By Inc42 Media

In July 2021, when Zomato filed for its IPO, there was no precedent for the food delivery market. Zomato had recorded a loss of INR 886 Cr in FY21 and was not profitable, a critical consideration for investors looking at a fresh IPO.

Despite all misgivings, the market sentiment for Zomato was positive. Few big tech companies or startups had gone for an IPO before Zomato. As a well-known brand for many Indians in tier I, II, and III cities, Zomato managed to bring in more than enough interest.

The IPO was subscribed 38.25 times, and Zomato listed at a premium of over 51% compared to the issue price.

And now, the focus is on Swiggy, which, fortunately or unfortunately, has Zomato as a benchmark.

Zomato has recovered from past losses and is trading at an all-time high. An investment of INR 1 lakh a year ago would have yielded over 200% profit today, showing investor confidence in the business.

Bengaluru-based delivery and quick commerce giant, Swiggy

After LIC, Paytm, Coal India, General Insurance and Reliance Power, this will be the sixth-largest IPO in the Indian market.

For Swiggy, the situation is clearer. With Zomato already listed, there is little room for overvalued pricing. If Swiggy’s pricing is accurate and the market remains positive, the IPO could easily be oversubscribed.

Drawing a parallel with Zomato, Umesh Chandra Paliwal, cofounder of UnlistedZone, said the current environment is positive for companies looking to raise funds via IPOs. The success of Zomato, which has delivered good returns and recently achieved profitability, sets a favourable precedent for Swiggy.

“Zomato has become profitable in its food delivery business, although its Hyperpure and Quick commerce segments are still incurring losses. Quick commerce is expected to become more significant than the food delivery business in the future. We believe Swiggy, given its market position and potential growth in Quick commerce, should achieve profitability within the next two years,” said Paliwal.

If Swiggy is to replicate Zomato’s success, a clear barometer would be the company’s performance in the unlisted market. So how are grey market traders looking at Swiggy?

Swiggy In The Grey Market

One caveat before we look at the analysis: Swiggy stocks are currently available only in tranches. Due to the limited supply, the stocks are not even being traded on multiple platforms, according to grey market analysts.

Inc42 checked up to six unlisted market platforms where Swiggy stocks are traded, and saw share prices ranging between INR 320 and INR380.

Confirming this, UnlistedZone’s Paliwal said Swiggy’s stock is being traded very sparingly in the unlisted market so this traction is still inadequate to gauge the potential IPO sentiment.

In January 2022, the company raised about $700 Mn at a $10.7 Bn valuation, led by US-based asset management company Invesco and Dutch investor Prosus Ventures.

However, Invesco cut Swiggy’s valuation twice in 2023 before raising the value of its investment in Swiggy to over $12.7 Bn. In line with this, Baron Capital also raised the value of its investment in Swiggy to over $15 Bn this week.

Currently, in the grey market, Swiggy is trading at a valuation of $9 Bn to $9.5 Bn, which could see some adjustments with Baron Capital’s markup.

Abhishek Ginodia, cofounder of pre-IPO platform Altius Investech, said that since Swiggy shares were introduced in the unlisted space, they have been trading in the range of INR 320-INR 350, which is at a valuation of $9 Bn-$9.5 Bn.

Trades are also limited as cheque sizes have been restricted to INR 5 Cr and above.

Based on the available information, Paliwal estimates Swiggy’s IPO valuation to be around $10 Bn. On the other hand, Ginodia expects the IPO valuation to be around $11 Bn-$12 Bn, approximately 30-40% lower than Zomato’s current market cap.

A managing partner of an auditing firm closely working with Swiggy said the IPO is the ultimate exit strategy for most investors, particularly late-stage ones. To offer them a profitable exit, the valuation could be anywhere between $12 Bn to $14 Bn, depending on how the pre-IPO round goes. “This is why Swiggy shares could also see a decline initially, as many might consider it overpriced,” they added.

Swiggy Vs Zomato: How The Two Giants Compare

Despite Swiggy surpassing Zomato in revenue till FY 23, Zomato has always led the way, from building the food delivery industry to going public.

Swiggy has no choice but to directly compare Zomato’s bottom line and scale while justifying its pricing. And, it falls short on multiple accounts compared to Zomato which has recorded a 67% rise in revenue for FY 24.

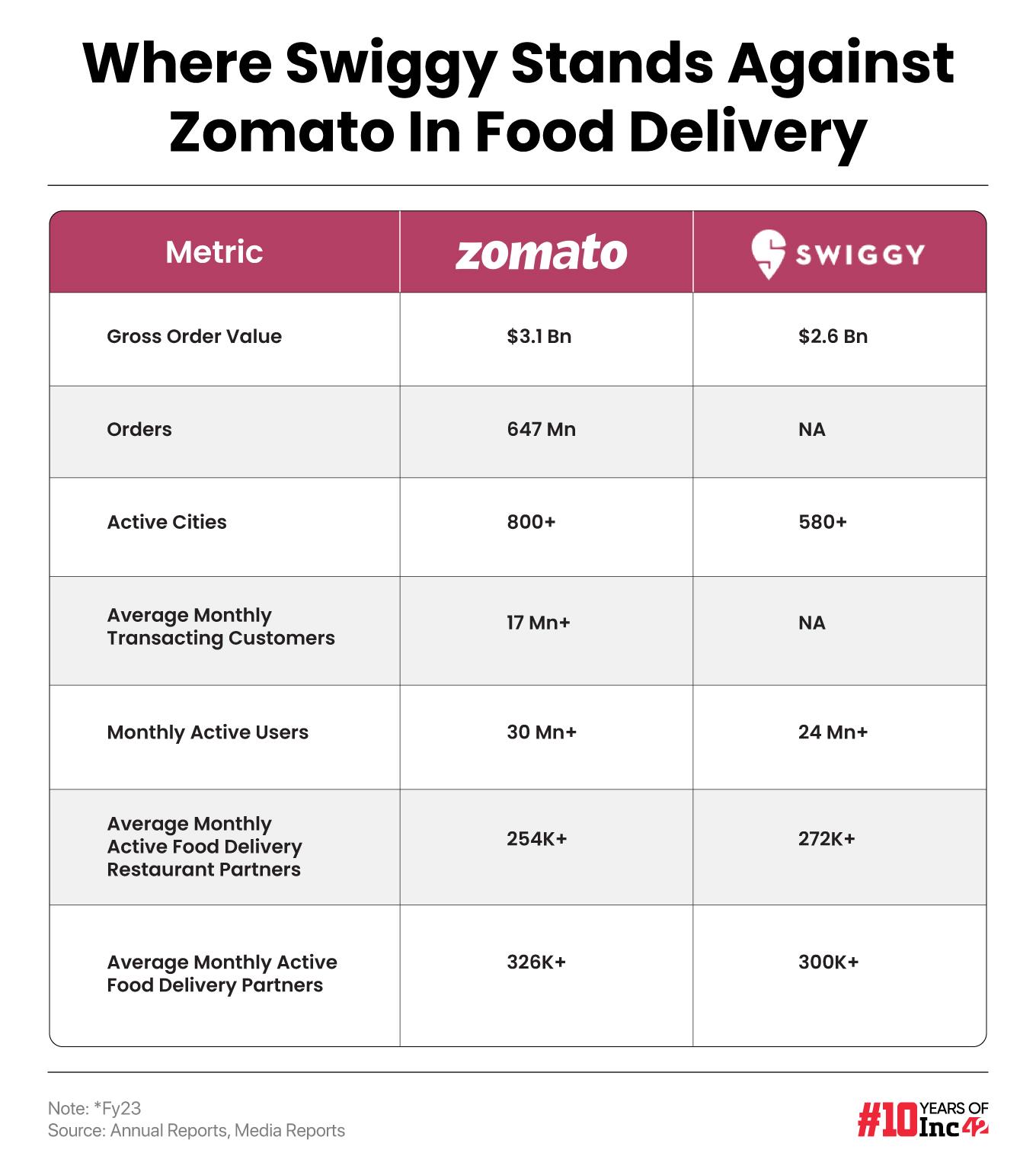

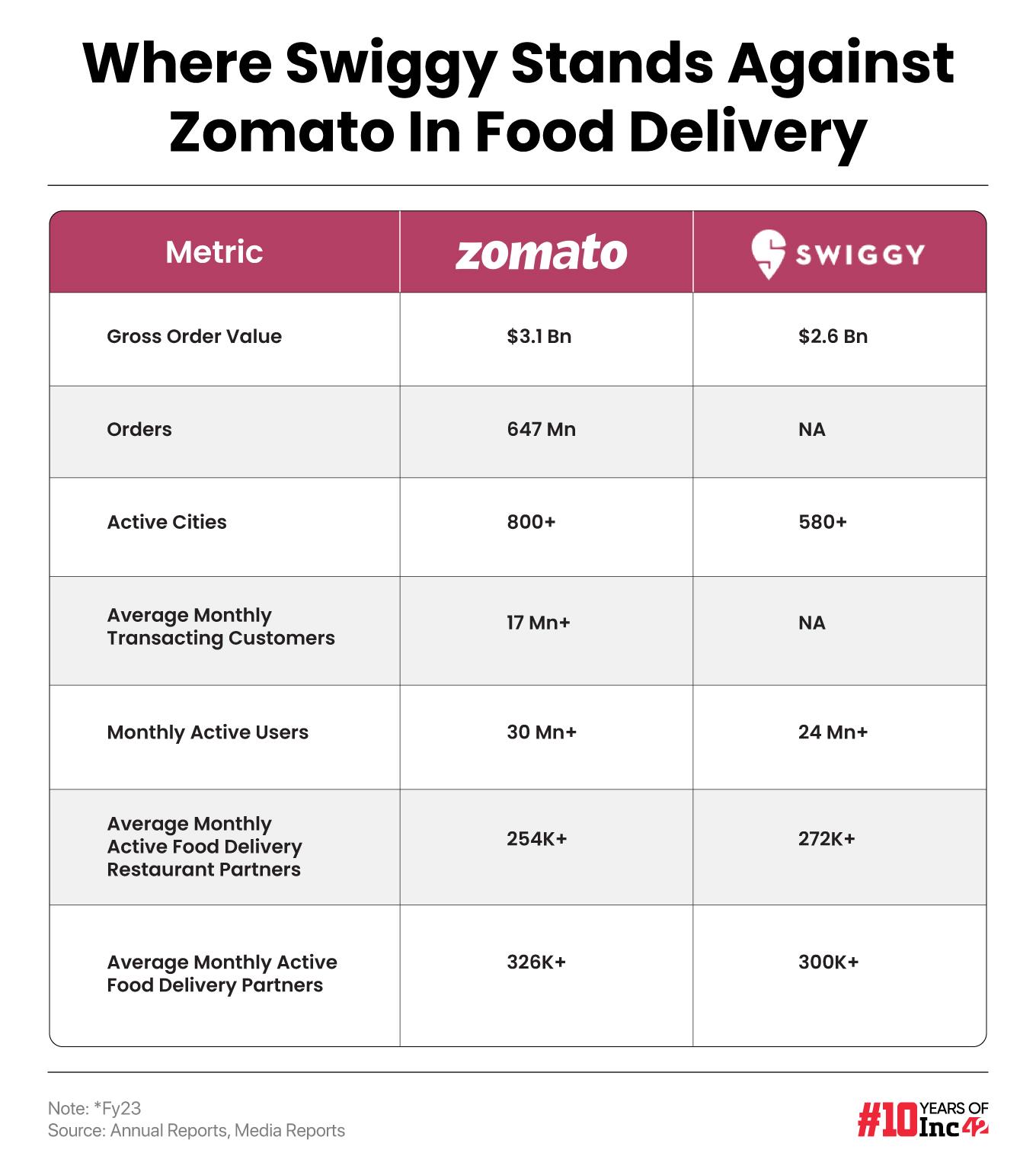

Swiggy lags in monthly active users (MAU) and gross order value (GOV). Zomato claims over 30 Mn MAUs, while Swiggy has around 24 Mn. Zomato’s GOV is $3.1 Bn, compared to Swiggy’s $2.6 Bn.

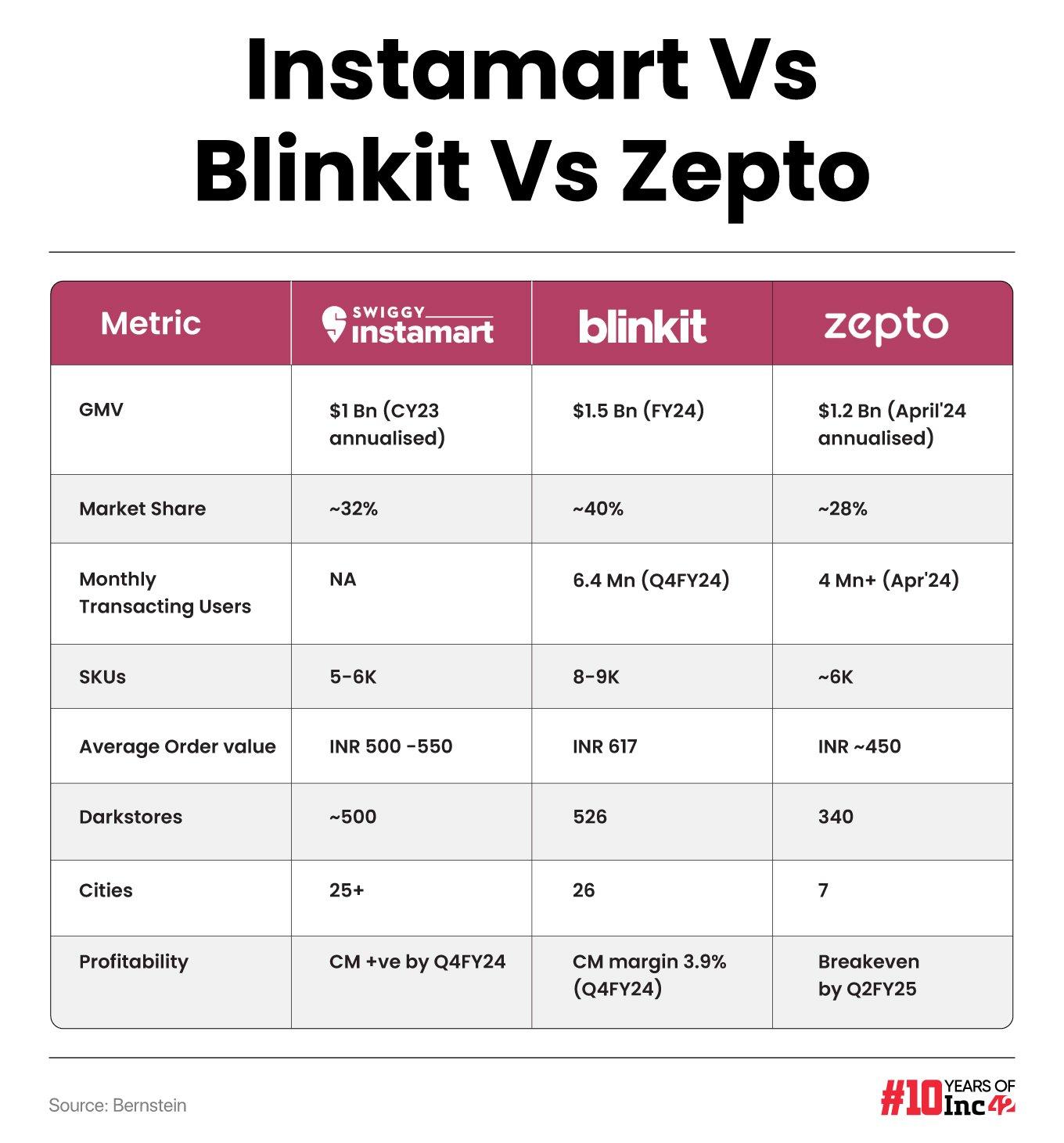

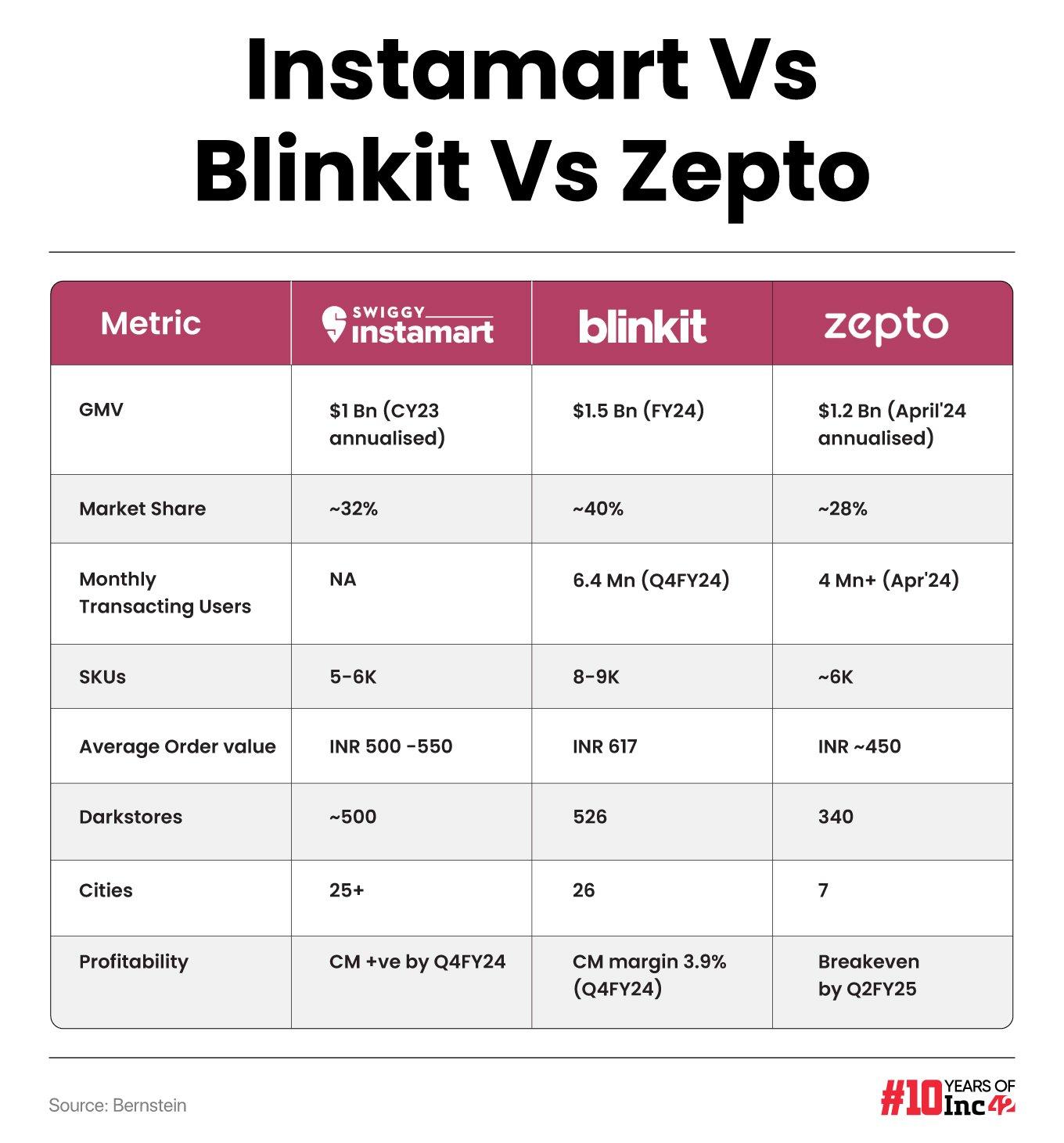

Ginodia points out that quick commerce is Swiggy’s key differentiator. “Swiggy and Zomato have similar revenue rates, but Zomato has performed better. Zomato improved its performance by reducing losses from Blinkit, while Swiggy’s quick commerce business negatively impacts its contribution margin by 50%. This could result in Swiggy’s IPO being valued lower than Zomato’s,” said Ginodia.

While Swiggy’s food delivery services have become profitable, the quick commerce segment, Instamart, has incurred significant losses despite revenue growth.

As per sources, who have seen Swiggy’s disclosures as of September 2023 (H1FY24), the company has touched INR 4,735 Cr in revenue from food delivery and quick commerce.

Thanks to this momentum, Swiggy is on course to report over 20% higher revenue in FY24, from the INR 8,260 Cr it reported in FY23.

While we don’t know the loss for FY24, Swiggy trimmed its net loss to around $207 Mn (INR 1,730 Cr) in the first nine months of the fiscal year. Sources did not indicate whether Swiggy would finish FY24 with a profit, after it reported a net loss of INR 4,179.3 Cr in FY23.

Will Confidential Draft Papers Sway Investors?

Swiggy has opted for the confidential route for its IPO. Will this create confusion among investors?

A managing partner of an audit firm explained that this means Swiggy’s draft red herring prospectus (DRHP) won’t be immediately available for public scrutiny. Swiggy can control the flow of information for a little longer. However, the papers will still be shared with institutional investors, so it won’t impact the overall IPO.

The confidential filing strategy helps the company control the narrative for a bit longer and is beneficial for the pre-IPO round.

Does the lack of a public DRHP raise concerns about transparency for potential retail investors?

Paliwal explained, “Filing confidential draft papers is unlikely to impact investor confidence negatively. IPO investors typically fall into three categories: QIB, HNI, and Retail. QIBs usually have access to detailed business and financial information, while HNI and retail investors rely more on the grey market premium (GMP). Therefore, we do not foresee any adverse effects on investor confidence.”

Zomato And Swiggy’s Interlinked Future

Market analysts and experts believe that the timing for Swiggy to go for IPO couldn’t be better, especially with Zomato trading at an all-time high for several weeks. There has been some weakness in the stock in the last month or so, however, when there has roughly been a 12% drop in Zomato share price.

This indicates that Zomato is not yet a stable stock and could be more vulnerable to market volatility. Paliwal thinks the timing looks favourable for Swiggy, however, when one compares the market to one year ago.

The IPO market is lively, and Zomato’s strong performance in the past year has yielded significant returns for investors. Swiggy, being valued lower than Zomato, might attract investors seeking value opportunities. They may sell Zomato shares to buy Swiggy shares, hoping for similar or better returns.

Others also said that the IPO momentum is strong which is a good factor for new IPOs, but Ginodia believes Swiggy faces challenges in its core business, especially with the focus shifting towards quick commerce, where it has lost ground as highlighted by our data above.

Beyond immediate factors, broader market trends and shifts in consumer behaviour are crucial.

The increasing adoption of online food delivery and quick commerce offers significant growth opportunities for Swiggy even as competition has grown in the latter — with the rise of Zepto and the imminent entry of Reliance Jio and Flipkart.

Strategic partnerships and cutting per-order costs will be crucial for Swiggy, even as it explores ways to improve the customer experience, which has lagged behind the competition.

Ultimately, the success of the Swiggy IPO will depend on the company’s ability to effectively communicate its growth strategy and financial roadmap to investors and show that it indeed has a clear path to profits, like Zomato.

After a decade-long duopoly and trying to outpace its archrival, Swiggy is realising that after all, its fortunes are more closely linked to Zomato than it may want to believe.

[Edited by Nikhil Subramaniam]