By Entrackr

As many as 17 Indian startups raised around $402.34 million in funding this week. These deals count 4 growth-stage deals and 11 early-stage deals. Moreover, two early-stage startups kept their transaction details undisclosed.

In the previous week, about 39 early and growth-stage startups cumulatively raised close to $387.23 million capital.

[Growth-stage deals]

Among the growth-stage deals, 4 startups raised $317 million in funding this week. Eyewear retailer Lenskart led the list with its $200 million secondary funding followed by a digital lending startup Fibe with $90 million, electric two-wheeler manufacturer Ather Energy with $15 million, and Small and medium enterprises-focused digital lending platform LendingKart with its $12 million debt funding.

[Early-stage deals]

Subsequently, 11 early-stage startups secured funding worth $85.34 million during the week. Spun off from Polygon, blockchain startup Avail spearheaded the list followed by online astrology platform AstroTalk, AI-based low-code test automation platform Testsigma, fintech platform iPiD, and robotics startup Botsync.

The list of early-stage startups also includes two startups that kept the funding amount undisclosed: IoT-driven green robotics solution provider Aegeus Tech and D2C nutrition brand Greenday (Better Nutrition).

For more information, visit TheKredible.

[City and segment-wise deals]

In terms of the city-wise number of funding deals, Bengaluru-based startups led with 7 deals followed by Delhi-NCR, Lucknow, Pune, Ahmedabad, and Chennai.

Segment-wise, e-commerce and fintech startups grabbed the top spot with three deals each. Robotics, SaaS, Blockchain, ClimateTech, and EV startups followed this list among others.

[Series-wise deals]

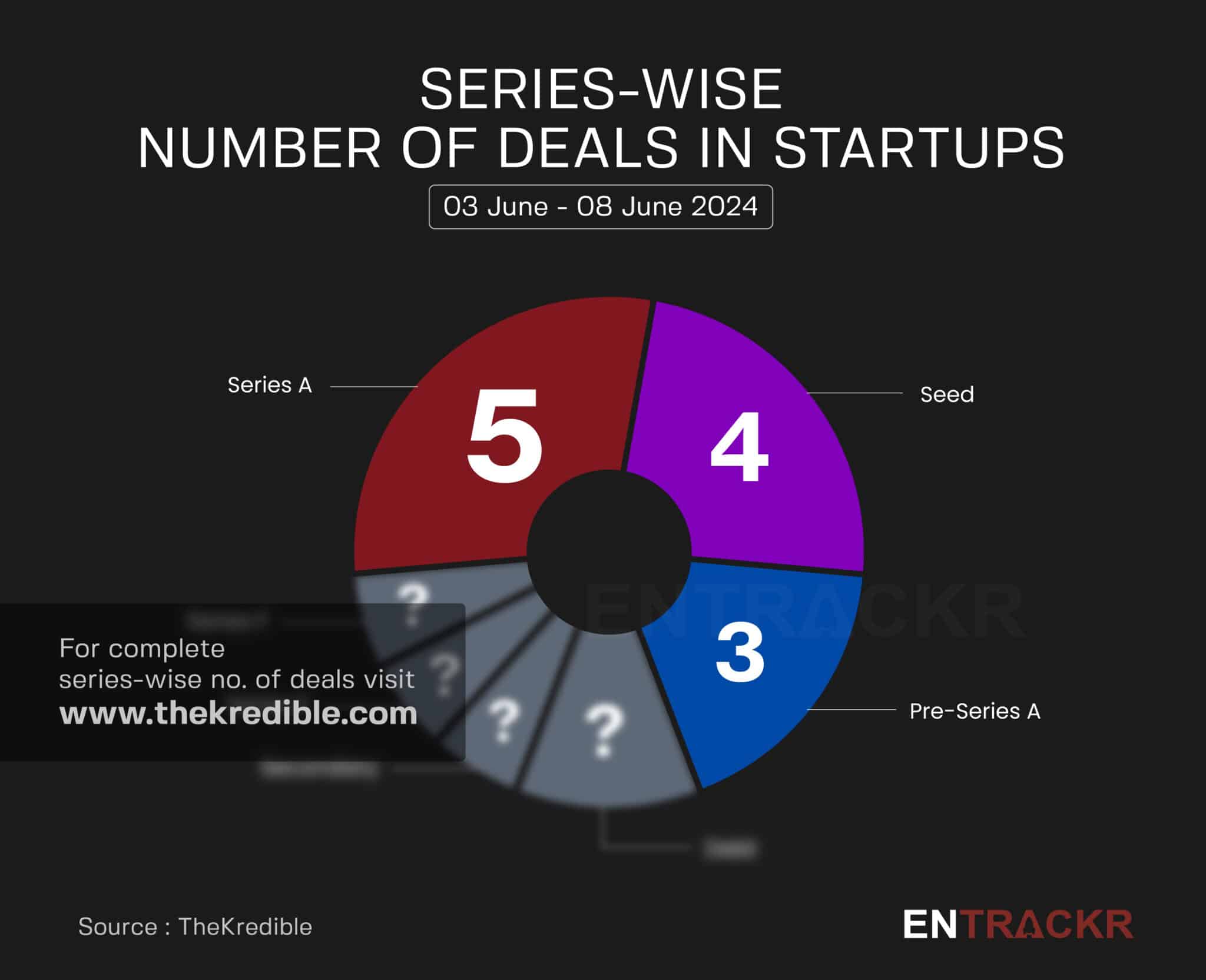

During the week, Series A funding deals led the list with 5 deals followed by 4 Seed and 3 pre-Series A deals. Further, the list includes Debt, Secondary, Series E, and Series F funding deals.

[Week-on-week funding trend]

On a weekly basis, startup funding barely increased 3.9% to $402.34 million as compared to around $387.23 million raised during the previous week.

The average funding in the last eight weeks stands at around $326 million with 28 deals per week.

[Key hirings]

Among key hirings, Hardeep Singh has been appointed as CFO by Stride Ventures, Good Glamm Group appointed Lauren Bloomer as International OPS, while Abhaya Hota has been appointed as the Independent Director by Cashfree Payments.

[Layoffs]

Simpl, a Bengaluru-based fintech startup, has undergone its second round of layoffs in less than a month, cutting around 30 employees. This move follows a previous layoff of around 100 employees. Ashish Kulshrestha, head of communications at Simpl, explained that these layoffs are part of the company’s efforts to achieve profitability by mid-2025 and to enhance operational efficiency.

The affected employees will receive a severance package including a pro-rated fixed salary up to the effective date and a two-month notice period salary as per the employment agreement.

[M&A]

Last week, Entrackr reported that Times Internet-owned MX Player is nearing an acquisition by Amazon. Amazon has now confirmed the acquisition of certain assets from MX Player, although the transaction isn’t yet complete. An Amazon spokesperson mentioned their continuous efforts to enhance customer experiences with local content available on Prime Video and miniTV in India.

Additionally, Absolute Sports, the parent company of Sportskeeda.com and ProFootballNetwork.com and a subsidiary of Nazara Technologies is set to acquire all assets of SoapCentral.com, a leading entertainment content source in the US. The all-cash deal is valued at $1.4 million (approximately Rs 11.6 crore) and is expected to close within the next 30 days.

[ESOP buyback]

Leverage.biz, the company behind the study abroad platform Leverage Edu, Fly.Finance, and Fly Homes, has completed its second ESOP buyback exercise. This initiative benefited over 50 employees across various functions, although the exact amount of the stock buyback was not disclosed. Leverage Edu previously concluded its first ESOP buyback in June 2022.

[Potential deals]

Scimplify, a platform for sourcing and manufacturing specialty chemicals, is raising a new $5 million round led by Omnivore with participation from existing investors, just six months after its previous round.

Meragi, an online platform for wedding-related services and products, is set to raise $8 million in a new round led by Accel, with existing investors Surge and Venture Highway also participating. The deal is in the final stages.

Statiq, an electric vehicle charging network operator, is in discussions to raise $50 million in its Series B round, with existing investors Shell Ventures and Y Combinator, along with new investors.

InsuranceDekho, the insurance arm of CarDekho, is in the final stages of acquiring a majority stake in wealth tech startup BankSathi through a share swap deal, allowing BankSathi shareholders to receive a stake in InsuranceDekho.

Visit TheKredible to see series-wise deals along with amount breakup, complete details of fund launches, and more insights.

[Financial results this week]

▪️ After 4X growth in FY23, Ather Energy’s revenue declines in FY24

▪️ After Rs 215 Cr profit in FY22, Molbio reports Rs 3 Cr loss in FY23

[News flash this week]

▪️ UPI in May: PhonePe maintains domination, Paytm sees marginal growth

▪️ Amazon says it has purchased some assets of MX Player, not entire company

▪️ No hurry to sell, indefinite horizon on Zomato: Sanjeev Bikhchandani

▪️ Trading app Investmint halts services; explores M&A deal

▪️ Baron Capital marks up Swiggy’s valuation to $15.1 Bn

[Conclusion]

The weekly funding increased 3.9% to $402 million, driven mainly by Lenskart’s $200 million secondary funding. Additionally, the week saw a layoff as fintech startup Simpl has undergone its second round of layoffs in less than a month, cutting around 30 employees.

PhonePe maintained its lead in the Unified Payments Interface (UPI) ecosystem with a market share exceeding 48% in May 2024, processing 6.8 billion of the 14 billion UPI transactions recorded by the National Payments Corporation of India (NPCI). Google Pay and Paytm processed 5.2 billion and 1.14 billion transactions, respectively.

Info Edge, renowned for its recruitment portal Naukri, has seen significant success with its investments in Zomato and Policybazaar, with Zomato’s market cap increasing 2.3 times since its IPO. Under the leadership of founder and chairman Sanjeev Bikhchandani, the company remains patient with its profitable investments while nurturing its brands. Read here for more.

Investmint, a signal-based trading app, has ceased operations due to challenges in establishing a reliable business model despite having decent traction and funds. The company is now exploring acquisition opportunities with wealth management firms.

Baron Capital has increased Swiggy’s valuation to $15.1 billion, a 25% rise from the previous $12.1 billion valuation in December 2023. Following Baron’s lead, Invesco also raised Swiggy’s valuation to $12.7 billion in April.

![Funding and acquisitions in Indian startup this week [03-08 Jun] Funding and acquisitions in Indian startup this week [03-08 Jun]](https://i1.wp.com/entrackr.com/storage/2024/06/Image-8-june.jpg?w=1200&resize=1200,0&ssl=1)