By Inc42 Media

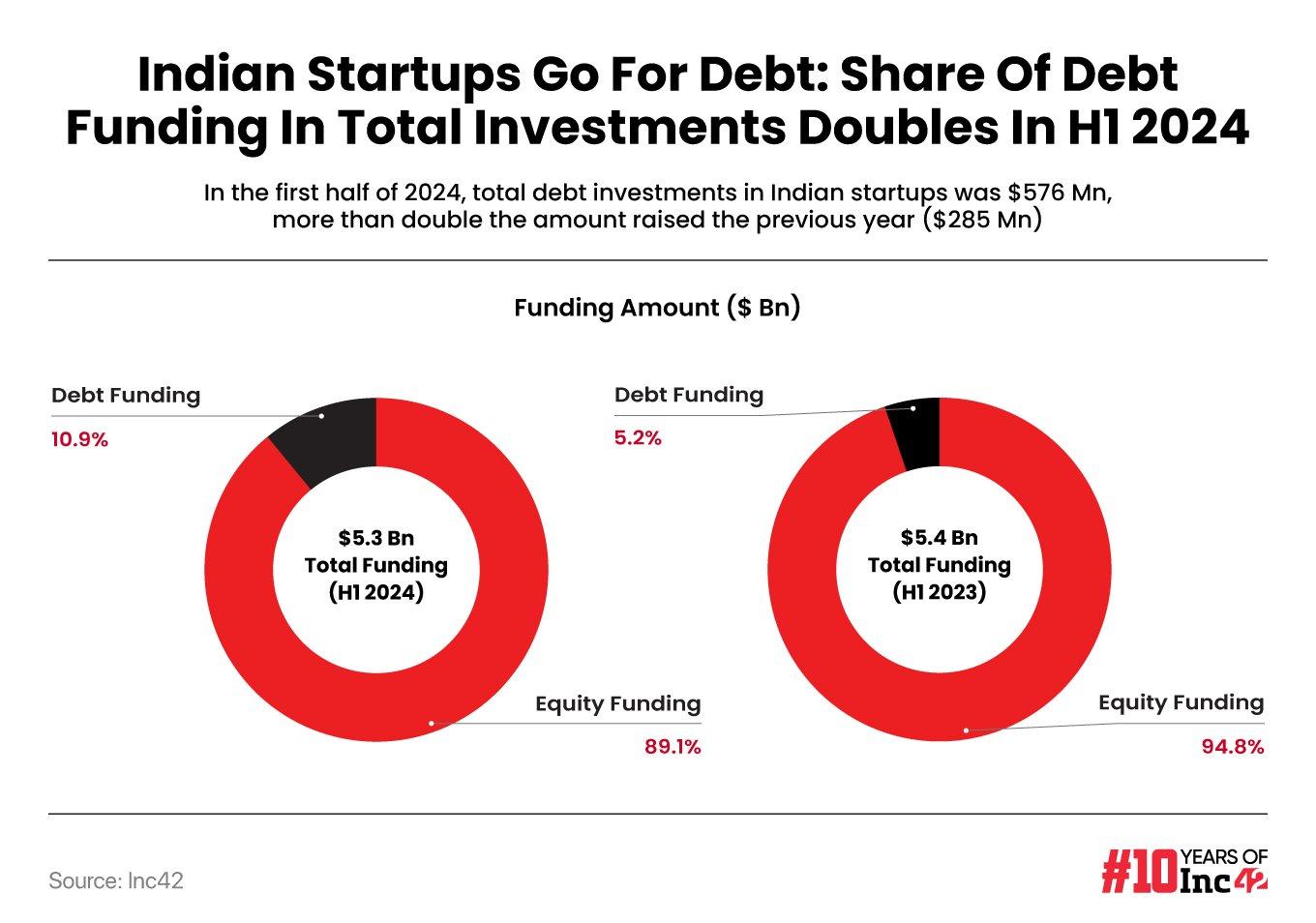

According to Inc42’s H1 2024 funding report, debt investments in Indian startups stood at $576 Mn, more than twice the $285 Mn raised by startups in the same period a year ago.

Equity funding, during the period under review (H1 2024), stood at $4.7 Bn, down 8% from the $5.1 Bn equity funding raised in H1 2023

IPO-bound non-banking lender Northern Arc Capital raised the most debt during the first half. It bagged debt funding on two separate occasions — $75 Mn from FMO in June and $80 Mn from IFC in April

While there wasn’t a monumental shift in startup funding trends in the first half of 2024, debt funding more than doubled in the first half of the calendar year 2024.

According to Inc42’s H1 2024 funding report, debt investments in Indian startups stood at $576 Mn, more than twice the $285 Mn capital raised by startups in the same period a year ago.

Some prominent debt deals between January and June included GPS Renewables’ $50 Mn debt funding, Bira 91’s $25 Mn debt funding round from Kirin Holdings, and Ola Electric’s debt funding of $50 Mn from Alteria Capital.

Additionally, while debt funding increased on a yearly basis, equity investments took a hit. Equity funding, during the period under review (H1 2024), stood at $4.7 Bn, down 8% from the $5.1 Bn equity funding raised in H1 2023.

Startups take the debt route as it allows them to fuel growth through fresh capital infusion without the existing stakeholders diluting their stake in the startup.

Download The Report

Pertinent to mention that it is a common practice among IPO-bound companies to take the route before listing. Besides Ola Electric, which has the SEBI go-ahead for an INR 5,500 Cr IPO, Bluestone, and Mobikwik raised debt funding in the first half of the ongoing year.

Notably, IPO-bound non-banking lender Northern Arc Capital raised the most debt during the first half. It bagged debt funding on two separate occasions — $75 Mn from FMO in June and $80 Mn from IFC in April.

Moreover, in line with startups’ growing interest in receiving debt funding, venture debt firms turned out to be the most active investors. In sync with the trend, venture debt firm Stride Ventures led the funding charts, investing in 46 entities, including Lendingkart, Ather Energy, Ola Electric, Zyod, and Solar Square, among others, in the first half of 2024. Other prominent debt investors keeping their hands full with startup investments were InnoVen Capital, Alteria Capital, and Trifecta Capital.

Overall, Indian startups raised a total of $5.3 Bn in H1 2024, registering a slight dip of 1.8% from the $5.4 Bn raised in H1 2023. However, the number of deals increased by 7%, rising to 504 from 470 in the same period last year.

Sequentially, deal volume improved by 15%, and the funding amount increased from $4.4 Bn in H2 2023. The median ticket size declined by 8% YoY to $2.8 Mn in the first half of 2024 but saw an 87% increase from $1.5 Mn in H2 2023.

Download The Report