Is the restaurant revolution taking place at long last? From small roadside eateries (including the ubiquitous dhabas) and popular QSR chains to midsize outlets and fine-dining havens, each crafted a unique culinary tale until the Covid-19 pandemic sent the crowds scurrying home.

But not for long. After a few months, the lockdown-fatigued populace started ordering from their favourite joints as the coronavirus waves gradually receded and the F&B supply chain presumably returned to normal despite a tenuous economy.

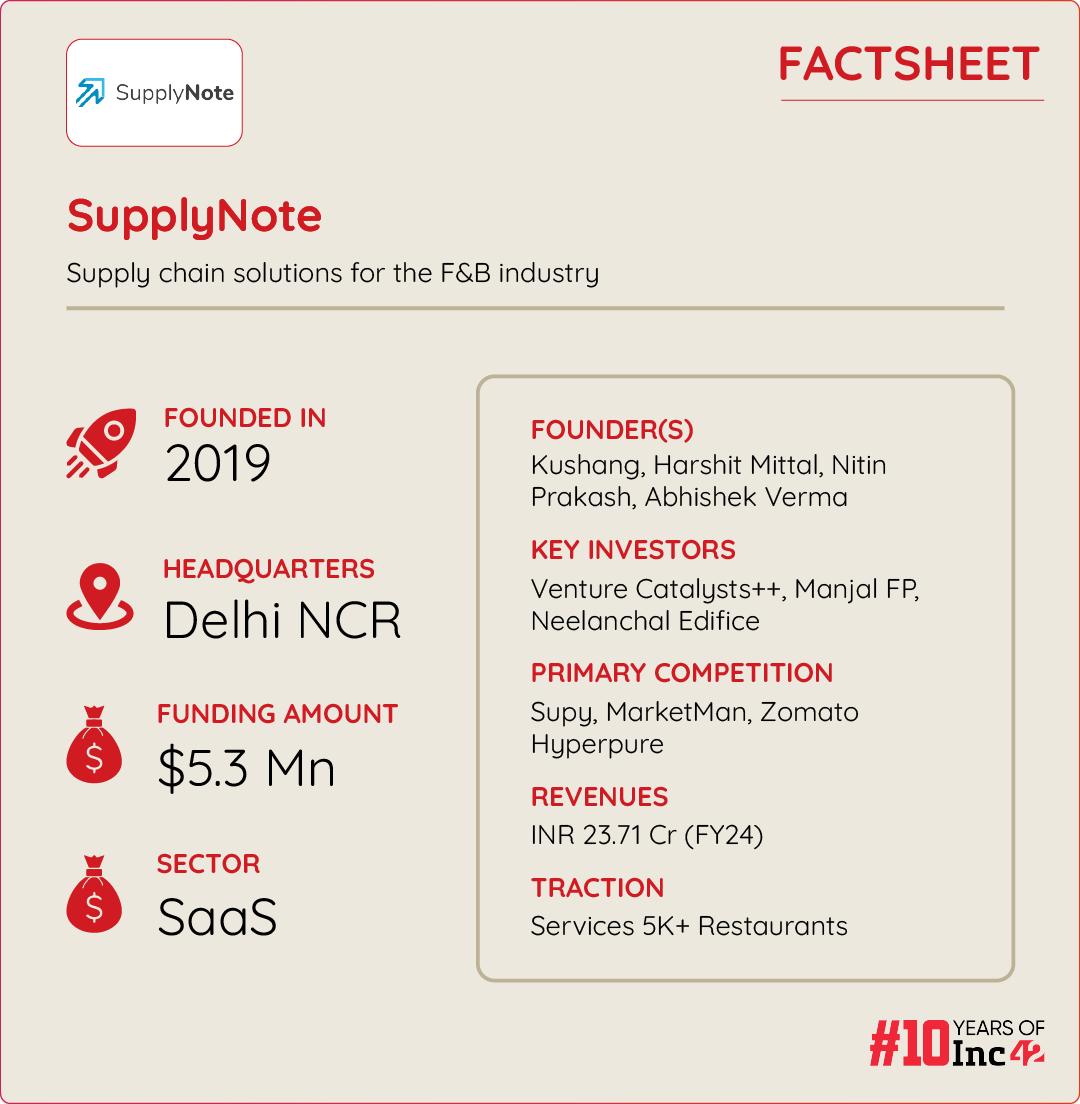

However, Kushang, Abhishek Verma, Nitin Prakash and Harshit Mittal – four IITians – firmly believed that the supply chain across the foodservice market needed speed, efficiency and a sustainable approach for better inventory management, procurement, waste reduction and a robust bottom line. To prove the point, they set up SupplyNote in 2019, a tech platform providing a bunch of SaaS and on-ground solutions to restaurants of all sizes.

India’s food service market is projected to reach a little over $125 Bn by 2029 from $77.5 Bn in 2024 due to key factors like growing urbanisation, rise in buying power and change in eating habits. But in spite of an estimated 10% CAGR for the projection period, food and beverage (F&B) businesses, especially the HoReCa segment (hotels, restaurants and cafés), continue to struggle with procurement issues, stock management and growing operational costs.

Keeping these pain points in mind, the Noida-based supply chain startup has acquired Posify (a point-of-sale which is now called BillNote) from its parent company Adcount Technologies or AdUrCup and developed inventory management system (IMS) to digitise and automate the supply chain operations of large restaurant chains. It has also set up an app and web-based e-commerce platform called Vyap that provides raw materials and kitchen supplies to restaurants like grocery, poultry, dairy, food packaging, housekeeping and more. Finally, there is SupplyLink, a tech-driven warehousing-cum-logistics vertical (more on the services later).

SupplyNote serves more than 1K F&B brands and 5K+ outlets across the country, including prominent names like Biryani By Kilo, The Cure Foods, Good Flippin’ Burgers, Khan Chacha, Natural Ice Cream, Nazeer Foods and Bakingo, among others, and boasts 90-93% customer retention rate.

It has multiple revenue streams in place to drive its earnings. Among these are subscriptions for its SaaS-backed PoS and IMS (its charges vary according to the client’s requirements), a fee on each transaction happening via its SaaS verticals and Vyap marketplace and warehousing and logistics charges.

The startup says 80% of its revenue comes from Vyap and the rest 20% from its SaaS platform. Its gross transaction value from SaaS services has reached $200 Mn, with an annual growth rate of 30%. The startup is projecting INR 50 Cr in revenue in the current financial year, around 110% jump from INR 23.71 Cr in FY24.

The supply chain platform also raised $5.3 Mn, including $1 Mn from VCats++, a stage-agnostic venture capital firm.

SupplyNote’s SaaS & AI Adoption Curb Costs, Keep Restaurants Well-Stocked

Like many startups, SupplyNote has an intriguing backstory and a history of pivots. The founders’ journey started in 2015 with the launch of AdUrCup, a brand which enabled companies to advertise within restaurants through their packaging materials, including paper cups, burger boxes, and pizza boxes. In short, AdUrCup acted as a single point of procurement solution for packaging materials for restaurants.

At the time, the founding team also developed a software solution in-house to streamline business operations. But when a client requested them to develop a similar tool for inventory management, they saw a new opportunity. In 2019, it was a pivotal moment that eventually led to SupplyNote, a platform dedicated to transforming the end-to-end supply chain for the F&B industry.

“F&B had long relied on traditional supply chains driven by personal networking and a good dose of informed guesswork. But without process automation and AI-based data analytics, we tend to find flawed procurement practices and poor inventory management, resulting in overstocking or stockouts. After the pandemic, every industry has adopted tech-driven solutions to manage costs and optimise margins. Hence, foodservice must do the same to operate comfortably,” observed Kumar.

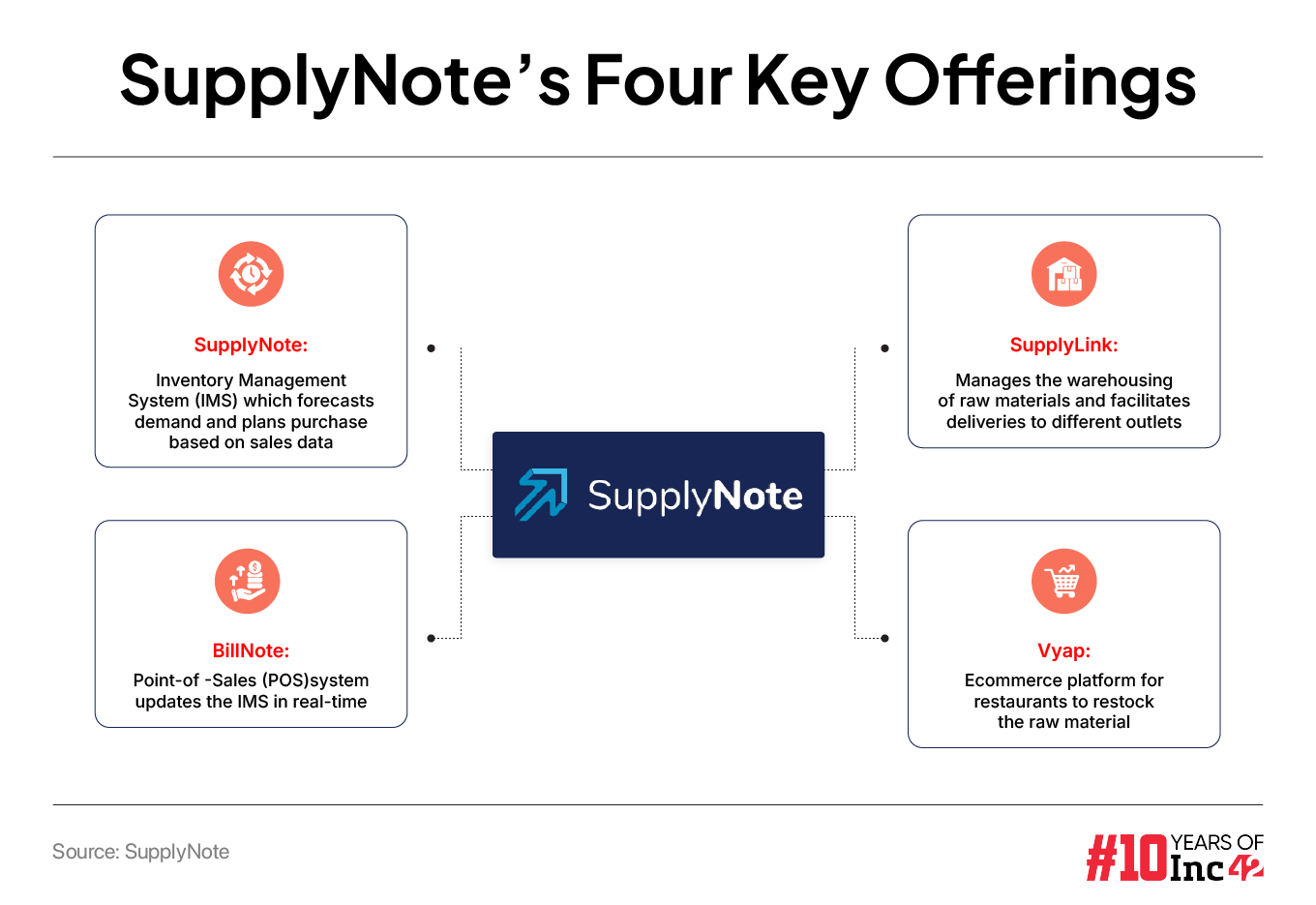

True to its core vision, SupplyNote has adopted SaaS and AI to come up with four key offerings and additional benefits. Here is a quick look at its cutting-edge advantages.

A fully integrated PoS and IMS: Its point-of-sale (POS) system called BillNote (formerly Posify which was developed by inhouse software engineers) is a front-end SaaS tool that records sales and billing in real-time. As it is integrated with a backend inventory management system (another SaaS tool), the latter can automatically monitor and immediately update stock levels based on PoS data, forecast demand and streamline production planning. Going by the latest inventory position, a restaurant can work out essential requirements and restock at the right time. This also prevents errors in stock calculation and curbs costs due to overbuying or wastage. Through this process, F&B businesses can do transactions worth INR 1,500 Cr+ annually.

SupplyNote also uses artificial intelligence (AI) to analyse market trends and historical sales data for best-in-class demand forecasting and procurement planning. “AI has been seamlessly integrated with our inventory stack to automate those functions besides raising purchase orders, converting invoices and challans into auto-generating GRNs (goods received notes) and updating payment ledgers,” said Kumar.

“Another key problem in this space is theft or pilferage. It can be overwhelming for a restaurant to check thousands or lakhs of orders every month. But AI now offers scalable solutions, and we may actively use them to cope with such challenges. In this way, we can ensure more precision and efficiency in tackling operational oversights,” he added.

SupplyLink for warehousing and logistics: Extending SupplyNote’s offerings to the logistical side of the supply chain process, it provides warehousing and transportation solutions which ensures that right products reach restaurants on time. Its key features include real-time tracking and temperature-controlled logistics which helps in safe handling of goods, specifically for sensitive products like dairy and poultry.

Vyap e-procurement and fast delivery: This Single vendor marketplace caters to small-to-medium-sized restaurants and helps them buy essentials like groceries, poultry and dairy products, food packaging materials and housekeeping supplies at competitive pricing. The orders placed through Vyap are delivered the next day according to the time slot chosen by the restaurant.

Vyap currently operates in Delhi-NCR and offers small businesses flexible payment terms and credit facilities, helping restaurants manage their cash flow more efficiently. Another standout feature is the bulk-breaking option, allowing restaurants to order smaller quantities, reducing storage costs and wastage. Although there is no minimum order value, the startup charges a delivery fee for orders below INR 2K. The platform also offers a digitised ledger of past transactions, pricing and supply terms, enabling restaurants to negotiate better deals.

Overall, its four service verticals are well-combined and work in sync to provide end-to-end supply chain solutions, including real-time sales & stock tracking, demand prediction, procurement and order fulfilment. As and when an F&B client’s inventory runs low and alerts are generated, it can place an order on Vyap to get it delivered the next day. SupplyNote’s sophisticated IMS, powered by AI, helps address demand volatility and reduces cost while ensuring product availability.

Ease of operations and robust data security: Besides its proprietary software tools, SupplyNote uses a powerful tech stack for seamless operations. It leverages Freshdesk for customer support, Zoho Books for accounting and Jira for project management to cover all essential areas efficiently.

“As for data security, we use API tokens (similar to passwords) for secure data exchanges. SupplyNote also conducts third-party audits to assess and strengthen its systems, ensuring that they meet industry standards by integrating the latest security protocols,” said Kumar.

The VCats edge: Meanwhile, SupplyNote’s $1.2 Mn fundraising from VCats++ has helped the business grow in more ways than one. Besides financial backing, it helped the startup build industry connections, provided operational and compliance support and ensured strategic planning. “Our association with VCats++ helped us accelerate growth and expand our client base. The VC connected us with its portfolio companies like Chai Break and others specialising in the food business, giving us a firm footing in the F&B supply chain,” said Kumar.

Can SupplyNote Bridge Supply Chain Gaps, Make F&B Sizzle?

SupplyNote has global ambitions and wants to enter the Middle East and Southeast Asian (SEA) markets in the next two to three years. “In the near term, we are targeting countries like the UAE, Saudi Arabia and Bahrain as part of our Middle East foray. Next on the cards are countries like Singapore, Malaysia and Indonesia, where the F&B sector is flourishing,” said Kumar.

More plans are afoot to expand its domestic market share. Buoyed by the strong growth of Vyap, the startup’s digital marketplace for restaurant essentials, the founders plan to scale up its operations in metros like Mumbai, Chennai, Bengaluru and Pune, followed by Tier II and III cities like Chandigarh and Lucknow. It also aims to onboard 10K F&B outlets across Tier I markets in the next two years and help create 1K+ food businesses. The mission is to standardise their operations in the next five years, enabling them to emerge as major food brands and hit INR 100 Cr in sales.

Given the supply chain’s fragmented nature and poor operations, these growth plans may sound slightly rambling. More importantly, around 70% of the country’s total foodservices consumption occurs in the top 50 cities, among high-income and upper-middle-class segments, per an NRAI (National Restaurants Association of India) report. This essentially limits the opportunity for F&B outlets outside metros and Tier I and, consequently, the market for pan-India growth aspirants like SupplyNote.

Increasing competition is another big risk startups are facing. Listed foodtech giant Zomato has forayed into the space with its B2B supply chain service Hyperpure (it delivers fresh and packaged products to restaurants), while F&B supply chain specialists like Centriti, Wheelocity and Supply Port have seen growing interest from institutional investors.

The HoReCa market at home and abroad is growing, though. Globally, it is projected to reach $6.45 Tn by 2032, while the Indian market contributes around $78 Bn annually, or more than 7% of the country’s GDP, according to a report by the Federation of Hotel and Restaurant Associations of India.

As the organised F&B sector continues to grow, so will the playing field for SupplyNote and its ilk. In fact, the Noida startup is uniquely positioned over its competition as it works with all sizes of restaurants and offers full-stack solutions to cover every aspect of a rapidly growing market.

By Inc42 Media

Source: Inc42 Media

Discover more from FundingBlogger

Subscribe to get the latest posts sent to your email.