Navi moved up a spot to fifth position last month, processing 120.41 Mn UPI transactions

Kunal Shah’s CRED was ahead of Navi at the fourth position, processing 140 Mn transactions worth INR 47,982.71 Cr last month

There was no change at the top, with PhonePe, Google Pay and Paytm continuing to occupy the top three positions, respectively

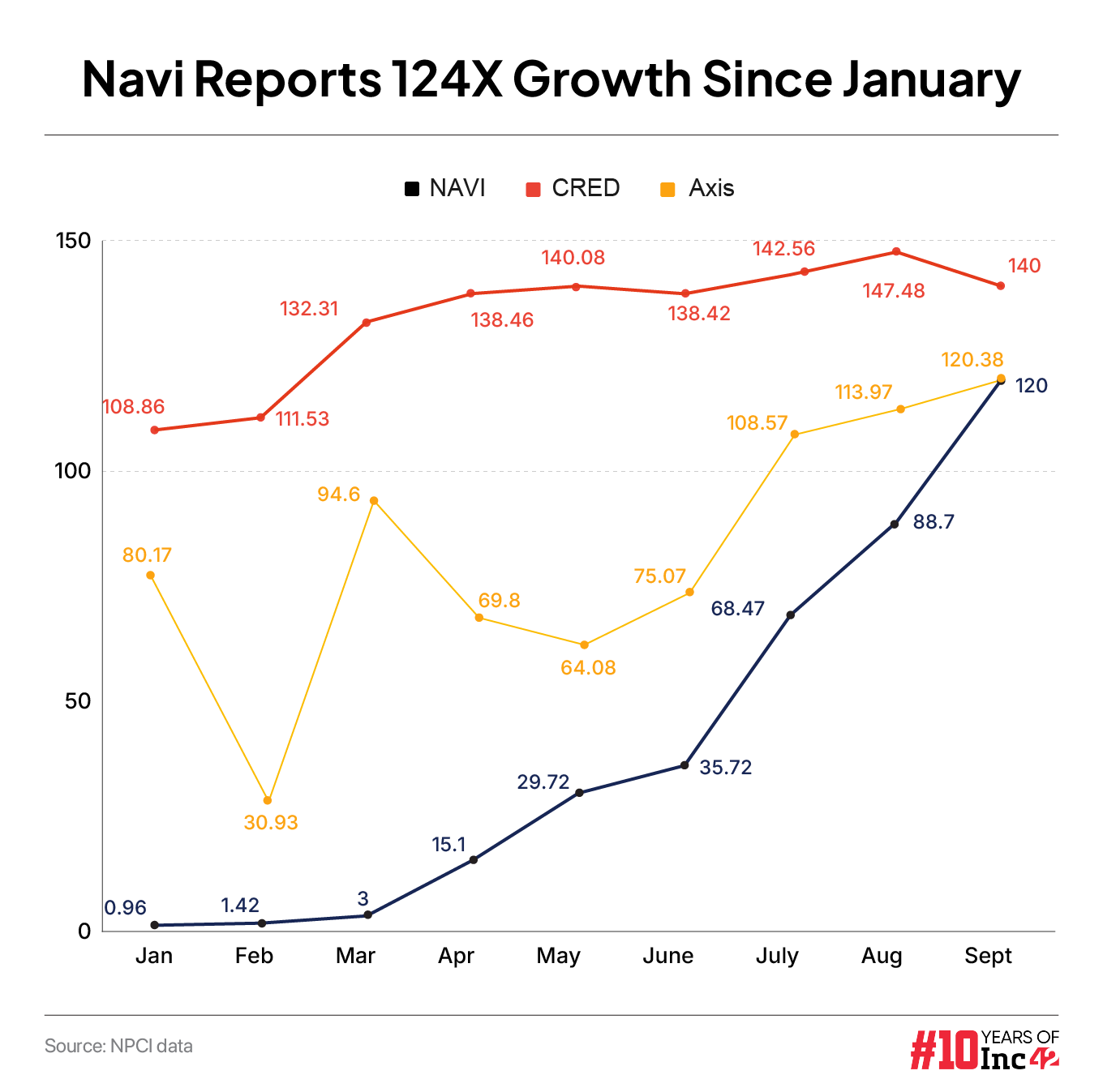

Continuing its upward momentum, Sachin Bansal’s Navi surpassed “Axis Bank apps” in terms of UPI transactions in the month of September. The fintech unicorn moved to the fifth spot in UPI transactions last month, improving from the sixth position in August.

Navi processed 120.41 Mn transactions in September, up 35,74% from 88.7 Mn transactions in August. According to the National Payments Corporation of India’s (NPCI) data, the value of Navi’s UPI transactions in September stood at INR 6,549 Cr.

With this, Navi overtook “Axis Bank apps”, which recorded 120.38 Mn transactions in September.

Kunal Shah’s CRED was ahead of Navi at the fourth position, processing 140 Mn transactions worth INR 47,982.71 Cr last month. Notably, CRED has seen little growth in UPI transactions over the last few months. From the start of this year until September, the company’s UPI transactions have mostly remained within the 130-140 Mn range.

However, Navi experienced exponential growth in the same period. In January, it recorded just 0.96 Mn transactions. This number increased to 15 Mn in April, before eventually surging to 120 Mn transactions by September.

(Amount in Mn)

However, there was no major change at the top of the charts. PhonePe continued to occupy the top spot with 7.2 Bn transactions worth INR 10,30,871 Cr. It was followed by Google Pay, which processed 5.6 Bn UPI transactions worth INR 7,46,690 Cr.

The market share of PhonePe and Google Pay in the UPI ecosystem stood at 48% and 37.4%, respectively, in September. At the third position was Paytm. It reported 1,064 Mn transactions worth INR 1,13,351.52 Cr. Its market share stood at around 7% in September, down from 12.79% at the start of this year.

Navi, which launched its UPI offering in August 2023, is part of Navi Technologies

Notably, Navi is one of the fastest-growing UPI apps in India. It recently launched credit line on UPI in partnership with Karnataka Bank.

Recently, in a post on X, Bansal said that ‘Credit on UPI’ can help close the credit gap for underbanked and underserved populations. “It’s time for all stakeholders to collaborate and build on the Credit on UPI stack to simplify and improve access to credit for everyone,” he said.

The company recently marked the close of $38 Mn (around INR 318.2 Cr) personal loans securitisation deal with financial and investment banking firm JP Morgan. Meanwhile, UPI continued its rise in September. The total UPI transactions rose 0.53% to 15.04 Bn in September from 14.96 Bn in August. The number of transactions jumped 42% on a year-on-year basis.

By Inc42 Media

Source: Inc42 Media