By Inc42 Media

In March 2023, Vineet Gupta, a confectionery store owner from Roorkee, and his wife Anjali were looking for the best investment options, not only for savings but also something that would give them guaranteed returns with minimal risk.

“My son scored over 97% in 10th grade. We wanted to save money for his higher studies,” Vineet said.

This is when they learned about the agritech investment platform Growpital from Google ads and on YouTube videos, which promised a tax-free 15% return on investments.

“There are no risks involved,” Growpital’s executives assured the couple via phone calls, he recalled. Further, since it’s an agricultural investment, there will be no taxes.

After speaking to multiple such salespeople, and watching webinars and interviews on YouTube, the Guptas decided to invest what they described as their entire life savings into Growpital — a whopping INR 32 Lakh for three years.

As per Growpital’s investment model, the couple was supposed to receive around 15% returns on a half-yearly basis plus any bonuses. But as it turns out that was just a story.

“We have received just one such payout last year from Growpital. After that, there have been no payouts. Now, we are unable to sleep at night, losing hope. We don’t have any money left to continue our only child’s education,” Vineet told Inc42.

Interestingly, all payouts to investment partners were made to their respective Growpital wallets which many of the investor-partners either reinvested or did not withdraw before the SEBI’s order.

He is just one among over 5,200 investor-partners (as per SEBI records) who are now stuck in limbo after investing in Growpital. The extent of their plight is clear from interviews that Inc42 conducted with 15 such investor-partners over the past few weeks.

Another investor Manoj (name changed) told us he was diagnosed with a severe mental illness after learning that he might not see any returns from the INR 20 Lakh invested with Growpital.

From plans to hit a revenue of INR 400 Cr in FY24 to inching towards a shutdown with every passing day, the Growpital story and promise have completely soured in the last six months.

- Over 5K investor-partners have stopped receiving instalments for the last six months

- Growpital’s employee count has reduced from around 100 to less than five, according to various sources close to the development

- What’s more the main investing platform i.e. Growpital’s website is not operational leaving investor-partners knocking on several doors for their returns

As reported by Inc42 in January this year, SEBI froze all the company accounts, leading to day-to-day operations coming to a halt. In an email response to Inc42, Rituraj Sharma of Growpital said that the total amount frozen by SEBI in bank accounts of entities is approx INR 50 Cr.

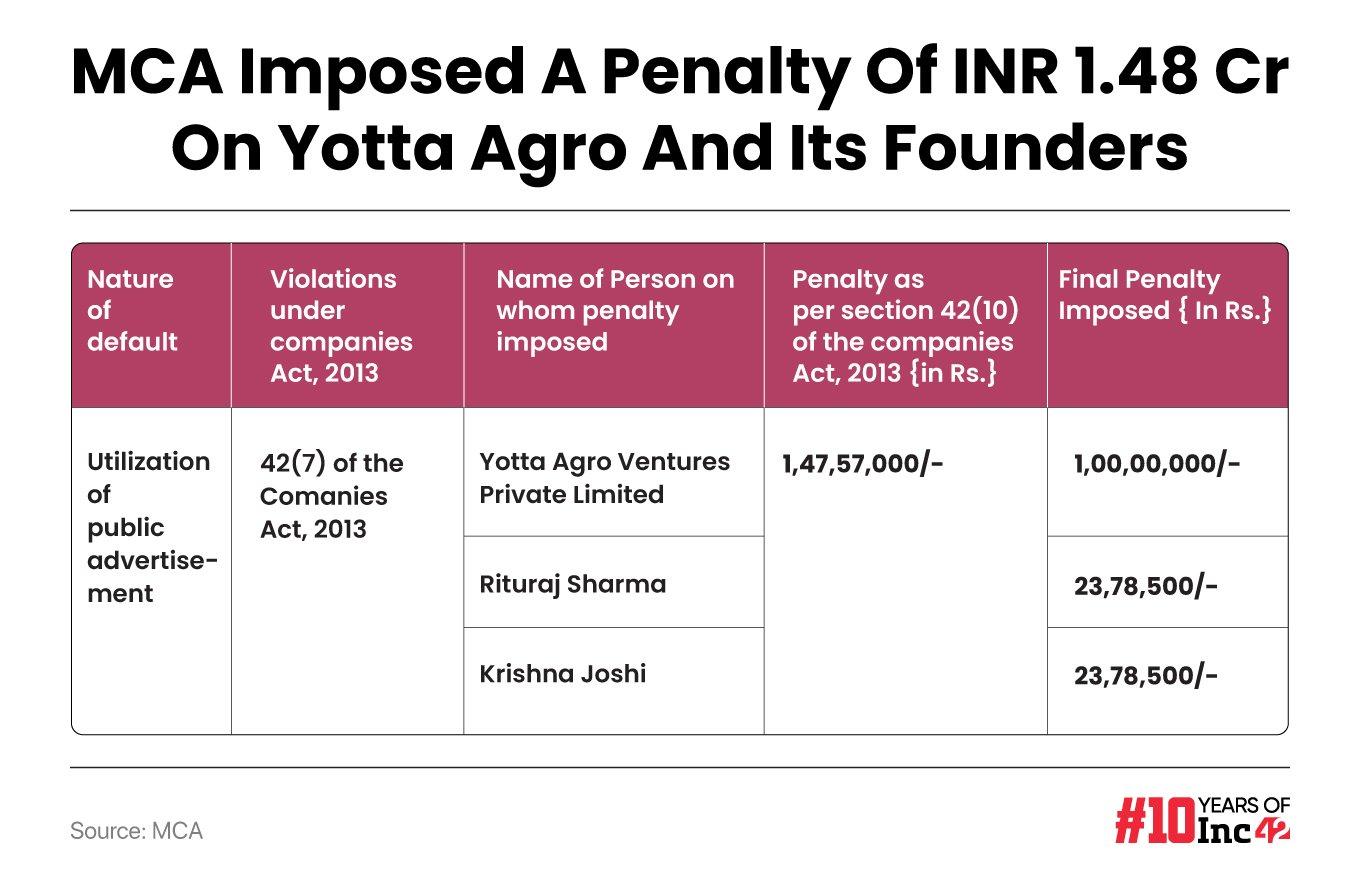

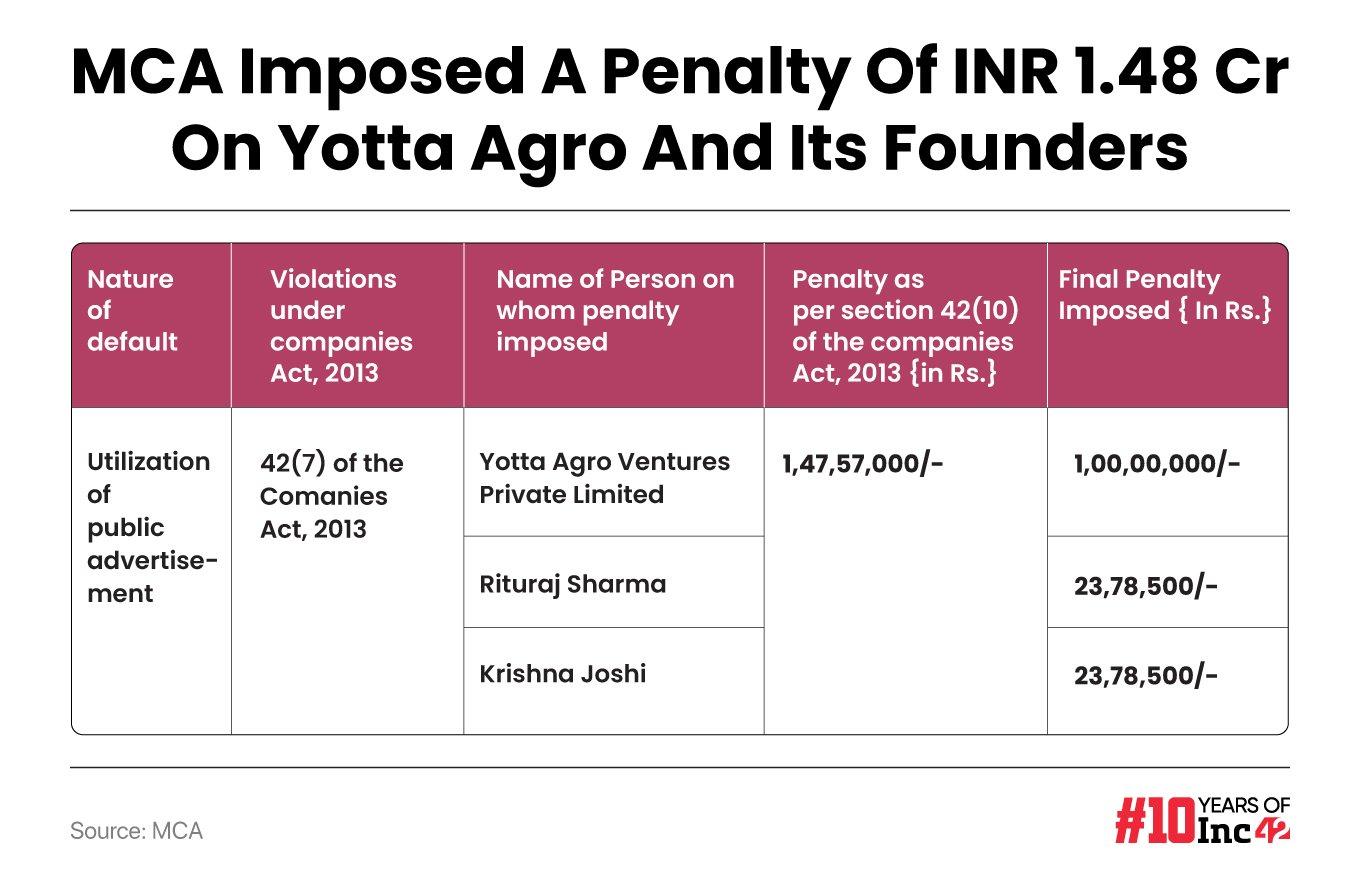

Besides this, the Ministry of Corporate Affairs imposed a penalty of INR 1.47 Cr on Yotta Agro, its partner entity which manages the farm properties and its directors including SHarma.

Growpital’s ‘False’ Promises

Founded by Rituraj Sharma in 2020, Jaipur-based Growpital was touted as one of the fastest-growing agritech investment platforms, offering 10%-18% returns on investments, and allowing investor-partners to invest as little as INR 5,000.

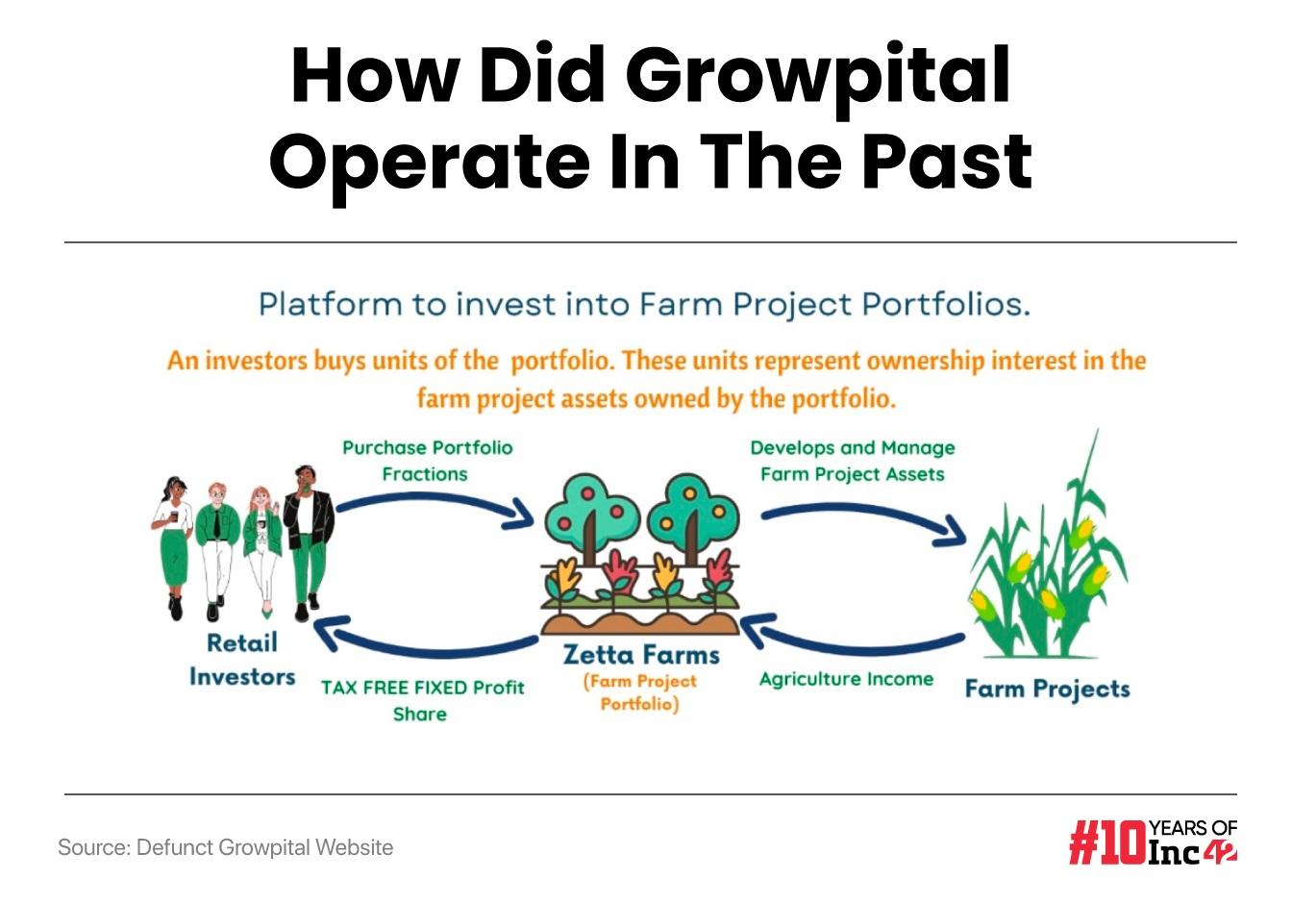

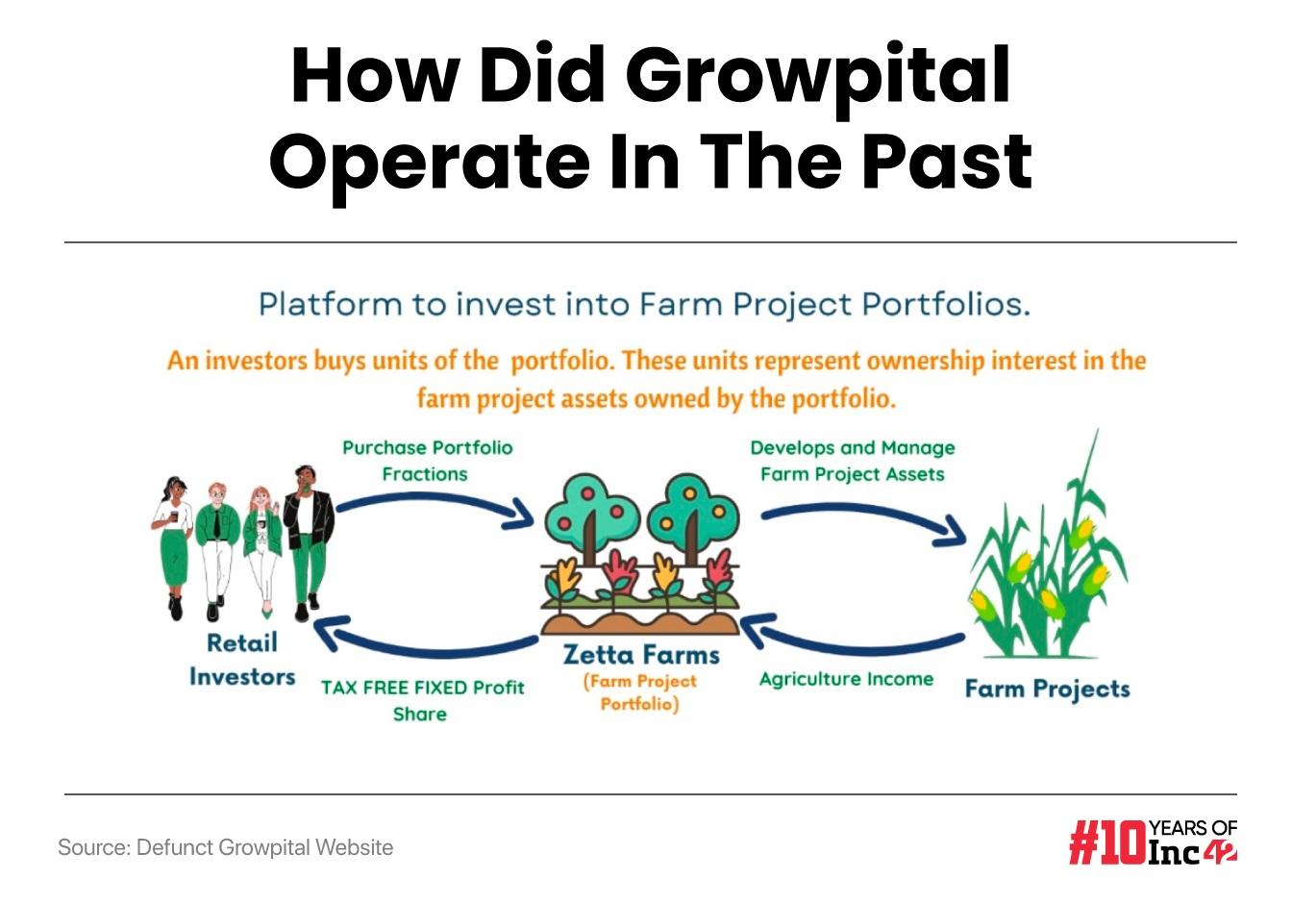

These investments were reportedly used for farming, and once the produce was sold, the firm claimed to have generated profits. These profits were then distributed among the investor-partners according to their respective investment plans.

Operated through a group of entities, the startup claimed to have raised funds for farming across 14 states in India for 70-plus crops, including fruits, vegetables, oilseeds, medicinal crops, and other cash crops.

To enable this, Growpital claimed to have partnered with various entities for farming and selling produce in the market. By collaborating with farmers, it provided standardised farming procedures. The platform compared its model to a mutual fund, cultivating a variety of crops across its agricultural projects.

Until SEBI issued its interim order in January 2024, the details of which we will see later in the article, Growpital had raised over INR 192 Cr. Interestingly, just before SEBI’s order, Growpital had increased discounts on its investment plans, which dozens of people subscribed to. Many of its plans were available only for a brief window, creating a sense of urgency among investor-partners.

In response to our query, Sharma claimed, “We had voluntarily also stopped taking any new contributions in the given structure w.e.f. 26 January, 2024, i.e. prior to the SEBI’s order and intimation in this regard was given to all partners on 8 January 2024 itself. This decision was in line with our business and commercial projections for deployment of funds on the farmlands.”

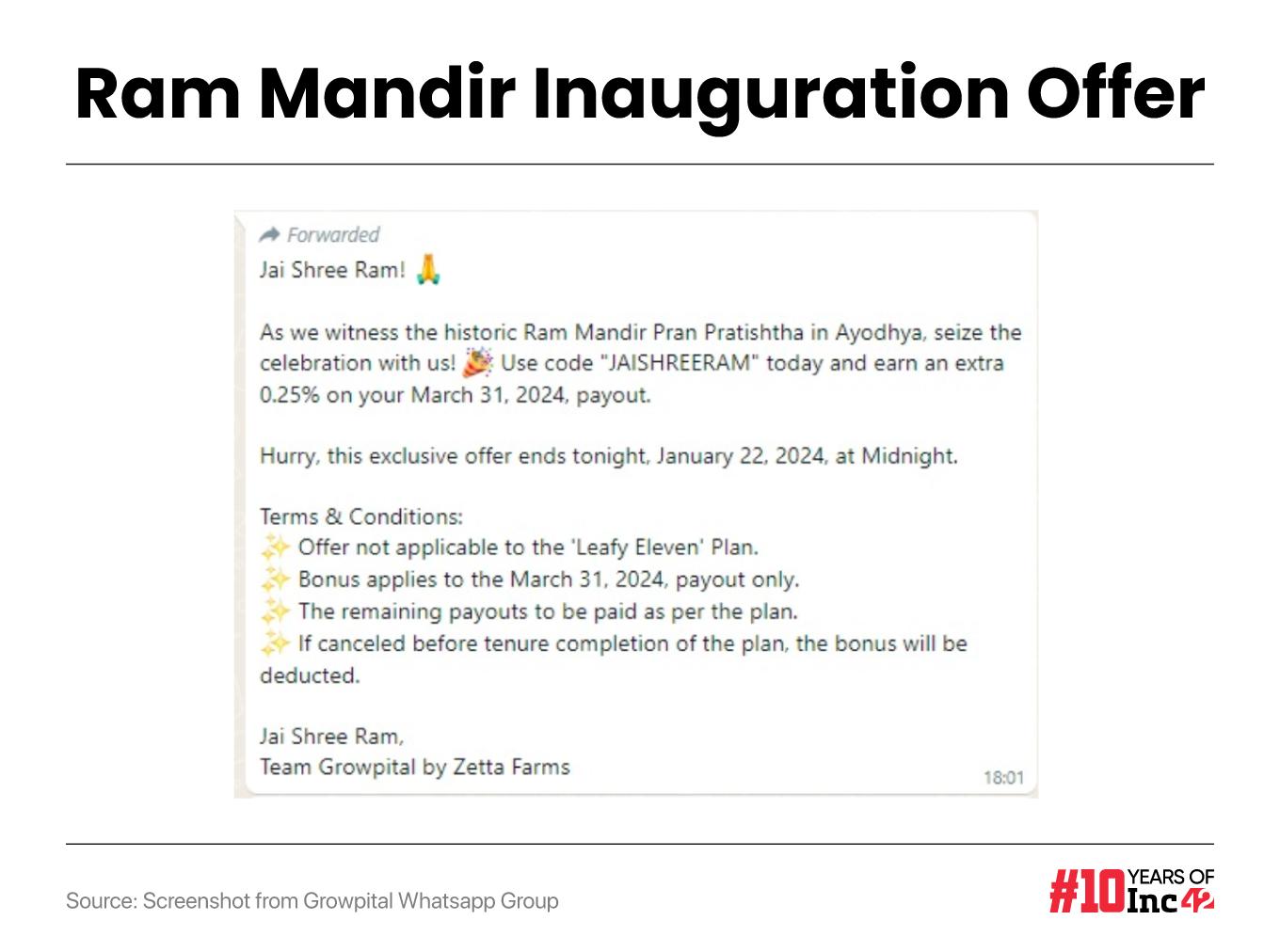

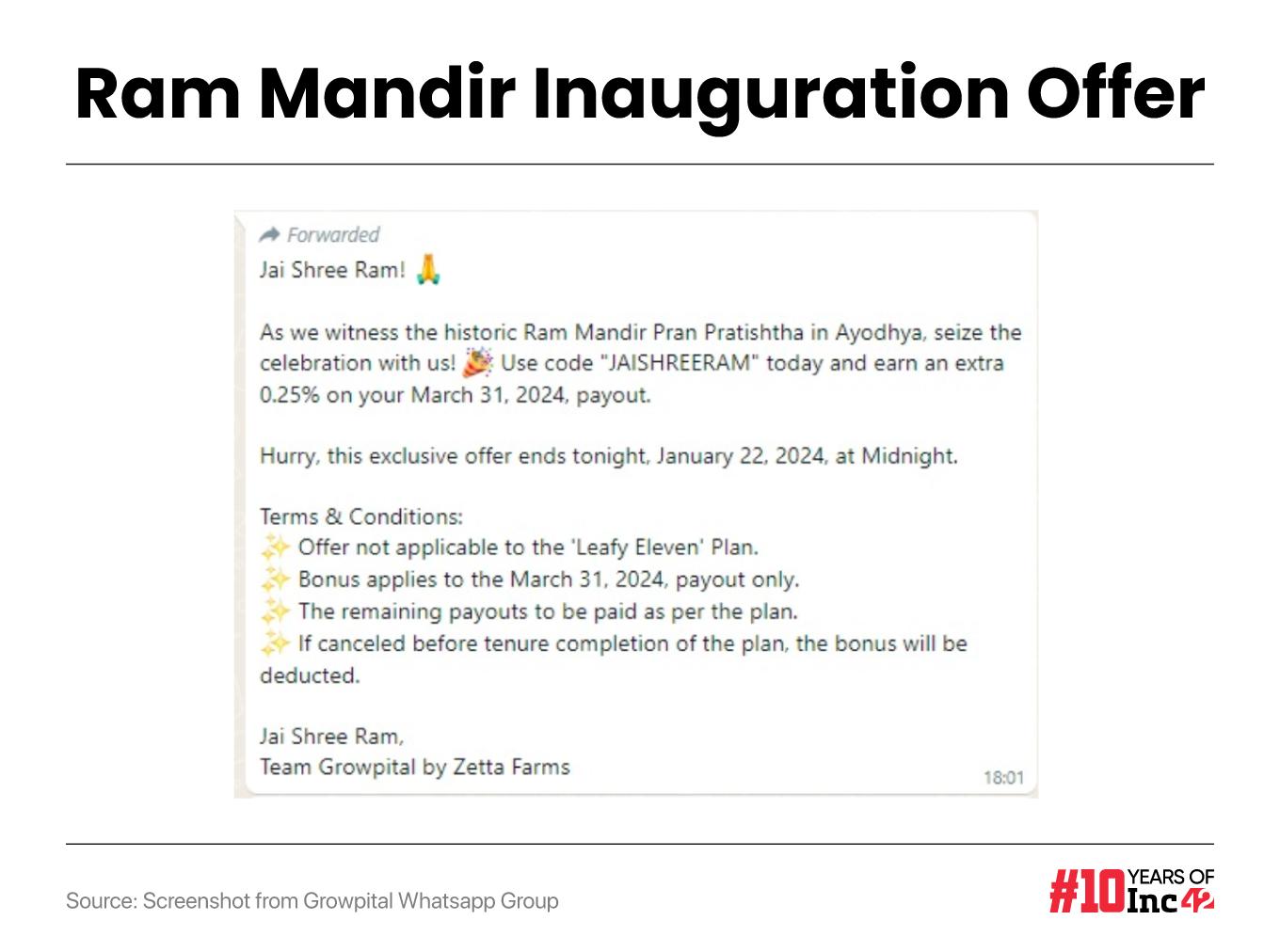

However, in January 2024, the company had in fact promised massive rewards too, from 0.5% to 1% of the invested amount as referral bonus during certain periods such as the consecration of the Ram Mandir at Ayodhya in January 2024, which was incidentally just a week before SEBI’s adverse order.

Understanding The Modus Operandi

Founder Sharma had set up numerous entities to operate the entire plan. These include:

- Farm Silo Tech LLP (Growpital): This platform acted as an interface between investor-partners and promoters, sharing all the investments plan details and luring investor-partners to invest in as partners in ZF Project LLPs.

- Yotta Agro Ventures Pvt Ltd: A DPIIT-registered startup entity that acquired properties such as farms on lease through agreements with other parties.

- ZF Project 1 LLP: This LLP was used for agreements with Indian investor-partners for fundraising, making them partners in the LLP. However, only the designated partner, Sharma, managed day-to-day operations. ZF stands for Zetta Farms.

- ZF Project 2 LLP: This LLP included institutional or B2B investor-partners

- ZF Project 3 LLP: This LLP was for NRI investor-partners only.

When investor-partners used the Growpital platform, they became partners in an LLP created by Growpital, with their investments treated as capital contributions to these LLPs. The pooled investments were claimed to be directed towards agricultural projects managed either by an in-house team or in collaboration with established market players.

The returns or profits from these projects were promised as returns on the investment made through Growpital.

The ZF Project LLPs had agreed with Yotta Agro Ventures, which stated:

- Yotta Agro would purchase or buy back all the agricultural produce from ZF Project LLPs.

- ZF Project LLPs would produce based on the requirements of Yotta Agro.

- ZF Project would get a definite price for the produce with a minimum premium of 30% over the cost incurred.

- Yotta Agro would maintain and monitor the agricultural work on the land without being bound by any maximum or minimum target regarding the quantity, quality, or type of produce.

- The price received by ZF for the produce would not be influenced by market prices.

Profits from the sale of agricultural produce were then distributed to the partners aka Growpital investor-partners, excluding the designated partners, as stipulated in the LLP agreement.

To get investor-partners on board and keep their investments coming, Growpital and Sharma routinely shared images of farms and produce with investor-partners, looking to boost their confidence in the model and attract further investments.

The platform derived credibility from Yotta Agro Ventures, since the startup had ties to government bodies and was registered with the DPIIT. He marketed these ties to attract investments in the LLP.

Some of the claims he submitted in the Rajasthan High Court while filing a petition against SEBI include:

- Yotta Agro Ventures received startup recognition from the Department for Promotion of Industry and Internal Trade (DPIIT)

- Received INR 18 Lakh in grants from the Department of Agriculture

- Received an appreciation letter from the Nagaland government’s District Planning and Development Board

- Signed an MoU with the Nagaland government

- Received a Rubber Nursery project under the supervision of the Rubber Board of India and Ministry of Commerce and Industry

Everything appeared fine on the surface, with investor-partners continuing to invest until January 25, 2024, just a day before SEBI’s interim order on January 29, 2024.

However, as alleged by SEBI in its order, Growpital was operating without the requisite regulatory licences and that the business was run in an illegal and fraudulent way.

Incidentally, the founder Rituraj Sharma has been on bail since 2021 in an unrelated case where he had allegedly defrauded another individual for INR 17 Lakh.

Why SEBI Termed Growpital ‘Illegal’

“There are no tangible assets owned by the ZF Project LLPs and the lands for farming are provided by Yotta Agro Ventures and the LLPs are used to deploy funds for growing and selling of crops. This kind of structuring makes it clear that the LLPs are mere conduits for pooling of funds in the guise of ‘capital contribution’, and actual operations are carried out through Yotta Agro Ventures.” – SEBI Order

In its January 29 interim order, SEBI called the Growpital business illegal and reiterated the same in its confirmatory order later in April. What exactly was the regulator’s problem with Growpital?

Interestingly, to investigate the matter fully, a SEBI official invested INR 5,000 through Growpital in June 2023 and then gained access to the documents shared with investor-partners. The regulator is known to undertake such investments to understand the extent of the illegality, if there is any.

Post its investigations, SEBI cited multiple reasons for deeming the business illegal. Most importantly, it termed the fundraising scheme identical to a “Collective Investment Scheme (CIS)” even though Growpital was not registered as a CIS with the regulator.

Explaining the applicability of CIS and Growpital’s argument, Ravi Prakash, associate partner at Corporate Professionals, said that Growpital’s argument that its operations through various LLPs did not fall under the CIS regulations was flawed.

While the platform claimed that investor-partners contributions in the LLP were capital contributions, no securities were issued in exchange and the contributions were in the form of partnership interests, placing them outside SEBI’s jurisdiction.

The definition of a CIS under Section 11AA of the SEBI Act includes any scheme where contributions are pooled and used for the scheme, with profits or returns promised to investor-partners. SEBI found that Growpital’s model met these conditions.

“Funds were pooled and invested in agricultural projects with returns promised to investor-partners, fitting the CIS criteria despite being structured as LLPs, making SEBI’s jurisdiction applicable,” added Prakash.

Experts also pointed out that the Growpital website promoted investment opportunities similar to mutual funds. The LLP structure, with no cap on partners or contributions, was allegedly misused for a covert investment scheme. The various LLPs created by Growpital, lacking tangible assets and using Yotta Agro Ventures for operations, pooled funds under the guise of ‘capital contribution.’

Growpital acknowledged that partners joined the LLP to earn profits. The platform argued profit distribution capped at the LLP’s net profits did not meet Section 11AA(2)(ii) of the SEBI Act.

According to Section 11AA(2)(ii) of the SEBI Act, a scheme would be termed as CIS, if the contributions or payments are made to the scheme by investor-partners in exchange for future profits, income, produce or property from the scheme.

Interestingly, during an AMA, a SEBI official even asked cofounder Sharma about this issue, who explained that as none of the LLPs had reached INR 100 Cr in contributions individually, the model cannot be deemed to be a CIS.

MCA’s Parallel Probe

But at around the same time as SEBI, another regulatory body also began investigating Growpital.

Sharma’s other entity, Yotta Agro, along with ZF Project LLPs, was under the scanner of the Ministry Of Corporate Affairs.

Abhishek Modak, an investor who used the Growpital platform, complained to the MCA in December 2023 that the company did not file its Form 3 and Form 4, despite having collected over INR 40 Cr from 400+ investor-partners.

It’s worth noting that Form 3 is required to be filed for information with regard to LLP agreement and changes, if any, while Form 4 is required to be filed for new appointment or cessation and changes in details pertaining designated partners or partners.

“While the LLP agreement has been amended more than 12 times with new investor-partners being added to the agreement list, the same was not being filed with the MCA. The MCA filing does not show us as partners even,” Growpital investor Geeta Vidyarthi told us.

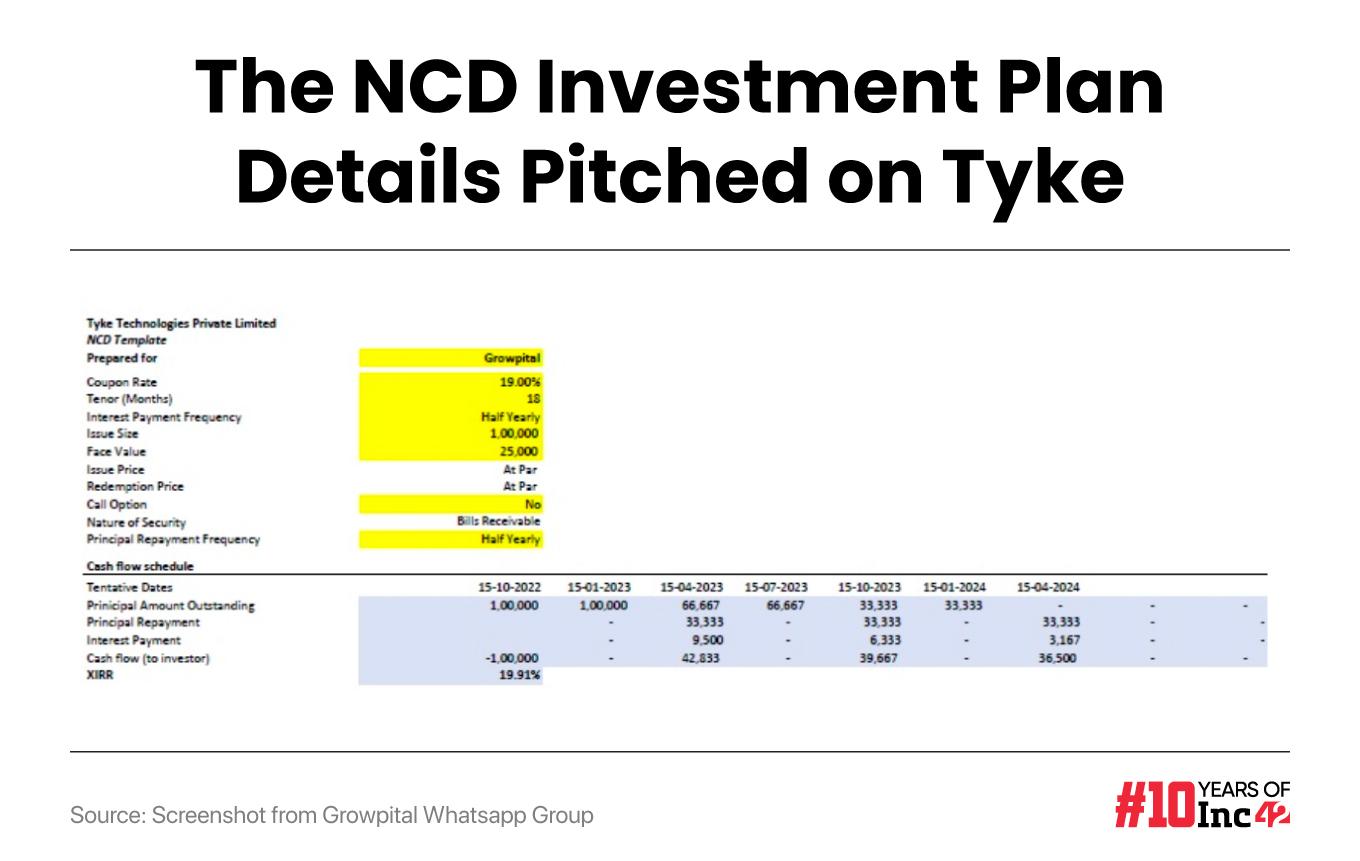

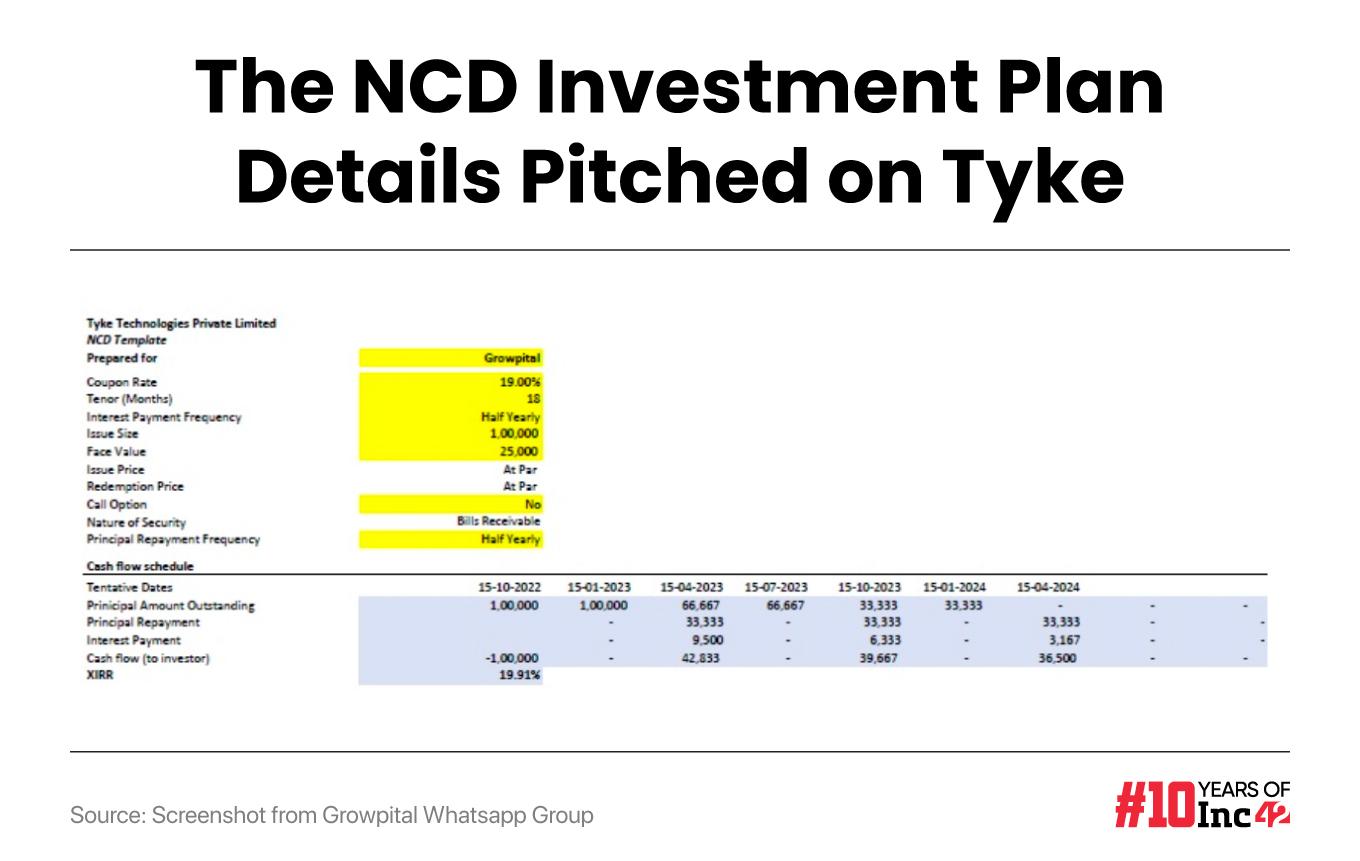

In its investigation, the MCA also found that Yotta Agro had raised INR 1.47 Cr through non-convertible debentures from Tyke Invest from some 183 investors at an interest rate of 19%.

Despite having filed the PAS-3 form (for private placement offer), the cofounder pitched to the public to raise funds and also used an ‘AMA’ video on YouTube, which has now been deleted.

In its order on May 6, 2024, the MCA observed that Yotta Agro had violated Section 42(7) of the Companies Act, 2013, and imposed a penalty of INR 1 Cr on Yotta Agro and INR 23,78,500 each on its directors, Rituraj Sharma and Krishna Joshi.

Simply put, Section 42(7) says private placement offers must not be publicly advertised.

The MCA further ordered the company and its directors to refund all the money to the 183 investor-partners with 19% interest as promised.

In a WhatsApp group, Sharma circulated a message stating that he was planning to file a petition against the MCA’s order. Out of two months given to appeal against the order, it’s been more than a month since the order, yet neither Sharma nor Yotta Agro has filed the appeal yet.

“The entity on which the penalty has been imposed shall take available legal recourse against the said penalty,” said Sharma.

Behind The Alleged ‘Fraud’

Inc42 spoke to over a dozen investor-partners who alleged that Growpital has committed fraud by keeping investor-partners and partners in the dark.

Firstly, Sharma, as the designated partner of the LLPs, kept investor-partners uninformed on certain accounts.

For instance, Vidyarthi, one of the investor-partners quoted above, told us that despite Sharma sharing images of farms and impressive production numbers, he didn’t share the actual locations of these farms.

“The farms were part of Yotta Agro Ventures and he said that he couldn’t share the locations of these farms since it is a separate business,” said Vidyarthi.

Sharma also started a farm tourism business, but investor-partners were not informed about this new model. The revenue from these activities was not shared with the investor-partners, alleged Vidyarthi.

SEBI also observed discrepancies in the numbers shared by Sharma and the company. For instance, the number of unique crops for which information was submitted was 42, but Growpital actually claimed to be growing over 70 crops in its partner farms.

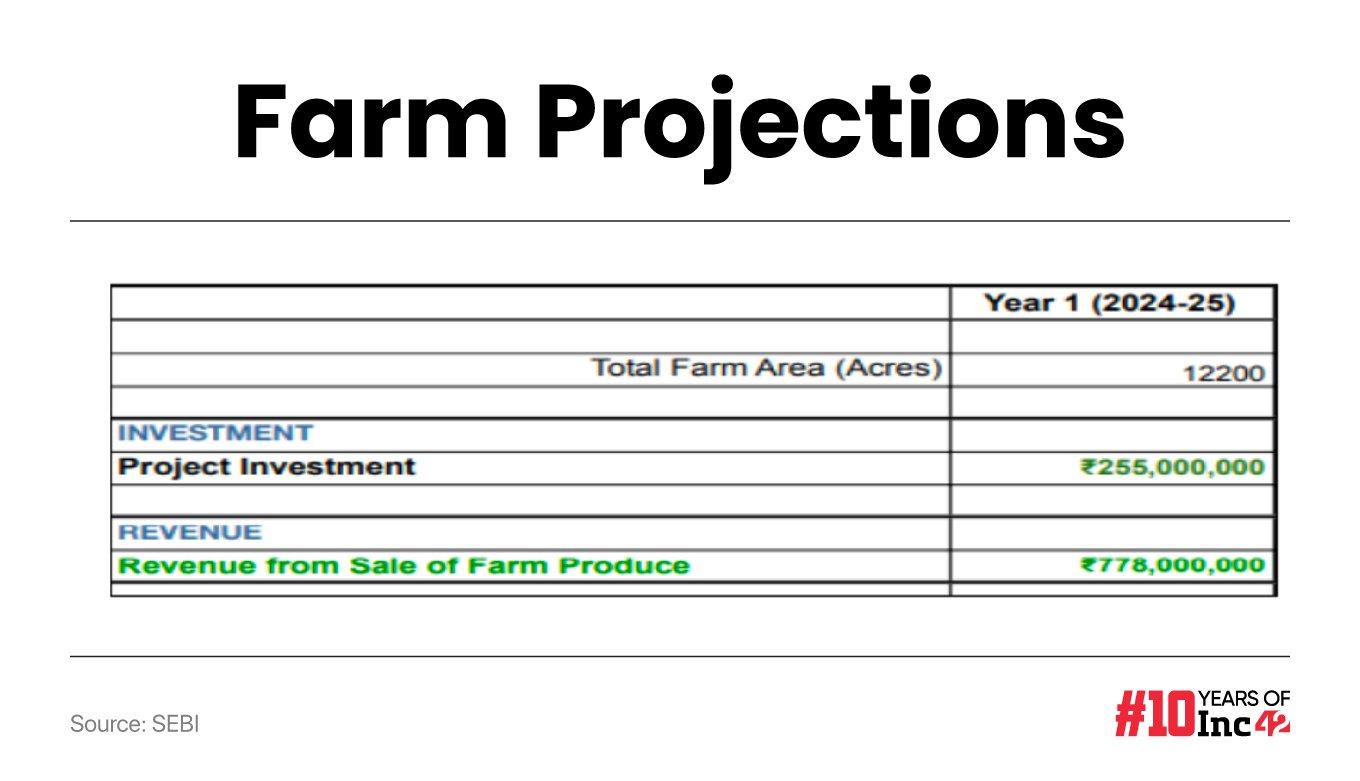

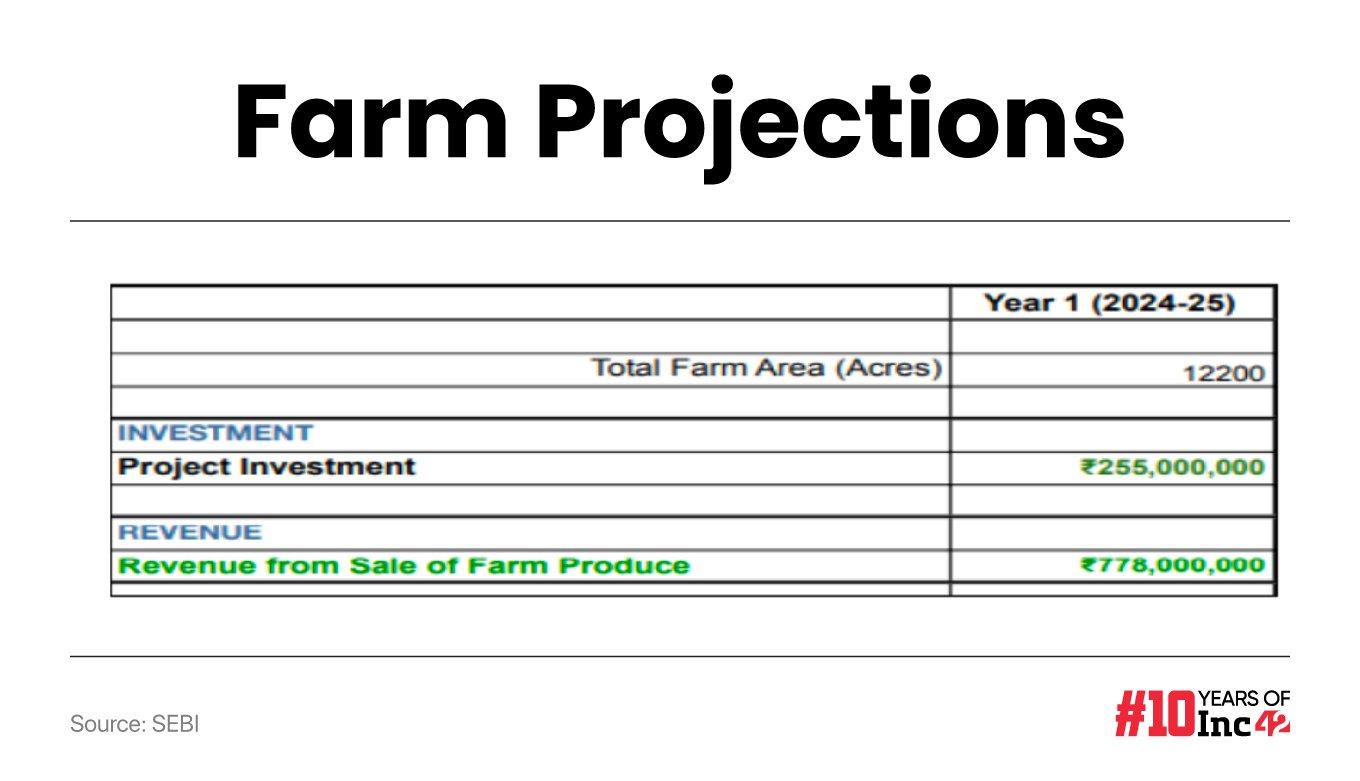

The farm projections shared with SEBI did not have any details on how the projections were made.

In one of his videos in December 2023, Growpital founder Sharma told investor-partners and partners that the platform has closed revenue of INR 110 Cr in the first nine months of FY24, and another INR 250 Cr-INR 300 Cr was expected by March 2024.

The revenue breakup from various farms was full of holes according to the people we spoke to.

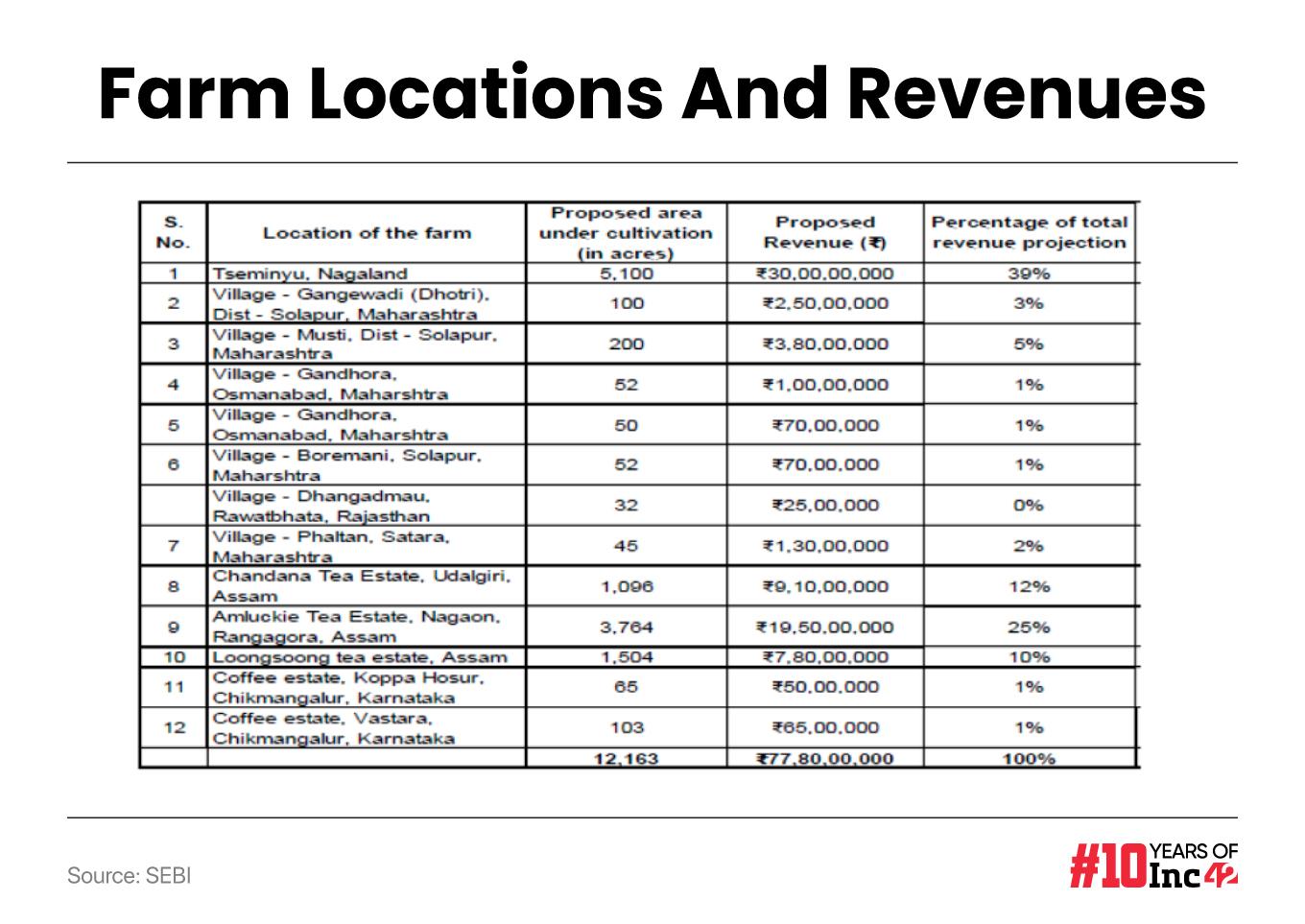

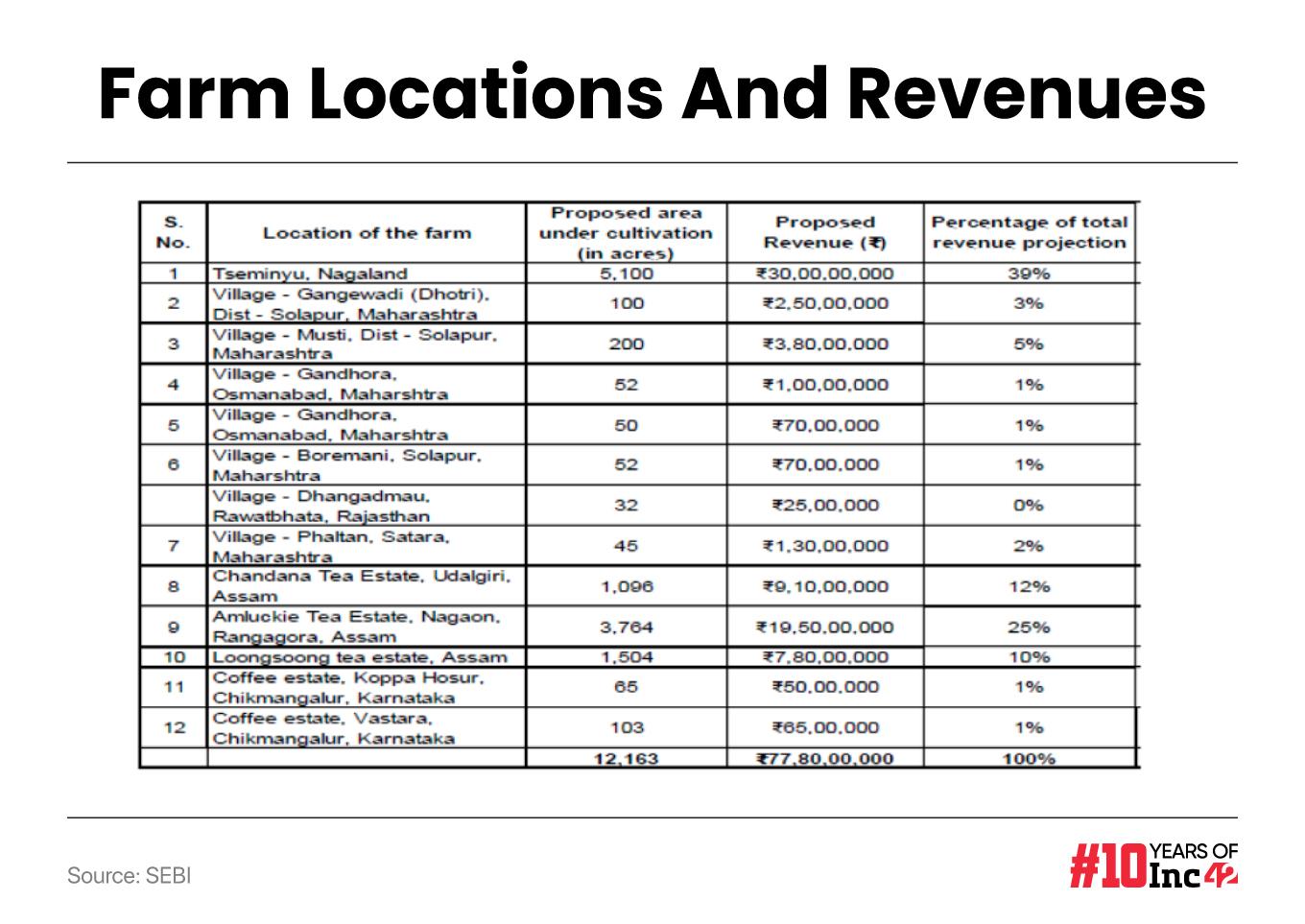

As shown in Growpital’s claims below, at least 85% of the projected revenues for FY25 were supposed to be derived from land parcels in Assam and Nagaland. However, no revenue has been claimed from these farms till date.

Further, there were claims that 84% (INR 61.7 Cr out of a total of INR 73.8 Cr) of the total revenues was derived from jeera or cumin seeds farmed on a 75 acre farm in Barmer, Rajasthan.

Another investor-partner Prudhvi Ram told us jeera needs at least four months to grow, so farms growing jeera can only cultivate jeera between November 2022 and March 2023. On an average, Indian farms can produce around 700 Kg of jeera each season per acre of farm. At the price quoted by Growpital in its revenue breakdown, the platform would need to have access to around 2,500 acres of jeera cultivation in one cycle.

But as per Growpital’s disclosures to SEBI it only has 503 acres of farms dedicated to growing jeera. This is barely one-fifth of the required acreage for the revenue claimed.

We asked about this irregularity and Sharma said, “This is part of the ongoing investigation and we have clarified the same to the SEBI. Accordingly, it is better to await the outcome of legal process in this regard.”

Investor-partners further allege that Sharma was never truthful with them or SEBI on multiple fronts, including claims about requesting an inspection of farms from SEBI.

Further, in an AMA with investor-partners, he claimed to have 73K acres of farming land which is far from the truth. According to the documents shared with SEBI, he did not have more than 13K acres of land for farming.

Roughly 5,100 acres of this was awarded by the government of Nagaland for farming, as per Sharma’s claims, but he did not provide the locations of these farms or any proof of the allotment from authorities in Nagaland.

On the varying figures regarding the land area, Sharma replied, “There is a distinction between land area over which we had acquired the right or interest to cultivate and the land on which cultivation was happening as on the date of the SEBI order. We had plans to expand land under cultivation after January, 2024, which could not be put in place due to the SEBI order. We had approx 60,000 Acres of Land area over which we had acquired the right or interest to cultivate the land, out of which cultivation was going on approximately 13,000 acres as on the date of the freeze order.”

The Fight Ahead For investor-partners

While Sharma continues to assure investor-partners that he will fight and appeal against SEBI, the Securities Appellate Tribunal (SAT) and the MCA and even claimed he would approach courts, things have not been in his favour so far.

His appeal against SEBI in the Rajasthan High Court was disposed of and he was told to appeal in the SAT. While the matter is still pending, SAT refused to offer any interim relief to Sharma.

Investor-partners meanwhile are still figuring out the legal remedies available. Maulik Lakhani, meanwhile has written to RoC, Jaipur and has complained to the Jaipur Police, on behalf of a group of investor-partners.

“The biggest problem for us is that we have to work daily to get our monthly bread and butter. Investments in Growpital were supposed to be our passive investments like mutual funds. We have kids who we barely manage to give our time to and at the same time, Growpital funds are our life savings which we can’t afford to lose,” one such investor-partner told us.

Lakhani said, “We have already hired an advocate in this regard and have prepared the legal documents on behalf of certain investors. Once SAT order is out, we will explore our legal options, starting with FIR.”

Investor-partners say that SEBI needs to disburse the frozen funds, as most of the investors don’t even have funds to pursue any legal fight.

While SEBI issued its confirmatory order on April 26, the investigation is still on. The SAT is set to pronounce its order on July 10, 2024. Inc42 will update the story on the basis of the SAT’s order or the status of the hearing.

In his response to Inc42, Sharma reiterated his stance stating, “We reaffirm our position that the LLPs established for agricultural activities operate as legitimate businesses, with individuals and corporate entities making capital contributions and becoming partners. We have meticulously adhered to all provisions stipulated under the LLP Act 2008 and its regulations.”

And it would also seem that Sharma has moved on — despite the thousands of investor-partners complaining and protesting.

Will the Growpital investor-partners left in the lurch be able to express their gratitude to authorities in a similar manner?

[Edited by Nikhil Subramaniam]