According to a 2023 report by the World Economic Forum, India is emerging as the key hub for impact investments.

This is perhaps the first opportunity for global investors to back businesses capable of bridging the gaps in sustainable development goals (SDGs) from the get go. With thousands of new startups and ventures emerging every year, impact investors have a significant role to play.

For those unfamiliar with the term, impact investing seeks to deliver positive social or environmental outcomes alongside financial returns.

In India, impact investing predominantly follows a venture approach, focusing on early-stage investments in for-profit enterprises that serve vulnerable and underserved communities.

However, a gap exists in growth-stage funding for impact enterprises, which limits their ability to scale solutions capable of driving substantial, global-level change. Often the core vision has to be diluted for business considerations to attract big ticket investments

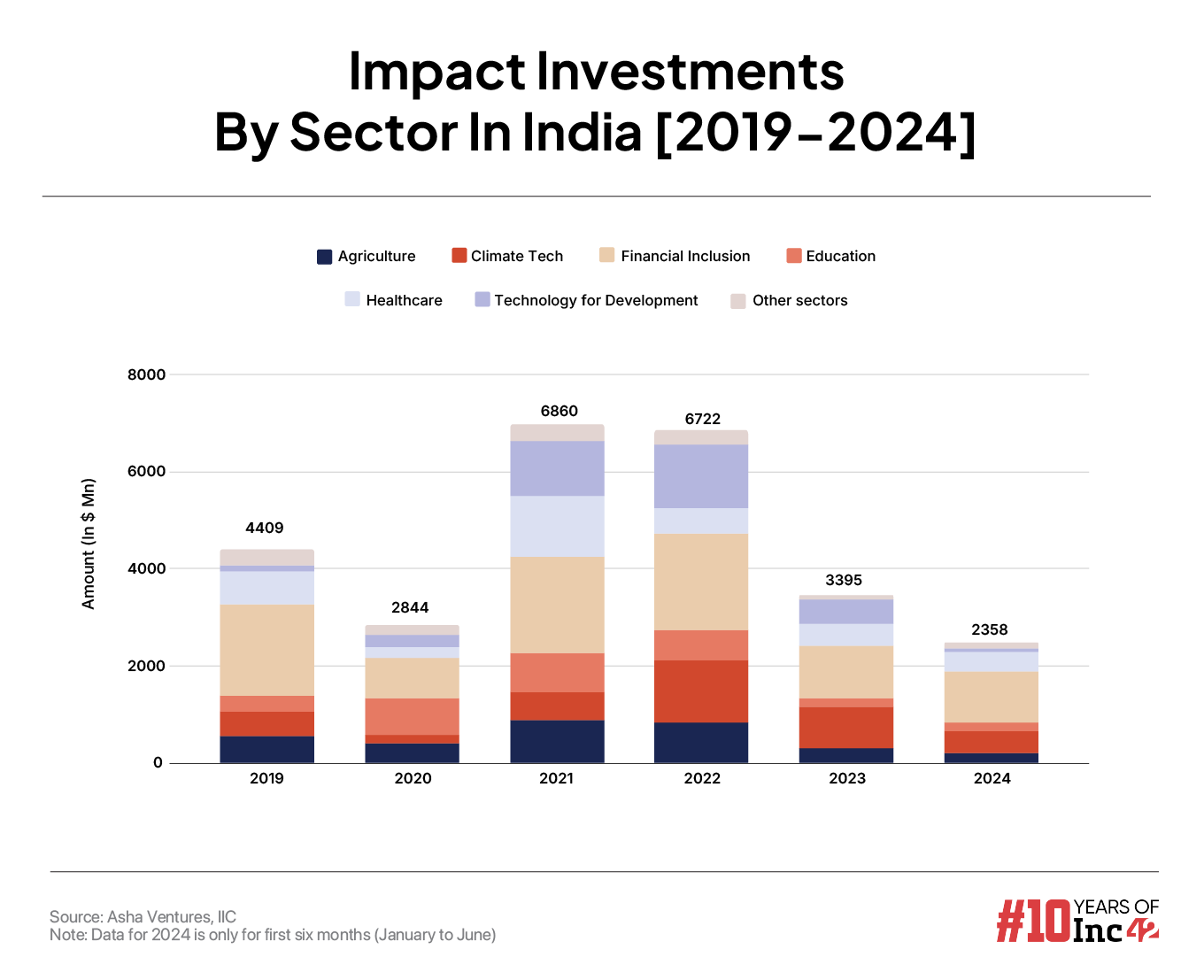

While the initial wave of impact investing predominantly targeted financial inclusion—such as microfinance and affordable lending to underserved populations—the scope has broadened significantly in recent years.

This is visible in the recent impact investment data across sectors shared in a monthly report published by industry body India Impact Investors Council (IIC). The report indicates that a total of $2.3 Bn has been invested in first six months of 2024 (January-June) within the impact investment domain.

In line with this growth, India’s domestic ecosystem of impact investors has grown substantially over the years, with key impact investors like C4D Partners, Ankur Capital, Omnivore Capital and Caspian Impact Investments among others leading the charge.

Among these is Asha Ventures, an early-to-growth stage impact fund founded in 2014 by former Morgan Stanley India head and president Vikram Gandhi, and former Genpact president and CEO Pramod Bhasin.

Between 2014 and 2023, the founders invested in startups, climate solutions and financial services companies such as Adda 24×7, Vaastu Housing Finance, Avanti, Nepra, Greenway, Jana Care, Saahas Zero Waste, Swarna Pragati Housing, Varthana, Gramophone and Janaadhar.

But with the launch of the maiden $100 Mn Asha Ventures Fund 1, Gandhi and Bhasin are stepping into the institutional investor territory. Launched in December 2023, the fund has seen a first close at $50 Mn. Targeting investments in the range of $2 Mn to $10 Mn, Asha Ventures is looking to lead rounds in business built around three core themes: sustainability, healthcare and inclusion.

“We target the emerging middle class in India, a segment of around 50 Cr individuals with annual incomes between INR 2 Lakh-INR10 Lakh. This group has unique needs and aspirations that differ from the wealthier segments typically targeted by mainstream PE/VC funds,” Amit Mehta, managing partner at Asha Ventures, told Inc42.

Mehta held leadership roles at IIFL Private Equity and Motilal Oswal Private Equity before joining Asha Ventures. Currently, he leads the firm’s strategy, fundraising and investment decisions.

Through the fund, Asha Ventures has made three investments from this corpus including Ascend Capital, Truemeds and AutoMony. “Over the next three to four years, we aim to make 10–12 more investments,” the managing partner claimed.

Unlike funds that prioritise trends such as 10-minute delivery, crypto, or gaming, Asha Ventures focuses on underserved markets. Mehta told us that the firm’s thesis on impact investing is built around scalable business models that not only benefit society but also generate sustainable returns.

How different is this from building a regular VC fund and what challenges do impact investors face when raising from LPs looking for quick returns, even as impact investing by itself is a patient capital game?

Edited excerpts

Inc42: Many VCs are now adopting sustainability as an investment theme. How is Asha Ventures aiming to make a difference?

Amit Mehta: Climate change is a major challenge we all face. The world is in a crisis and India, as a large country, must urgently work to reduce its carbon footprint. At Asha Ventures, we are making significant investments in the climate space, focusing on both adaptation and mitigation.

The middle class, particularly farmers, is among the most vulnerable to climate change. We explore ways to support sustainable consumption and back innovative brands that position themselves as sustainable consumer companies. These brands are also improving their supply chains to reduce their environmental impact.

We are particularly interested in startups addressing the carbon footprint of hard-to-abate sectors like steel and cement. Innovations in these areas are critical to making a difference. Similarly, we explore bio-alternatives across various industries, such as replacements for plastics and agricultural inputs.

In the renewable energy sector, we avoid asset-heavy investments, like power plants, because of their slow growth and lengthy project timelines. Instead, we focus on enabling sectors within the renewable supply chain. For example, as India becomes less dependent on China for solar components, we see opportunities to invest in companies emerging within this ecosystem.

We’ve also invested in an NBFC that finances EV three-wheelers, helping rickshaw drivers earn a sustainable income while promoting clean energy. Although we generally avoid direct EV investments, this opportunity aligns with our themes of sustainability and inclusion.

At Asha Ventures, our goal is to back innovations that drive impactful change, whether by addressing climate challenges, supporting sustainable industries, or creating inclusive economic opportunities.

Inc42: Can you elaborate more on the other two themes: healthcare and inclusion? These are broad sectors that need widespread impact.

Amit Mehta: Healthcare is a basic necessity and we are seeing many innovations aimed at making it more affordable and accessible. For example our portfolio company Truemeds is an online platform that focuses on generic drugs.

The likes of PharmEasy and 1MG primarily cater to upper middle-class customers who may need medicines along with services like annual health checkups or wearable devices to monitor vitals. However, millions of people across India, especially those managing chronic conditions like high blood pressure or diabetes, cannot afford branded medicines.

Generic drugs, which are non-branded versions of the same medicines, offer a solution. For instance, Crocin is a normal paracetamol drug. While the branded version might cost INR 10, the generic version could be as low as INR 1. This significant cost reduction makes essential medicines more accessible to a larger population. Our investment in True Meds focuses on tapping into this mass-market opportunity.

On the inclusion side, we primarily work in the financial sector. Despite significant progress over the past decade, there is still much to do. Our investments focus on areas like affordable housing, commercial vehicles and education, providing opportunities to underserved communities and driving greater economic inclusion.

Inc42: Inc42 data shows that between 2021 and 2024 over 15 new impact funds were announced with a total corpus of $1.3 Bn. How do you see this competitive landscape and what is your pitch to founders given the number of new investors?

Amit Mehta: When an entrepreneur seeks to raise funds, they look for an investor who aligns with their vision and understands their business model. This alignment often depends on how well the investor understands the target customer base. For example, take a used commercial vehicle NBFC targeting low-income individuals with a household income of ₹2–3 lakh annually in a tier-2 city.

The entrepreneur will want to know: Does this investor have experience working with such customers? Have they invested in similar businesses before? Do they understand the growth potential and risks involved? These are critical questions when choosing an investor.

When it comes to Asha Ventures, we have over a decade of experience working with companies that serve this customer base. This gives us a deep understanding and expertise that many traditional VC funds may lack. For instance, while some VCs might focus on metro-based digital models offering personal loans to tech-savvy users, we focus on understanding the needs, behaviours and aspirations of underserved, price-sensitive customers.

We know that this customer base may not fully adopt digital models and often values a strong, low-cost core product over unnecessary add-ons. Our focus is on ensuring the product is efficient, affordable and impactful. Entrepreneurs targeting the emerging middle class will seek investors who understand these nuances.

Our expertise extends beyond financial services into sustainability and healthcare, allowing us to support businesses transitioning from early to growth stages while staying connected to their customer base

Inc42: Can you share a few examples of how Asha Ventures has helped its portfolio companies nurture and scale?

Amit Mehta: Take, Vastu Housing Finance, an early affordable housing finance company founded in 2016. We invested in the company when it was just a concept on paper. Our understanding of the target customer base enabled us to help design the product and build the technology to deliver it effectively. Additionally, our credibility within the financial ecosystem played a key role in helping the company raise both equity and debt.

Today, Vastu Housing Finance has over INR 10,000 Cr in assets under management (AUM) and is highly profitable. We continue to be involved with the company and plan to take it public within the next two years.

Truemeds is another example. When we invested, the startup was generating only INR 50 Lakh in monthly revenue. Now, its revenue is nearly 100x that.

We’ve also worked with sustainability-focused companies like Greenway, which manufactures efficient stoves as affordable alternatives to traditional chulhas. These stoves not only provide value at a low price point but also earn carbon credits.

These examples demonstrate how we support our portfolio companies in transitioning from the early stage to the growth stage, leveraging our expertise across inclusion, healthcare and sustainability to help them scale effectively.

Inc42:In India, impact investments are still largely driven by international investors. Why do you think Indian impact investors have not yet created a mainstream VC-like presence?

Amit Mehta: The impact industry in India has evolved significantly over the past two decades. Historically, much of the capital has come from development finance institutions. However, we’re now seeing a growing interest from domestic investors and limited partners who are becoming more conscious about investing in impact funds.

We believe that over the next decade, domestic equity investors will become an integral part of the impact investing ecosystem. This shift is already beginning, including within our own investments.

You’re correct that offshore capital has historically led the way in impact investing. One challenge we face is the perception that “impact” means low returns. At Asha Ventures, we aim to debunk this myth and demonstrate that it’s possible to deliver strong financial returns while creating meaningful social and environmental impact.

As we continue to prove this, we expect more domestic investors to join and help grow the impact investing space into a more mainstream model in India.

Inc42: From regulatory and LPs perspective how can the ecosystem help promote impact investing in India?

Amit Mehta: Currently, there isn’t a separate regulatory category for impact funds; they are treated the same as other AIFs. Impact funds also face generic challenges and the industry has been engaging with regulators to address them. There is potential value in creating a distinct category for impact funds and these discussions are ongoing. When regulators deem it appropriate, they may introduce specific frameworks for this sector.

From an LP perspective, the key is addressing the perception that investing in impact funds might compromise returns. Many investors still hold this belief, but it’s important to demonstrate that impact investing can deliver competitive returns alongside social and environmental benefits.

Additionally, government-backed LPs, like SIDBI and other similar institutions, could play a pivotal role by prioritising investments in impact funds. If such entities adopt a clear agenda to fund impact-focused AIFs, it would significantly strengthen the ecosystem. This would not only attract more capital but also align with the government’s push to address the needs of the mass market and drive solutions for underserved communities.

By creating the right regulatory framework and encouraging domestic LPs to invest in impact funds, the ecosystem can grow more robustly and channel capital into sectors vital for uplifting the broader population.

Inc42: How does impact investing in India compare to the global scenario?

Amit Mehta: India is one of the top markets for impact investing globally, thanks to its large population and immense market potential. Unlike other impact markets such as Africa or Latin America, India offers a more stable and well-regulated environment, making it highly attractive to both local and international investors.

Additionally, many family offices are showing growing interest in this space. While some approach it from a business perspective, there’s a broader understanding among successful entrepreneurs that doing good and doing well can go hand in hand. This mindset is driving increased investments in businesses targeting underserved customer bases in India.

Inc42: Where do you see impact investing heading in India over the next few years?

Amit Mehta: As I mentioned, the potential in this market is enormous. There are around 50 crore people in the middle-income bracket, which is a much larger market than the upper middle-class segment. With limited capital currently targeting this demographic, we believe now is a great time to invest.

We anticipate strong returns in this market over the next couple of decades, driven by the significant rise in earnings among this consumer class. They are set to become the largest consumer segment in the next decade.

Our approach focuses on the consumer’s needs. What are they seeking? Financial stability, good health and resilience against unexpected setbacks like health crises, natural disasters, or economic shocks. These challenges align with our focus on sustainability, healthcare and financial inclusion.

For example, sustainability addresses the risks of environmental shocks that can disrupt lives. Healthcare ensures people remain productive and avoid earnings losses due to poor health. Financial inclusion empowers consumers by providing the tools they need to improve and stabilise their income.

By viewing these sectors from the consumer’s perspective, we see tremendous opportunities to deploy billions of dollars over the next decade. That’s why we remain committed to these sectors and confident about the future of impact investing in India.

By Inc42 Media

Source: Inc42 Media

Discover more from FundingBlogger

Subscribe to get the latest posts sent to your email.