Layoffs continued to be the norm for Indian startups in 2024 as well. As many startups withered under the impact of extended funding winter and shutdowns, hundreds of startup employees were handed pink slips this year, too, carrying on the legacy issue of the past two years.

But, the new-age tech ecosystem found an interesting way to arrest the damage of talent loss – stock options. Interestingly, the year saw startups doling out employee stock ownership plan (ESOP) programmes in droves to attract and retain quality talent.

Notably, an Inc42 survey last year had indicated that many founders hinged their bets on stock options to lure and keep talent. At the time, about 55% of founders said that they were banking on ESOPs to bring the Indian workforce back to the startup ecosystem, and that is what exactly seems to have happened in 2024.

Fearful of the mass layoffs that took place in the Indian new-age tech ecosystem for the past two years, what brought back the confidence this year was the wealth generated by stock options for startup employees. The biggest example was Swiggy’s initial public offering (IPO), which minted 500 “Crorepatis”.

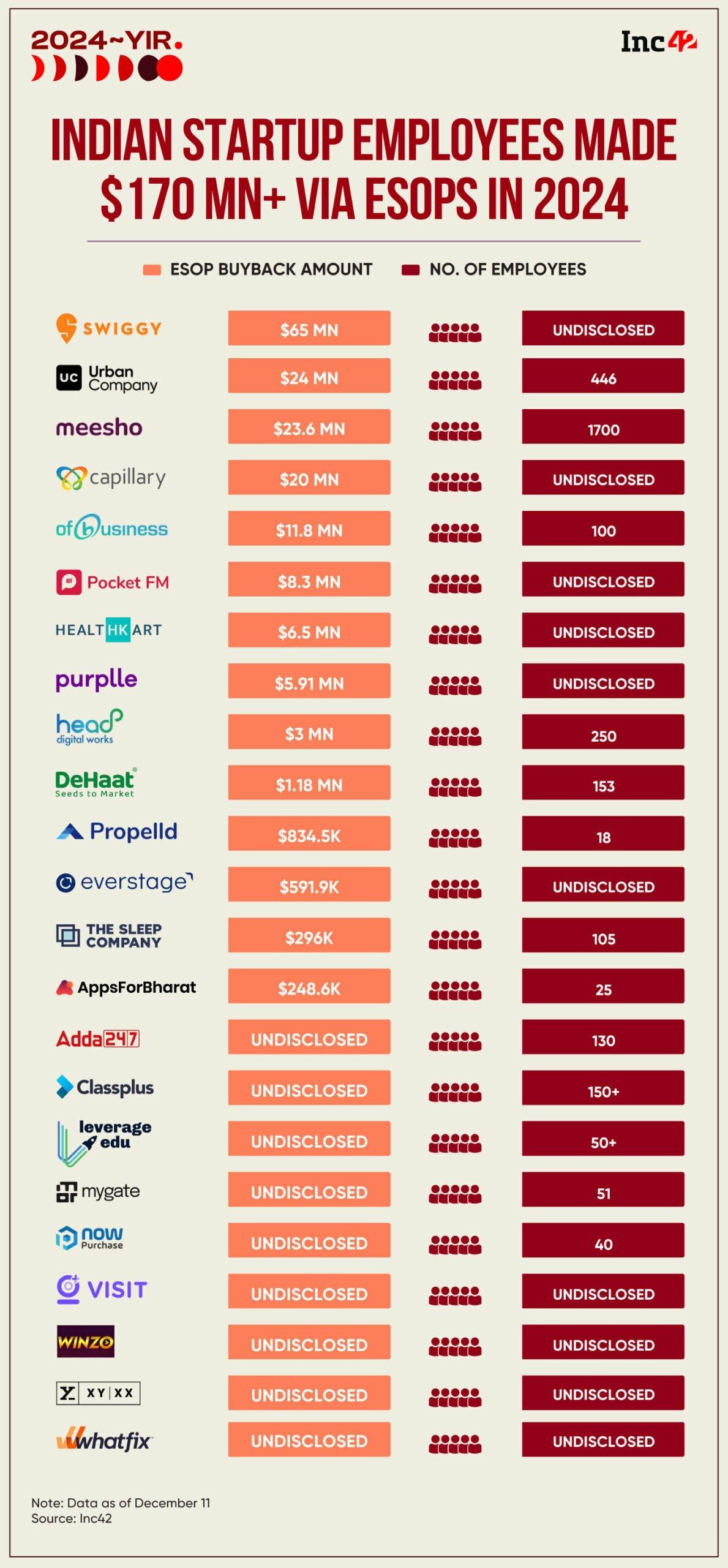

Realising that stock options were a good way to retain quality talent, a slew of big names in the homegrown startup landscape undertook some of the biggest ESOP liquidation programmes, including the likes of Meesho, Urban Company, Capillary Technologies and OfBusiness.

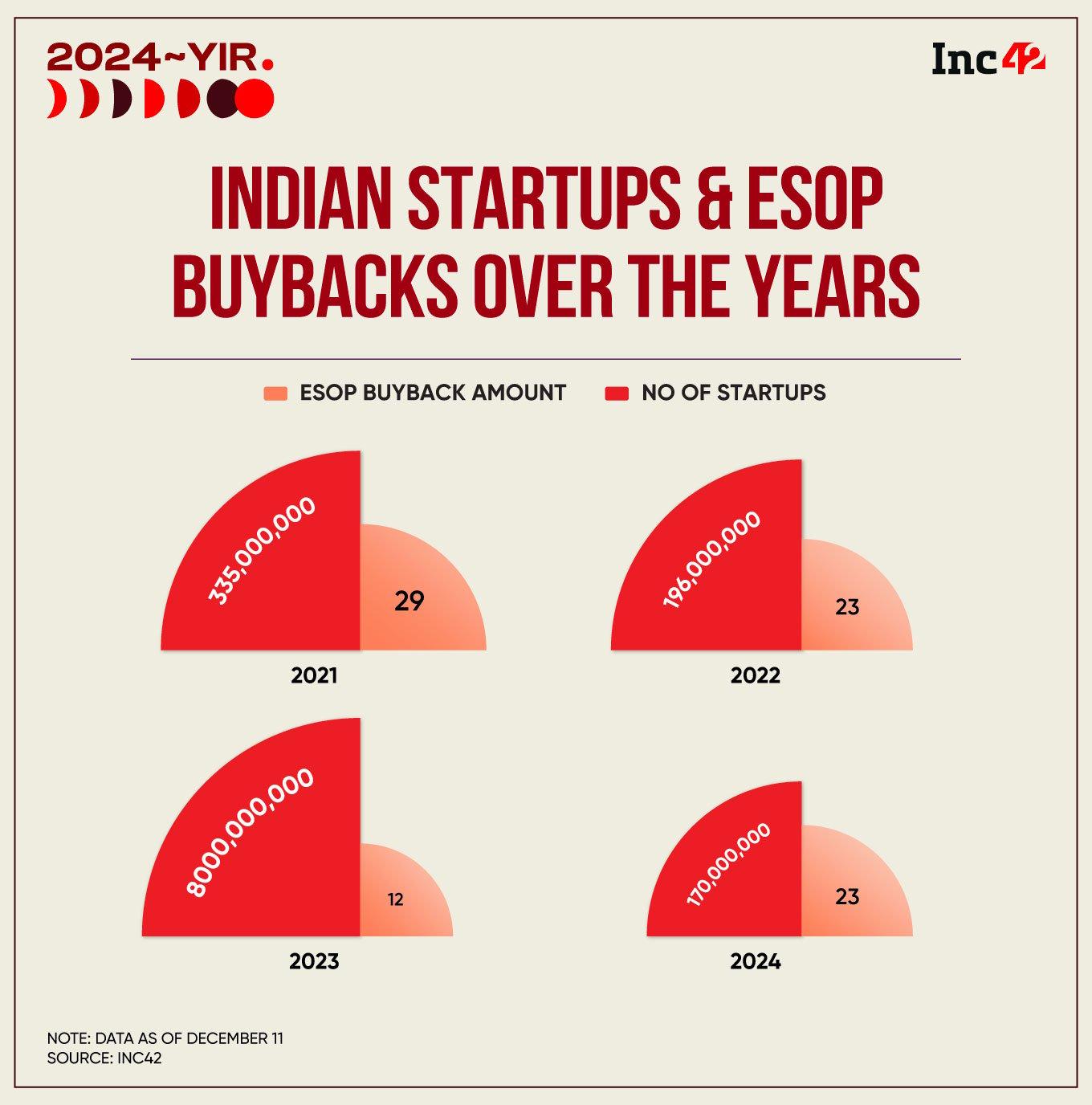

As per Inc42 data, as many as 23 startups undertook buyback schemes, which helped 3,000+ employees generate wealth worth more than INR 1,448 Cr (around $ 170.7 Mn).

However, the total worth of ESOP buyback in 2024 declined by a whopping 73% from last year. In 2023, ESOP buybacks by a mere 12 startups helped their employees net $850 Mn, albeit $700 Mn came from Flipkart alone.

If we rationalise for Flipkart, Indian startups put up a rather good show on the ESOP front in 2024. In addition, the number of startups that participated in ESOP buyback programmes this year also nearly doubled compared to last year.

While it remains to be seen whether the coming year 2025 bodes well for the new-age tech workforce on the ESOP front, Inc42 has prepared a list of Indian startups that rewarded their employees through stock option buyback schemes and helped them make more wealth. This endeavour is part of the 11th edition of Inc42’s annual “Year in Review” series — 2024 In Review.

Editor’s Note: This is not a ranking of any kind, and the startups have been listed alphabetically

130 Employees Participated In Adda247’s First ESOP Payouts

Google-backed edtech startup Adda247 rolled out its first ESOP buyback programme in July 2024. According to Adda247 at least 130 employees participated in the buyback programme.

The Delhi NCR-based edtech startup allotted INR 150 Cr (around $17.75 Mn) worth of stock options under its ESOP grant programme 2022, with a total vesting period of four years.

Though the startup did not disclose the total ESOP payout amount, it claimed that the buyback came to around averaging 40 times of the initial purchase price.

The edtech’s financial performance has shown promising signs. Adda247 reported an 88% year-on-year (YoY) increase in its revenue in FY24 to INR 243.39 Cr from INR 129.65 Cr in FY23. This helped the startup cut its losses by 66% to INR 101 Cr in FY24 from INR 296 Cr a fiscal ago.

Adda247 made two major acquisitions this year, starting first with Ekagrata Eduserv in July and PrepInsta in September. The startup did not disclose the financial details of these acquisitions.

AppsForBharat Rolls Out Its First ESOP Buyback Scheme Worth INR 2.1 Cr

AppsForBharat, which operates spiritual platform Sri Mandir, rolled out its ESOP buyback programme worth INR 2.1 Cr last month (November 2024). It will allow 25 of its employees to cash out their stocks, creating wealth for them.

The payout programme was initiated by partnering with Infinyte.Club, a Bengaluru-based wealthtech startup.

The founder of AppsForBharat, Prashant Sachan, said in a statement that the stock option buyback programme was in line to reward employees who played an important role in the growth of the company. He also added that the leadership did not participate in the ESOP payout.

Peak XV-backed AppsForBharat also bagged $18 Mn in a Series B funding in September, led by Nandan Nilekani’s VC fund Fundamentum.

The Bengaluru-based spiritual and religious service provider recorded a jump of 5X in its losses to INR 44.9 Cr in FY23 from INR 9 Cr in the previous fiscal year.

Capillary Designates $20 Mn For ESOP Buyouts

Customer loyalty and engagement solutions provider Capillary Technologies secured an extended Series D of $140 Mn, bagging $95 Mn in secondary transactions. Out of these, the company provisioned $20 Mn for ESOP buyouts.

At the time of ESOP allocation, founder Aneesh Reddy said in a statement, “Our employees are the backbone of Capillary’s success, and we are dedicated to rewarding their hard work and dedication. The ESOP allocation reflects our commitment to fostering a culture of ownership and accountability within our organisation.”

Last year in June, Capillary raised $45 Mn in its first leg of Series D round from Avataar Ventures and its limited partners (Pantheon, 57Stars, and Unigestion), Filter Capital, and Innoven Capital.

Sequoia-backed Capillary also made to two major acquisition last year. First came in April when it bought Brierley and then it acquired Tenerity in June.

Capillary slipped into the red in FY22, posting a standalone net loss of INR 22.2 Cr. It had posted a net profit of INR 16.7 Cr in FY21.

Classplus’ ESOP Buyback Benefits Over 150 Staffers

In February, edtech SaaS platform Classplus liquidated its ESOPs for third time in last three years allowing over 150 of its employees to participate in the programme. It did not disclose the amount of the payout programme.

In the current ESOP payout, employees across business verticals will reap the benefits and as per a statement by cofounder and CEO Mukul Rustogi, most of the participants were youngsters, a 23-year old being the youngest of them all.

Rustogi also cited that in an infamous segment like edtech, it was quite rare to see an edtech startup taking such an initiative for its employees.

The Delhi-NCR based completed its first ESOP buyback, which was pegged at $1 Mn where 30 employees benefited.

Tiger-backed soonicorn continued its spree for making losses in FY23 by clocking a net loss of INR 256.6 Cr versus a loss of INR 163.5 Cr in the previous fiscal year.

DeHaat Completed Its First Ever ESOP Buyback Worth INR 10 Cr

Agritech startup DeHaat marked the completion of its first ever ESOP buyback programme worth INR 10 Cr in June. Till date, the Peak XV-backed venture has issued ESOPs worth INR 100 Cr to 200 of its employees. The current buyback programme will benefit 153 individuals including senior executives and employees part of the field teams.

Founded in 2012 by Shashank Kumar, Amrendra Singh, Shyam Sundar, and Adarsh Srivastav, Patna and Delhi NCR-based DeHaat is an agritech platform which focuses on helping Indian farmers in rural India providing them access to crop advisory services, financial services, help them buy good quality agri inputs such as seeds, fertilizers and seedling at affordable prices. It also gives farmers an opportunity to sell directly to institutional buyers.

DeHaat’s consolidated net loss surged by 3.67% to INR 1133.1 Cr in FY24 from INR 1094.4 Cr a year ago owing to its increasing expenses.

Everstage Announces Its ESOP Buyback Programme Of INR 5 Cr

Elevation Capital-backed Everstage announced its ESOP buyback programme in October. The buyback programme was pegged at INR 5 Cr. The programme is meant to reward the early employees of the Chennai-based enterprise tech startup.

The startup currently employs around 200 people but did not disclose how many employees will reap the benefits of the buyback programme.

The decision of liquidating employee stock options came on the back of Everstage’s Series D funding where it raised $30 Mn led by Eight Road Ventures and also saw participation from existing investors – Elevation Capital and 3one4 Capital.

Founded in 2020 by Siva Rajmani and Vivek Suriyamoorthy, Everstage is an enterprise tech startup, which offers sales automation solutions to companies.

It raised its seed funding round in 2021 worth $1.7 Mn led by 3one4 Capital and a year later it raised a Series A funding round of $13 Mn led by Elevation Capital.

E-Gaming Platform Head Digital Works Liquidates $3 Mn Worth ESOPs

The e-gaming platform Head Digital Works, which operates platforms like A23 Rummy, A23 Poker and Cricket.com, said it has decided to reward its employees with its first-ever ESOP payout initiative. The ESOP buyback is worth $3 Mn and was announced in November.

Out of the employees who hold stock options in the firm, 97% of them opted to sell their portion. The programme has benefitted about half of the total workforce of 500 employees at Head Digital.

Founded in 2006 by Deepak Gullapalli, Head Digital Works is an online e-gaming platform, which claims to have more than 60 Mn users across the segment of e-games it offers like rummy, fantasy sports and casual gaming. The platform claims to be a leading skill gaming platform with over 17 years of presence in the field. The skill gaming platform is backed by Clairvest.

The Hyderabad-based startup announced the ESOP buyback scheme at a time when the gaming sector is going through a slew of headwinds due to the imposition of 28% GST on the full value of bets placed.

HealthKart Rolls Out Its ESOP Payout Plan Of INR 55 Cr

In November, healthtech platform HealthKart said that it will be rewarding its employees with the startup’s first ESOP buyback plan worth INR 55 Cr. It was not clear how many employees would reap the benefits of this ESOP payout plan, but it would include its current and former employees.

The buyback plan was part of Delhi NCR-based HealthKart’s funding round of $153 Mn, co-led by venture capital (VC) firm ChrysCapital and asset management platform Motilal Oswal Alternates (MOA). The round also saw participation from Neo Group and its existing investor, A91 Partners.

Founded in 2011 by Sameer Maheshwari and Prashant Tandon, the startup sold its generic drug business to Tata 1mg in 2015 and its epharmacy to Tata Group in 2021. The Delhi-NCR based startup now operates an omnichannel consumer nutrition platform and is home to many digital brands like MuscleBlaze, HK Vitals and TrueBasics.

In FY24, the healthtech venture’s financial books swung in the black with Bright Lifecare Pvt Ltd, parent of HealthKart, posting a standalone net profit of INR 38.33 Cr against a loss of INR 164.73 Cr in FY23.

Leverage Edu Completes Its Second ESOP Buyback Plan

Blume Venture-backed Leverage Edu marked the completion of its ESOP buyback programme in June. The edtech startup did not disclose the payout amount but said that it has benefitted over 50 current employees across verticals.

As per the founder and CEO, Akshay Chaturvedi, a majority of employees sold less than a quarter of their vested shares and some did not sell at all.

The New Delhi-based edtech platform last liquidated its employee stock options in 2022.

Founded in 2017 by Chaturvedi, Leverage Edu is a study abroad platform, which help students to apply to foreign universities and prepares them for standardised English academic tests like TOEFL and IELTS through its digital apps namely – Study Abroad With Leverage Edu, LeverageIELTS and LeverageTOEFL.

The edtech’s losses widened 118% to INR 102.8 Cr in FY23 from INR 47.1 Cr in FY22.

Meesho Rolls Out Its Biggest ESOP Buyback Plan Worth INR 200 Cr

Bengaluru-based ecommerce unicorn, Meesho rolled out one of the biggest ESOP buyback programmes of 2024 worth INR 200 Cr (about $23.5 Mn), which would benefit around 1,700 of its current and former employees.

Meesho announced the employee stock options payout plan in March, which saw participation from eligible junior-level executives to senior level leadership personnel.

The SoftBank-backed ecommerce venture conducted three ESOP buyout programmes between 2020 and 2021 with a total payout value of $11.5 Mn.

Founded in 2015 by Sanjeev Barnwal and Vidit Aatrey, Meesho is an ecommerce platform, which sells multi-category products like fashion, home furnishing, jewellery and accessories at affordable prices. The unicorn claims to have over 15 Lakh sellers and over 140 Mn annual transactions on the platform.

On the back of improving margins, Meesho was able to cut its net losses by 81.8% to INR 304.9 Cr in FY24 from INR 1,675 Cr posted a fiscal year ago.

Improved Financial Performance Makes MyGate Liquidate Its Employee Stock Options

Bengaluru-based security and community management solutions provider, MyGate rolled out its ESOP buyback programme for its 51 employees. The Tiger Global-backed platform announced the development in March without disclosing the value of the buyback deal. The vesting period of the ESOP plan is four years.

As per a statement, the ESOP buyback plan came on the back of the startup’s FY23’s improved performance.

It reported a net loss of INR 227.1 Cr, widening more than 30% YoY. However, if one excludes the ESOP costs and financial liabilities, MyGate’s net loss would narrow down to 35% to INR 76.43 Cr in FY23.

In FY24, the community and management startup reported a 35.3% jump in its operating revenue from INR 96.2 Cr in the previous fiscal year. Further, the startup said that the cash burns declined by 84% during FY24, recording zero cash burn in the March quarter.

Founded in 2016 by Abhishek Kumar, Shreyans Daga and Vijay Arisetty, MyGate provides security and community management solutions to resident colonies which digitises maintenance services such as gate security, maintenance collection, clubhouse booking and resident complaints.

NowPurchase Employees Earned 100X In Its First ESOP Payout

NowPurchase, an online marketplace for metal manufacturers completed its ESOP payout plan in November. The Kolkata-based marketplace did not disclose the value of the buyback but said that participating employees earned 100X on their initial purchase.

Naman Shah, the founder and CEO of NowPurchase said that 40 of its employees got the opportunity to cash out their vested stock options while others chose to hold their shares. The ESOP liquidation programme benefitted employees across functions from people working in its warehouses to CXOs.

The ESOP programme at NowPurchase was launched in July 2019.

Founded in 2017 by Naman and Aakash Shah, the SaaS-based marketplace procures raw materials through its recycling services and metal cloud platform, which gives competitive prices to metal producers.

In September, NowPurchase raised $6 Mn in a mix of debt and equity rounds led by its existing investor Info Edge and others.

OfBusiness Undertakes ESOP Payout Programme Worth INR 100 Cr

B2B raw material procurement platform, OfBusiness initiated the liquidation of its employee stock options early this year. The ESOP payout is valued at INR 100 Cr, with a little over 100 employees bound to benefit.

The liquidation programme began early this year, however INR 70 Cr was liquidated in the last three months prior to October when the development was announced.

The ESOP buyback plan comes on the back of OfBusiness’ secondary share deals, which saw participation from HNIs and family offices. Prior to this, Inc42 reported that Zodious Capital, an early investor in OfBusiness, made its full exit via a secondary share sale worth $100 Mn-$120 Mn.

The Delhi NCR-based unicorn has liquidated a total of INR 350 Cr between 2021 and 2022.

Prior to filing its papers for IPO, the startup is likely to do another secondary share sale deal worth between $200 Mn to $250 Mn, giving partial exits to its existing investors such as Z47 (formerly known as Matrix Partners India) and Alpha Wave Global.

Founded in 2016 by Asish Mohapatra, Ruchi Kalra, Vasant Sridhar, Bhuvan Gupta, and Nitin Jain, OfBusiness provides raw material procurement and financing solutions to SMEs.

In FY24, OfBusiness’ net profit jumped 30% YoY to INR 603 Cr.

Pocket FM Undertakes ESOP Liquidity Programme Worth $8.3 Mn

Audio entertainment platform Pocket FM marked its first ESOP buyback plan worth $8.3 Mn, which saw participation from the startup’s exiting and former employees in April.

Founded in 2018 by Rohan Nayak, Nishanth KS and Prateek Dixit, Pocket FM is an audio series platform, which provides content in multiple regional languages.

In FY24, Lightspeed-backed startup recorded almost a 5X surge in its operating revenue to INR 1,051.97 Cr from INR 176.36 Cr in the previous year.

Pocket FM raised $103 Mn in a Series D round led by Lightspeed with participation from Stepstone Group. The fresh funds were deployed to expand into foreign markets, strengthen its content library and create a strong IP playbook for writers.

Propelld’s ESOP Buyback Worth INR 7.05 Cr

Education-focussed fintech startup Propelld marks the completion of its ESOP liquidation programme worth INR 7.05 Cr with 18 of its employees participating in the same. India Angel Network-backed startup further expanded its ESOP pool with the allotment of another INR 6.5 Cr worth stock options among 70 employees. The allotment was undertaken on the basis of the performance and potential of employees.

Founded in 2017 by Bibhu Prasad Das, Victor Senapaty, and Brijesh Samantaray, Propelld provides students with education loans via online channels. The platform claims to go beyond traditional ways of dispatching loans to students by focussing on students’ learning capabilities and employment potential to assess their eligibility for a loan.

Propelld raised a debt funding round of $25 Mn for its non-banking financial company (NBFC) arm, Edgro Finance.

Purplle Offers ESOP Buyback To Its Employees Worth INR 50 Cr

Beauty ecommerce marketplace Purplle paved the way for the largest-ever ESOP buyback programme worth INR 50 Cr. The startup has allotted stock options to 320 of its employees till date. Of the total, 85 have liquidated their share worth INR 75 Cr in three rounds of ESOP payouts.

The employee stock option liquidation came on the back of Purplle’s INR 1,000 Cr funding, which was a mix of primary and secondary sale of shares.

Founded in 2012 by Manish Taneja and Rahul Dash, Purplle sells beauty products and appliances. It sells products of several D2C brands, including Plum, WOW Skin Science, mCaffeine, Maybelline and SUGAR Cosmetics, on its platform.

The ecommerce unicorn reported operating revenue of INR 679.6 Cr in FY24, while net losses were reduced by 46% to INR 124.1 Cr in FY24.

Swiggy’s $65 Mn ESOP Payout For Its Employees

The listed foodtech giant made the biggest ESOP buyback of 2024 worth $65 Mn, benefiting employees at all levels and across functions.

Though Swiggy did not say how many employees reaped the benefits of the ESOP liquidation programme, the Bengaluru-based company has facilitated over INR 1,000 Cr via five different ESOP buyback rounds over the years, helping more than 3,200 employees to mint long-term wealth.

Reportedly, cofounders Sriharsha Majety and Nandan Reddy also sold their shares in the ESOP liquidation programme.

Swiggy’s September quarter (Q2) of FY25 saw a 30% increase in its operating revenue at INR 3,601.45 Cr from INR 2,673.33 Cr in the year-ago period.

The Sleep Company Rolled Out Its INR 2.4 Cr ESOP Payout

Mumbai-based The Sleep Company launched its second consecutive ESOP buyback programme in April, worth INR 2.4 Cr, providing long-term wealth benefits to 105 employees.

About 50% of its staffers who liquidated their shares were women employees. Also, the liquidation plan saw participation from junior executives to senior leadership personnel as part of the board.

Last year, too, the startup initiated an employee stock buyback programme valued at INR 83.47 Lakh, which benefitted 62 of its employees.

Founded in 2019 by Priyanka Salot and Harshil Salot, The Sleep Company has seen a 28X growth in its total revenue to INR 328.19 Cr in FY24 from INR 11.74 Cr in FY21.

Due to rapid scale-up, it posted a loss of INR 48.31 Cr in FY24, up from INR 37.06 Cr in the previous fiscal year.

Urban Company Announced Its ESOP Liquidation Plan Worth INR 203 Cr

Hyperlocal service startup undertook one of the biggest ESOP liquidation programmes of 2024 worth INR 203 Cr, which gave its 446 employees an opportunity to generate wealth.

The ESOP buyback programme was facilitated by the secondary sale of shares to existing investors Vy Capital, Prosus, along with Dharana Capital.

As of now, Delhi NCR-based unicorn has granted ESOPs to 1,593 current and ex-employees. Of the total number of employees, 784 have liquidated INR 306 Cr worth of shares in five ESOP secondary sale programmes.

Founded in 2014 by Abhiraj Singh Bahl, Raghav Chandra and Varun Khaitan, Urban Company is a consumer services startup that offers a range of services, including home cleaning, electric appliance repair, and saloon services.

Urban Company’s net revenue surged by 30% YoY to INR 827 Cr in FY24, while its loss before tax reportedly declined by 70% to INR 93 Cr in FY24.

Visit Health Undertakes ESOP Payout Via Secondary Share Sale

Delhi NCR-based Visit Health conducted ESOP buybacks through the secondary sale of shares. However, the company did not disclose the details of the investor who participated in the secondary sale.

Further, the worth of ESOP liquidation and the number of employees who sold their vested shares were also not revealed.

The ESOP payout took place when Visit Health raised INR 250 Cr in a mix of capital infusion and secondary sale purchase. The stakes which were sold in the secondary share sale were held by PB Fintech’s healthtech arm Docprime Technologies.

Founded in 2016 by Vaibhav Singh, Anurag Prasad, Chetan Anand and Shashvat Tripathi, Visit Health is an online consultation platform connecting patients with physicians and other medical experts.

Whatfix Liquidates ESOPs In A Secondary Purchase Deal

SoftBank-backed Whatfix reportedly facilitated an ESOP buyback plan through its secondary share sale in October.

With this, Whatfix marked its fourth liquidity programme for its existing investors, including ESOP buybacks with a total value of $58 Mn.

However, the company did not reveal the ESOP’s valuation or the number of employees who liquidated their shares.

Founded in 2013 by Khadim Batti and Vara Kumar, Whatfix earns revenue by selling subscriptions and professional services to other businesses. The digital adoption platform offers solutions for onboarding new customers, effective training and better support to users through a contextual content display at the time of need.

Whatfix reported an operating revenue of INR 425 Cr in FY24, while its net loss was reduced by 20% to INR 263 Cr.

WinZO Marks The Completion Of Its Fourth ESOP Buyback

Online gaming platform WinZo completed its fourth ESOP liquidation programme, with 30% of its employees completing the vesting period of two years.

Delhi-based WinZO has undertaken three ESOP buyback programmes between 2021 and 2023, building wealth for their employees.

Founded in 2018 by Paavan Nanda and Saumya Singh, WinZO is a skill-based e-gaming venture that partners with third-party game developers and hosts it on its platform. It generates revenue from the platform fee that it charges from its users.

XYXX Unveiled Its Maiden ESOP Liquidation Exercise

Menswear D2C startup XYXX announced its ESOP buyback programme in April, which saw eligible senior managers, heads of departments and the leadership team liquidate their vested shares.

The Amazon-backed D2C brand did not disclose the size of the buyback but said that employees made a 6X premium on their initial purchase.

Founded in 2017 by Yogesh Kabra, XYXX is a menswear D2C brand, which sells products across multiple categories like underwear, loungewear and athleisure.

Last year, XYXX raised a Series C funding of INR 110 Cr led by Amazon Smbhav Venture Fund.