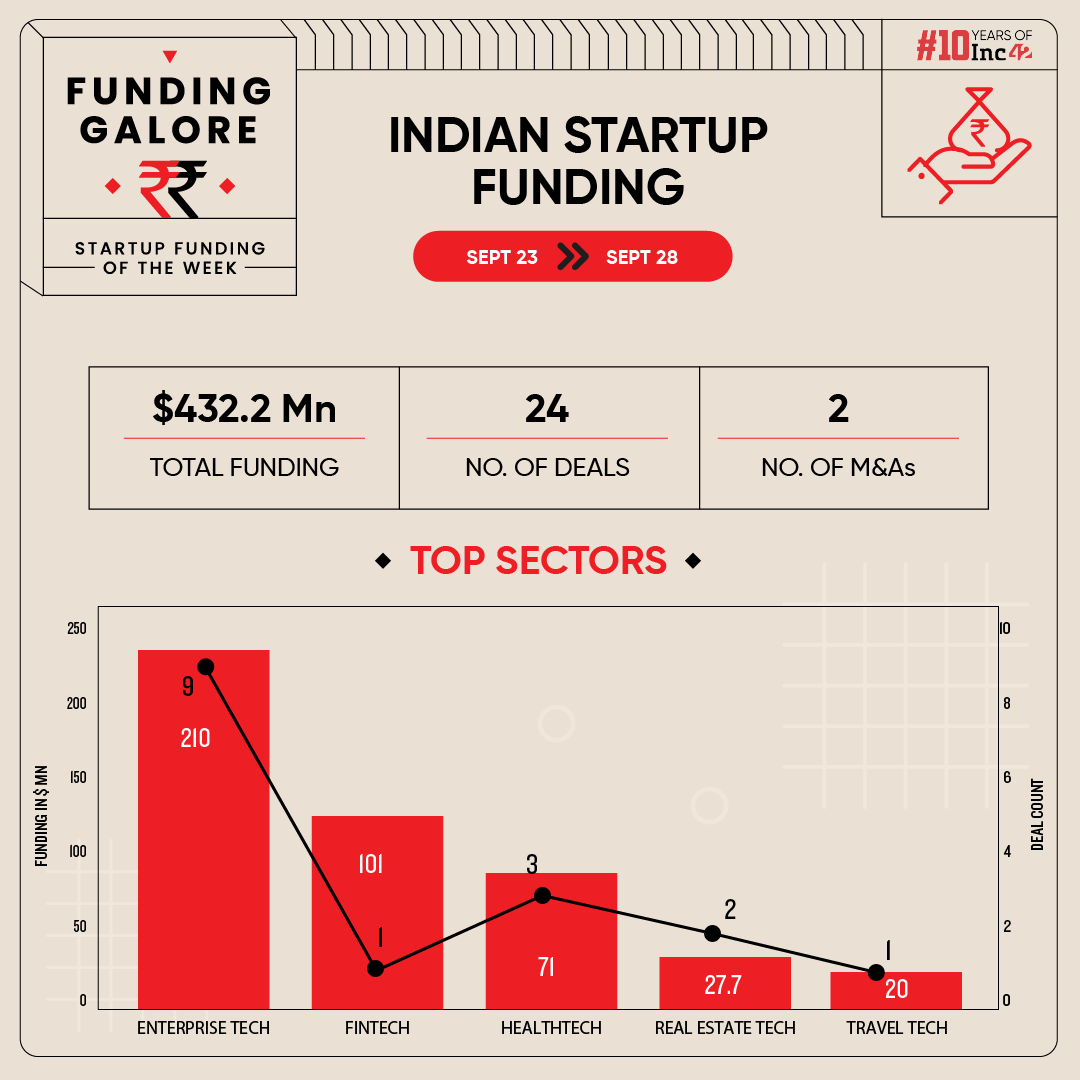

Indian startups cumulatively raised $432.2 Mn across 24 deals, a 3% decline from the $447.5 Mn raised last week via 22 deals

The week saw two mega funding round materialise with Whatfix’s $125 Mn fundraise and M2P Fintech’s $101 Mn raise

Peak XV emerged as the most active investor this week, backing Atlys and The Health Factory

Funding momentum across the Indian startup ecosystem continued to remain strong throughout the ongoing month. Between September 23 and 28, startups cumulatively raised $432.2 Mn across 24 deals, marking a 3% drop from the $447.5 Mn raised via 22 deals in the preceding week.

This week, the uptick in investment activity was largely driven by two large-sized deals, which include enterprisetech startup Whatfix bagging $125 Mn and M2P Fintech securing $101 Mn, with both nearing the unicorn status.

Funding Galore: Indian Startup Funding Of The Week [ Sep 23 – Sep 28 ]

| Date | Name | Sector | Subsector | Business Model | Funding Round Size | Funding Round Type | Investors | Lead Investor |

| 25 Sep 2024 | Whatfix | Enterprisetch | Horizontal SaaS | B2B | $125 Mn | Series E | Warburg Pincus, SoftBank | Warburg Pincus |

| 24 Sep 2024 | M2P Fintech | Fintech | Fintech SaaS | B2B | $101 Mn | Series D | Helios Investment Partners, Flourish Venture | Helios Investment Partners |

| 24 Sep 2024 | Qure.ai | Healthtech | Healthtech SaaS | B2B | $65 Mn | Series D | Lightspeed Venture Partners, 360 ONE Asset Management, Merck Global Health Innovation Fund, Kae Capital, Novo Holdings, Health Quad, TeamFund | Lightspeed Venture Partners, 360 ONE Asset Management |

| 24 Sep 2024 | Nurix AI | Enterprisetch | Horizontal SaaS | B2B | $27.5 Mn | Seed | Accel, General Catalyst, Meraki Labs | Accel, General Catalyst |

| 25 Sep 2024 | HomeLane | Real Estate Tech | Real Estate Services | B2C | $27 Mn | – | Hero Enterprise | – |

| 25 Sep 2024 | AdOnMo | Enterprisetch | Horizontal SaaS | B2B | $25 Mn | – | Rigel Capital, Sinar Mas | Rigel Capital, Sinar Mas |

| 24 Sep 2024 | Atlys | Travel Tech | Travel Planning & Activities | B2C | $20 Mn | Series B | Peak XV Partners, Elevation Capital | Peak XV Partners |

| 23 Sep 2024 | The Wellness Co | Consumer Services | Hyperlocal Services | B2C | $7.1 Mn | – | EaseMyTrip | EaseMyTrip |

| 26 Sep 2024 | Two Point O | Cleantech | Climate Tech | B2B | $6.3 Mn | Seed | Omnivore, Multiply Ventures, RTP Global, GrowX, Spectrum Impact | Omnivore |

| 25 Sep 2024 | Ahammune Biosciences | Healthtech | Healthcare Services | B2B | $5 Mn | Series A | pi Ventures, Capital2B, Colossa Ventures, Bipin Agarwal, Unicornus Maximus, Ideaspring Capital, Kotak Alternate Assets, Legacy Assets LLP, IAN | pi Ventures |

| 24 Sep 2024 | CoRover | Enterprisetch | Horizontal SaaS | B2B | $4 Mn | Series A | Venture Catalysts, CanBank Venture Capital Fund, IIM Calcutta, IIIT Delhi, Cogniphy LLC, Karekeba Ventures, Lead Angels | Venture Catalysts |

| 25 Sep 2024 | The Health Factory | Ecommerce | D2C | B2C | $3.5 Mn | Seed | Peak XV, Kartik Mehta, Aliasgar Tambawala, Sunil Tulsiani | Peak XV |

| 25 Sep 2024 | Atomicwork | Enterprisetch | Horizontal SaaS | B2B | $3 Mn | Seed | Rich Waldron, Avanish Sahai, Arun Penmetsa | – |

| 27 Sep 2024 | Vedantu | Edtech | K-12 | B2C | $2.4 Mn | Debt | Stride Ventures | Stride Ventures |

| 24 Sep 2024 | Tuco Intelligence | Ecommerce | D2C | B2C | $2 Mn | Seed | Fireside Ventures, Whiteboard Capital, Suashish Group, Vijay Nehra, Arjun Purkayastha | Fireside Ventures, Whiteboard Capital |

| 25 Sep 2024 | jhana.ai | Enterprisetch | Vertical SaaS | B2B | $1.6 Mn | – | Together Fund, Shyamal Anadkat, Scott Davis, Harshil Mathur, Shashank Kumar, CKunal Shah, Cory Levy, Ojas Shukla | Together Fund |

| 26 Sep 2024 | First Coffee | Consumer Services | – | B2C | $1.2 Mn | Seed | BEENEXT, Ashish Gupta, AngelList India, Ritesh Malik, Sahil Malik | BEENEXT |

| 25 Sep 2024 | aarna.ml | Enterprisetch | Horizontal SaaS | B2B | $1.2 Mn | Series A | Exfinity Venture Partners | Exfinity Venture Partners |

| 24 Sep 2024 | Pepsales | Enterprisetch | Horizontal SaaS | B2B | $1.1 Mn | pre-Seed | Chiratae Ventures | Chiratae Ventures |

| 24 Sep 2024 | ORIGHT | Agritech | Market Linkage | B2B | $1 Mn | Seed | Aeravti Ventures | Aeravti Ventures |

| 26 Sep 2024 | Care.fi | Healthtech | Healthtech SaaS | B2B | $956K | Debt | Wint Wealth, Caspian Debt | – |

| 25 Sep 2024 | Flent | Real Estate Tech | Shared Spaces | B2C | $776K | pre-Seed | WEH Ventures, AM Ventures, Pareto Holdings, Sanchan S Saxena, Aneesh Reddy, Arjun Vaidya, Shradha Sharma, Abhilash N | WEH Ventures |

| 23 Sep 2024 | Sharang Shakti | Deeptech | Defencetech | B2B | $598K | pre-Seed | AUM Ventures, Venture Highway, JK Group Family office, Appreciate Capital | AUM Ventures, Venture Highway |

| 23 Sep 2024 | TraqCheck | Enterprisetch | Horizontal SaaS | B2B | – | Seed | Caret Capital, Alok Oberoi, Aakash Anand | Caret Capital, Alok Oberoi |

| Source: Inc42 *Part of a larger round Note: Only disclosed funding rounds have been included | ||||||||

Key Startup Funding Highlights Of The Week

- Buoyed by Whatfix’s mega funding round, enterprisetech emerged as the investor favourite sector of the week. Besides, the sector witnessed the highest nine deals materialise via which startups raised $188.4 Mn.

- Fintech was a distant second, seeing M2P Fintech raising $101 Mn only.

- Venture Capital firm Peak XV was the most active investor this week, backing two startups.

- Seed funding picked up dramatically this week. Startups at this stage raised $44.5 Mn as against the $2.3 Mn raised during the past week.

Startup Fund Launches Of This Week

- SaaS startup Kissflow’s founder and CEO Suresh Sambandam launched a new VC firm MudhalVC, which aims to invest around INR 125 Cr in 25 to 50 early stage startups, with average ticket size ranging between INR 25 Lakh and INR 1 Cr.

- VC firm Tribe Capital has partnered with investment firm Oister Global to launch ‘Oister Tribe Ace Fund 1’. With a target corpus of $500 Mn, the fund will serve as the first alternative investment fund dedicated to secondary transactions.

- Bengaluru-based AIF Optimistic Capital rolled out a maiden fund INR 200 Cr (around $23.9 Mn) to invest in India’s microbrewery space.

Updates On Indian Startup IPOs

- Fintech unicorn MobiKwik secured approval from the Securities and Exchange Board of India (SEBI) for its INR 700 Cr initial public offering (IPO). The offer will entirely comprise a fresh issue of equity shares, with no offer for sale component.

- Foodtech major Swiggy filed updated IPO papers with the SEBI for an INR 3,750 Cr ($450 Mn) IPO. Swiggy’s public issue will comprise a fresh issuance of shares worth INR 3,750 Cr and an offer for sale (OFS) component of 18.53 Cr equity shares.

- Online furniture rental startup RentoMojo’s founder and CEO Geetansh Bamania will be looking to file its IPO within the next 18 months.

- SaaS unicorn Fractal is considering filing papers for a $500 Mn IPO with SEBI in November. The IPO will value the startup at $3.5 Bn.

Other Developments Of The Week

By Inc42 Media

Source: Inc42 Media