India is experiencing its very own Startup Gold Rush. But more than 90% of the capital invested in Indian startups comes from outside of India, while Indian investors are still figuring out how it all works.

After two successful cohorts, Inc42 is back with AngelX 3.0 – India’s first-ever live angel investing program to master the art and science of angel investing from India’s top 1% of investors.

AngelX has already created 100+ new angel investors who have gone on to invest in 500+ startups, deploying more than ₹50 crore in capital.

India is on the brink of an economic revolution. We’re witnessing a transformation unlike anything before – and it’s happening at breakneck speed.

From economic liberalisation in 1991, it took us 33 years to hit the $4 trillion GDP mark. But what’s truly remarkable is that we’re on track to double that in the next 6 years, by 2030.

Let that sink in: 33 years for the first $4 trillion, but the next $4 trillion? Just 6 years!

This is not just another phase of growth, it’s the fastest wealth creation era India has ever seen, and at the epicentre of this revolution are startups.

We’re talking about an ecosystem brimming with potential, fueled by innovation, and ready to disrupt industries. The numbers tell the story:

- 1 lakh+ registered startups in India

- 118 unicorns valued at $354 billion

- 112+ soonicorns valued at $200 billion

- $150 billion+ invested in Indian startups since 2014

The momentum is building, and India is experiencing its very own Startup Gold Rush.

But there’s a catch: More than 90% of the capital invested in Indian startups comes from outside of India. Indian investors are putting in less than 10%. What does that mean?

A huge chunk of profits is flowing right out of India. And while we’re excited about global interest, wouldn’t it be nice if Indian investors got a bigger piece of the pie?

The reason for low domestic investor participation is that startups are a relatively new asset class, and many Indian investors are still figuring out how it all works.

More importantly, angel investing is not for the faint-hearted or the ill-prepared. It requires more than just capital — it demands foresight and vision, sharp instincts, a keen sense to observe opportunities, and access to a network that can get you in the room where deals happen.

This is why Inc42 launched AngelX in 2022.

Announcing AngelX 3.0

“AngelX has already created 100+ new angel investors who have gone on to invest in 500+ startups, deploying more than ₹50 crore in capital.”

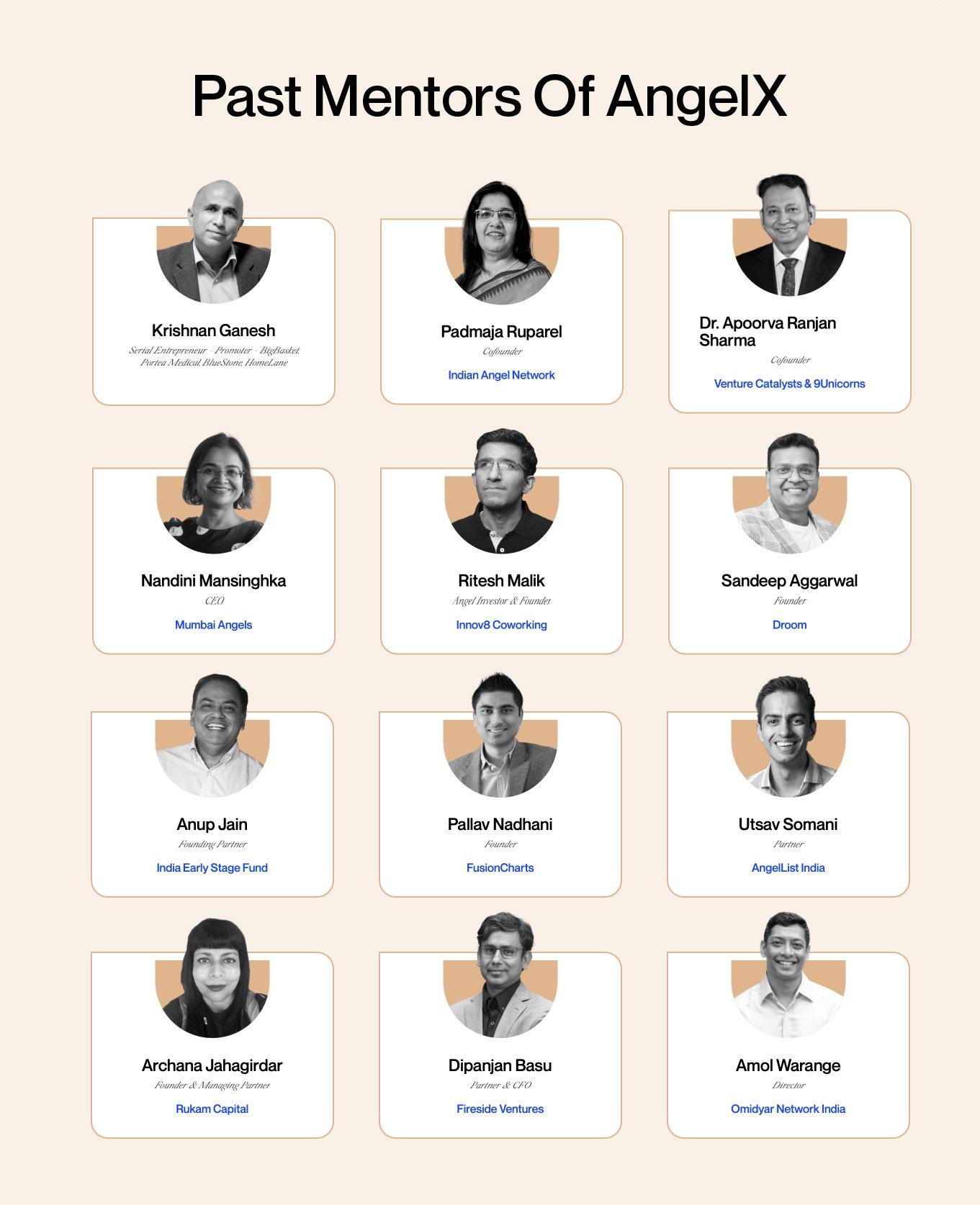

After two successful cohorts, Inc42 is back with AngelX 3.0 – India’s first-ever live angel investing program to master the art and science of angel investing from India’s top 1% of investors.

Imagine learning not from textbooks or theory, but from the very people who have already backed the unicorns of today.

Learn directly from early investors of BharatPe, Swiggy, OfBusiness, Curefoods, Third Wave Coffee, Jupiter Money, and pretty much every successful Indian startup.

AngelX isn’t just about learning, it’s about answering the big questions that will shape your investment future:

- What sectors should I invest in?

- How do I assess whether to bet on the startup idea or the founding team?

- How do I time my exit for maximum gains?

These questions will define your investment journey, and AngelX is where you’ll get all the answers.

The program starts on 23rd Nov 2024.

Learn Alongside An Ambitious Community

Angel investing is a team sport, and having the right co-investors on your side significantly ups your odds of success.

That’s why at AngelX, you won’t be learning alone. You’ll be part of a carefully curated group of HNIs who are just as ambitious and driven to succeed.

You’ll also get access to our alumni community of 100+ prolific investors who have already made over 500 investments.

AngelX community will give you access to a powerful deal flow, opening doors that would otherwise remain shut. Connections matter in this game, and AngelX ensures that you’re plugged into the right circles from day one.

And that’s not all: you get access to live session recordings, Inc42’s cutting-edge research reports and exclusive content, arming you with the latest trends, data, and insights that will keep you ahead of the curve long after the program.

Bottom line: A wise man once said that wealth is created not by the accumulation of money, but by the accumulation of knowledge. (We’ll let you figure out who.)

And for all the knowledge of angel investing, you have AngelX.

By Inc42 Media

Source: Inc42 Media