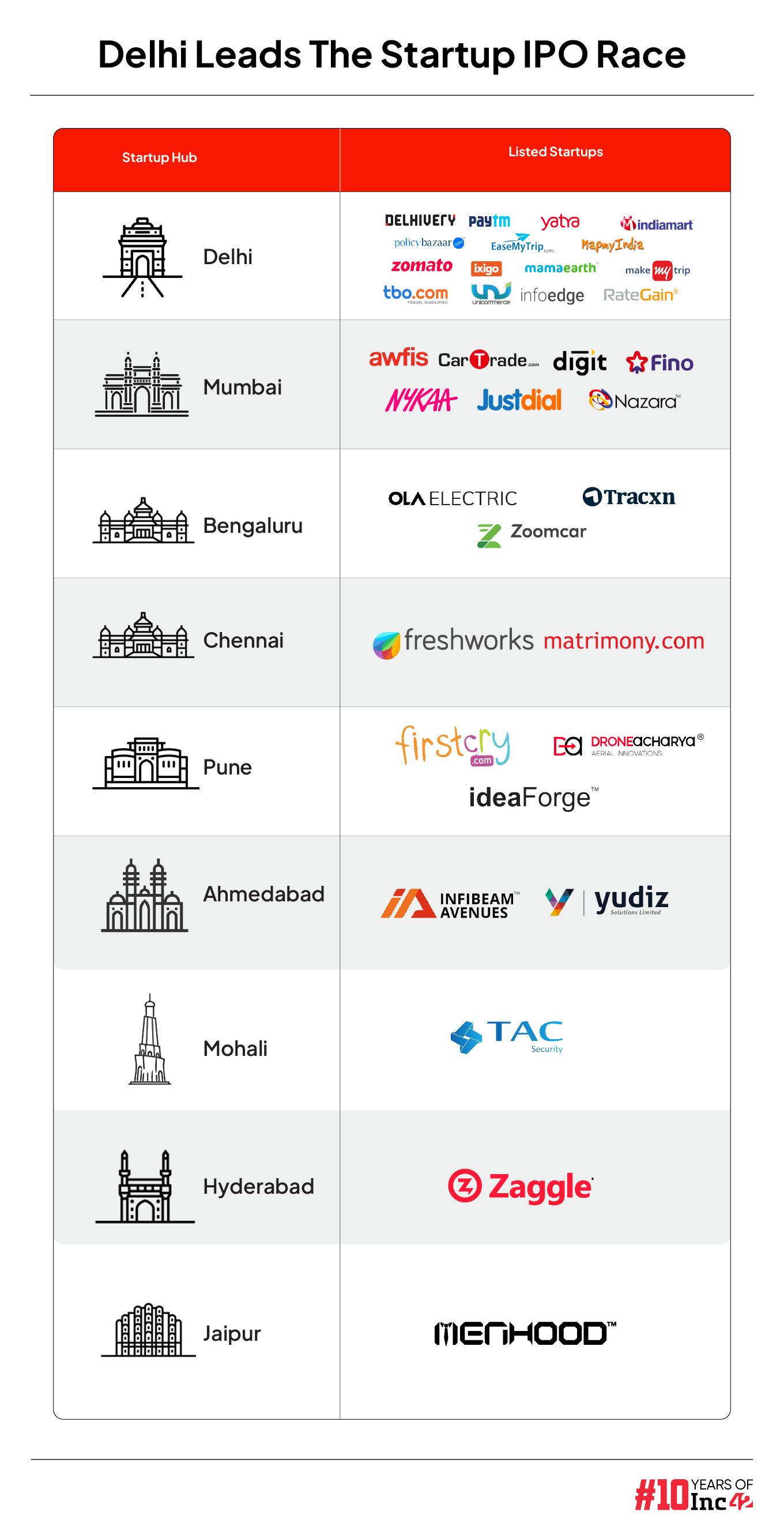

Delhi NCR has seen 15 startups get listed on the bourses, ahead of Mumbai’s 7 and Bengaluru’s 3

Of the 35 listed startups under Inc42’s coverage, Delhi based Zomato is the most valuable startup in India with market cap around $30 Bn

Despite a host of startups slated to make their public market debuts soon, Delhi NCR is expected to retain its lead in terms of startup IPOs

Despite Bengaluru being the startup capital of India, Delhi NCR leads the ‘Silicon Valley’ of India, Bengaluru, with a very comfortable margin in the startup IPO race.

According to Inc42’s ‘The State Of Indian Startup Ecosystem Report 2024‘, 15 new-age tech companies from the national capital region are listed on the stock exchanges. Delhi NCR-based companies account for 43% of the 35 such listed companies under Inc42’s coverage.

Delhi NCR-based listed startups include fintech major Paytm, logistics unicorn Delhivery, foodtech giant Zomato, Mamaearth parent Honasa Consumer, among others. In comparison, only three Bengaluru-based startups have been able to go public so far – electric vehicle (EV) manufacturer Ola Electric, market intelligence platform Tracxn, and Nasdaq-listed Zoomcar.

Interestingly, the country’s financial capital is also ahead of Bengaluru in the startup IPO race. Seven Mumbai-based startups have gone public so far, including coworking space provider Awfis, insurtech startup Go Digit, beauty ecommerce major Nykaa, gaming major Nazara Technologies, fintech Fino Payments Bank, and hyperlocal search engine provider Justdial.

Like Bengaluru, Pune has also seen three startup listings. While Chennai and Ahmedabad are home to two listed startups each, Mohali, Hyderabad and Jaipur have seen one startup each make it to the bourses so far.

How Delhi Forged Ahead

Delhi NCR leads in the startup IPO race despite not being the leader in terms of number of registered startups in the country. As per government data, there were 1,40,803 startups registered with the department for promotion of industry and internal trade (DPIIT) as of June 30, 2024.

Maharashtra led the list with 25,044 startups, followed by Karnataka with 15,019 startups. While national capital Delhi was home to 14,734 startups, Uttar Pradesh and Gujarat were home to 13,299 and 11,436 startups, respectively.

Access Free Report

It is also pertinent to mention that Bengaluru continues to lead in terms of startup funding trends. Indian startups raised $151 Bn across 10,500 deals between 2014 and H1 2024. Of these, Bengaluru-based startups bagged the highest capital at over $70 Bn.

In comparison, startups in Delhi NCR raised $44 Bn during the period, followed by Mumbai-based startups at $20 Bn.

So, how did Delhi NCR surged ahead in terms of IPOs? According to 100X.VC founder Shashank Randev, there are three key factors behind this – access to more land, more B2G (business-to-government) opportunities due to closeness to the central government geographically, and access to talent.

“Mumbai and Bengaluru are more congested geographically and the ecosystem often gets siloed in one pocket of the city. In NCR, you get chances to set up spaces in Delhi, Gurugram, and Noida without connectivity being an issue. Besides, the startup hub is also better connected to the political ecosystem and is not too far away from the financial capital of India, Mumbai. Hence, there is access to all sorts of resources in the city,” Randev said.

He added that while Bengaluru-based startups have better access to talent, the influx of tech talent is on the rise in Delhi NCR given the national capital region’s potential to expand geographically and offer more opportunities.

Concurring with this, Auxano Capital partner Brijesh Damodaran said, “This is driven by the interplay of several factors – namely market maturity (Delhi had 36 IPOs in last four years, second only to Mumbai with 50 IPOs), government support due to close proximity and diverse industry representation, coupled with presence of major educational institutions providing skilled human capital and also the entrepreneurial bug.”

Zomato – The Most Valued Startup

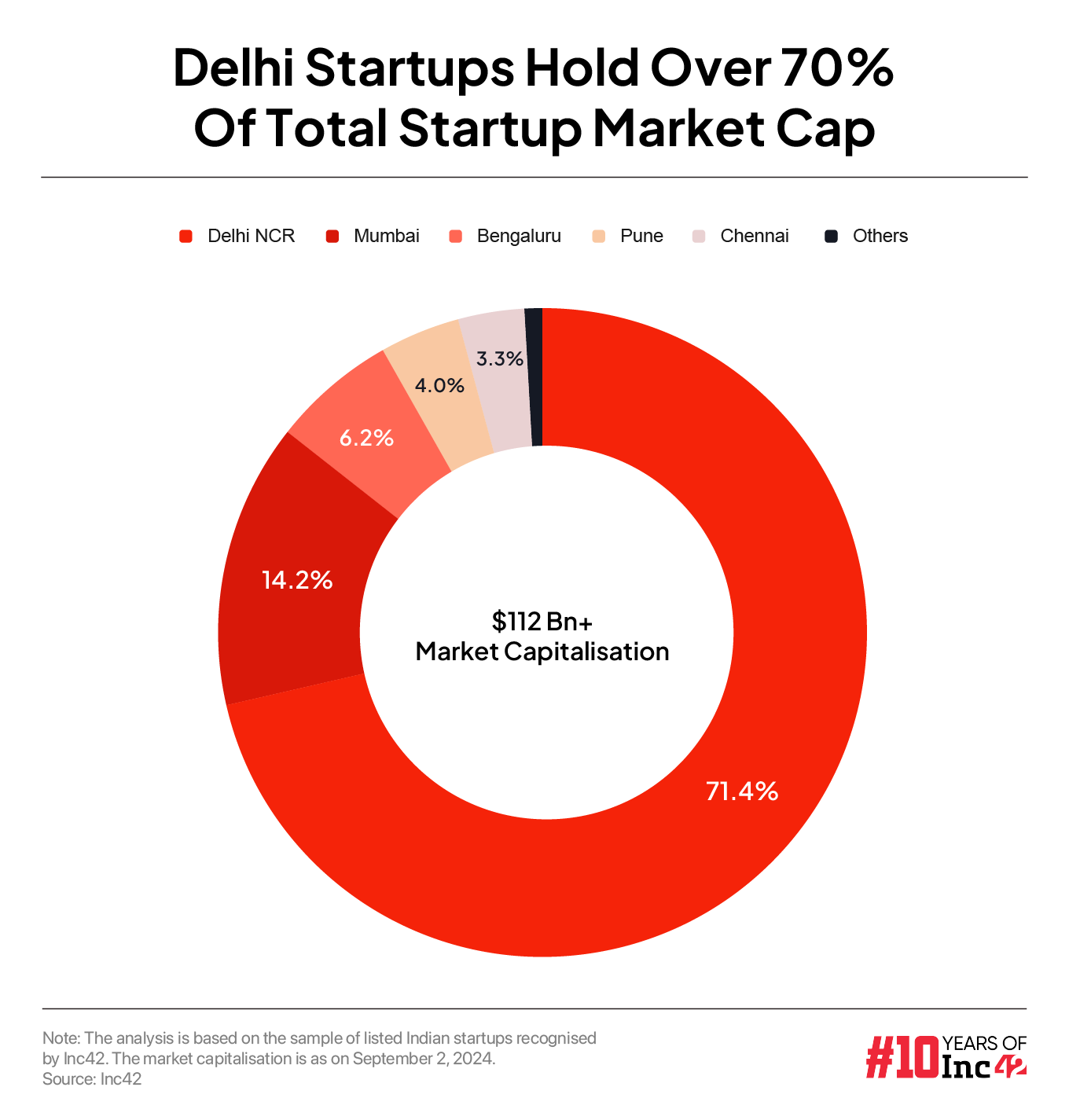

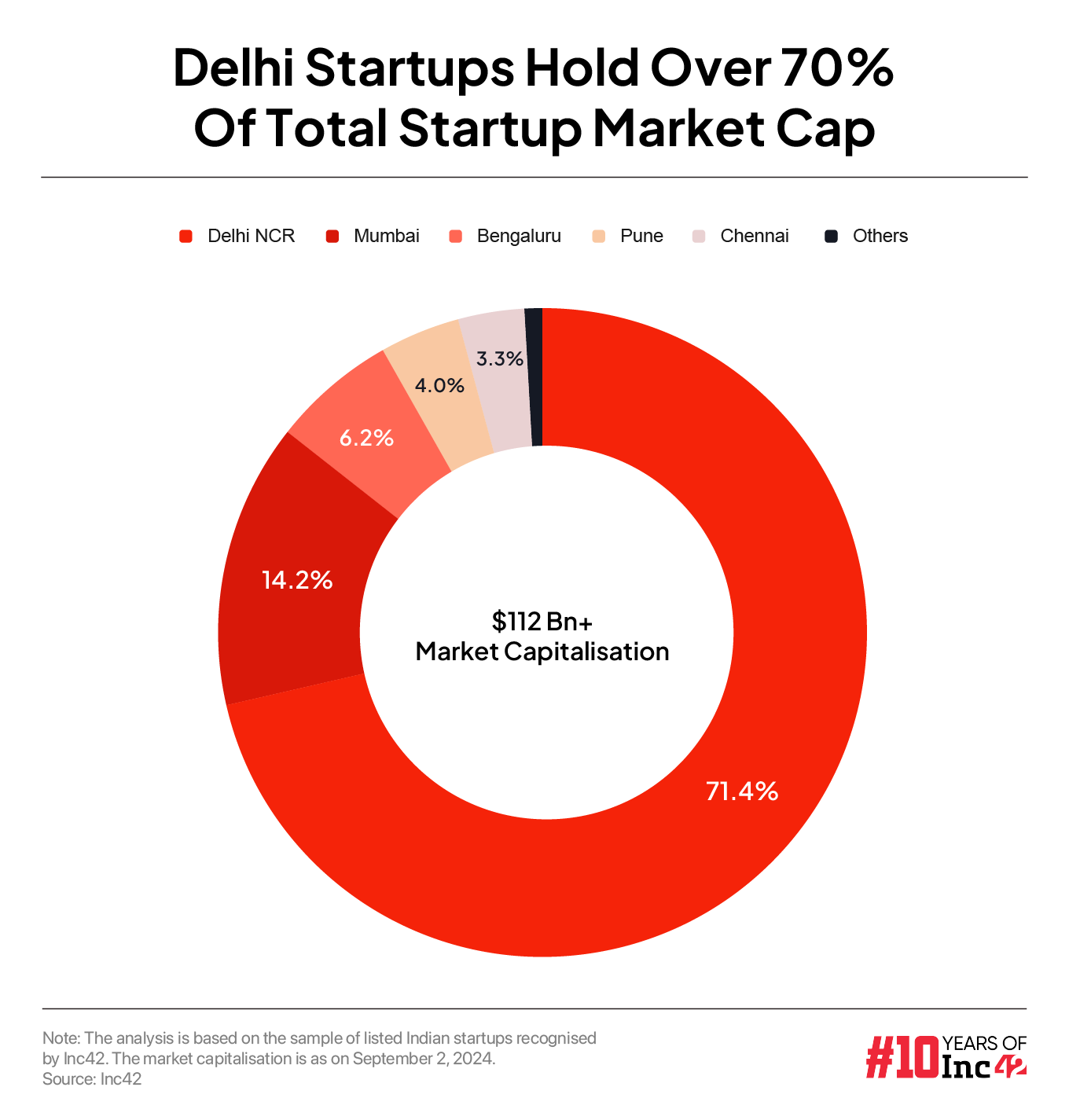

The 35 listed new-age tech companies had a total market capitalisation of over $112 Bn as on September 2. Of this, Delhi NCR based startups accounted for 71.4% of the cumulative market cap.

Meanwhile, Mumbai and Bengaluru startups accounted for 14.2% and 6.2% share in market cap, respectively.

From an individual lens, foodtech major Zomato is the most valued startup. As of September 2, Zomato’s market cap stood at $27 Bn mark. Later in the month, its market cap crossed the $30 Bn mark.

Meanwhile, one of the oldest Indian internet companies Info Edge is the second most valued company with a market cap of over $12 Bn. Trailing it is MakeMyTrip and Policybazaar parent PB Fintech, with their market caps sitting at around $11 Bn and $10 Bn, respectively. Notably, all of the aforementioned companies call Delhi NCR their home.

The Way Ahead For Startup IPOs

Amid the ongoing IPO boom, as many as 10 new-age tech startups listed on the bourses in 2024 so far. With a plethora of startups looking to make their public debuts soon, Delhi NCR is expected to retain its lead in terms of startup IPOs.

The following startups have received SEBI nod for their IPOs or are awaiting the market regulator’s approval to go ahead with their public listing plans:

Besides, a host of other startups, including Zepto, Shadowfax, IndiQube, Pure EV, Physics Wallah, have public listings on the cards in the near future. As such, the IPO run of the startups is expected to continue next year as well, with Delhi NCR likely to continue to be in the pole position.

“The top cities of Delhi, Mumbai and Bengaluru will continue to hold their position as more startups look to list on the bourses. With startup investing becoming more democratised and gaining traction across cities, there is more scope of startups from these cities as well in the coming decade. Irrespective of which city the company is based in, the ecosystem should grow. Moreover, with the continued reception for SME IPOs, enterprises across the board can look to raise via public markets,” Auxano Capital’s Damodaran said.

Access Free Report

By Inc42 Media

Source: Inc42 Media