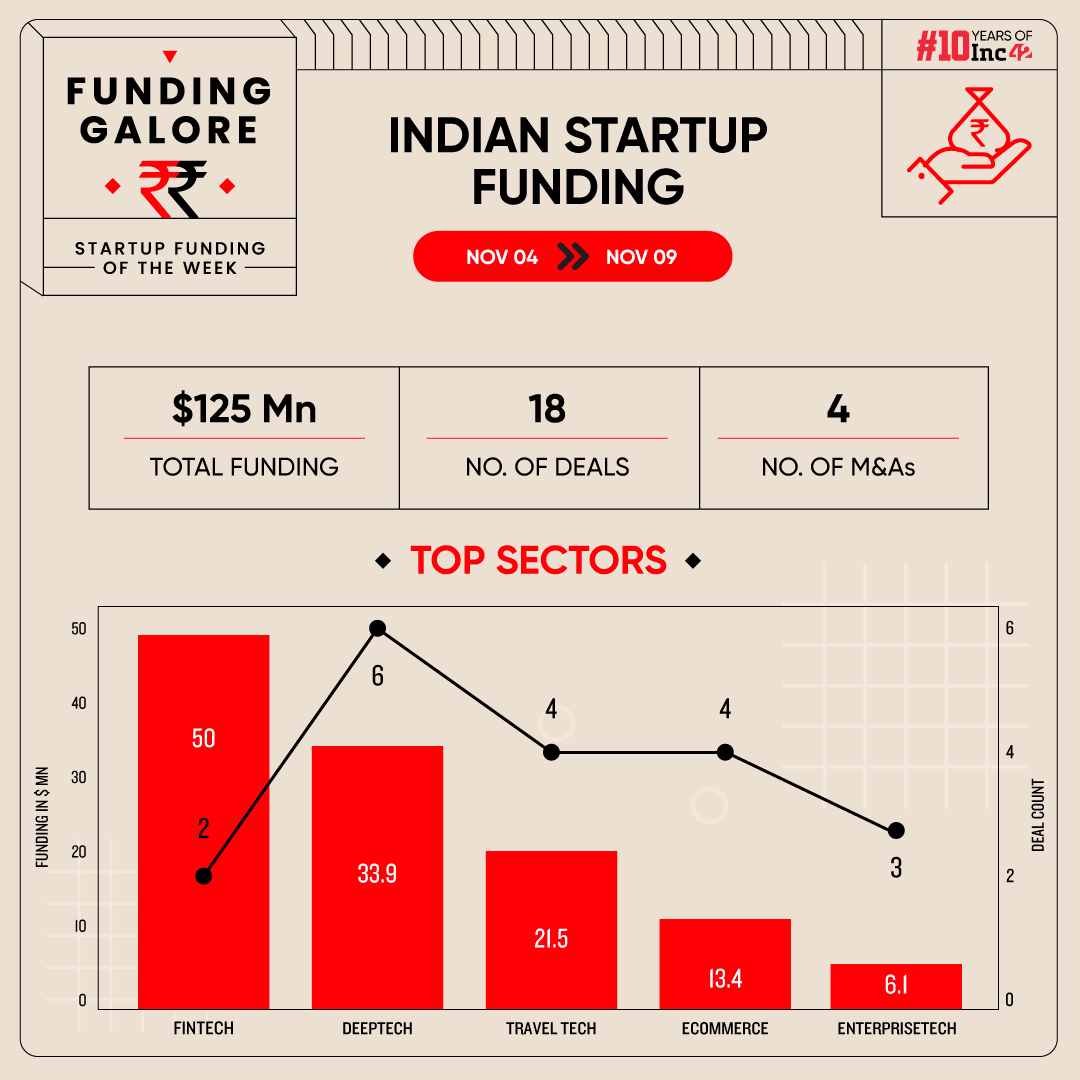

Indian startups cumulatively raised $125 Mn across 18 deals, a 54% decline from $256.9 Mn secured via 8 deals in the preceding week

Fintech was the investor favourite sector this week, with startups bagging $50 Mn via 2 deals

Deeptech startups raised $33.9 Mn via the highest six deals in the week

This year, festivities in India fuelled a mixed bag of funding trends for the world’s third largest startup ecosystem. After seeing a renewed vigour in investor interest between October 28 and November 2, the fresh capital infusion subsided in the first week of November.

Between November 4 and 9, Indian startups secured $125 Mn across 18 deals. This marked a 51% decline from the $256.9 Mn secured via 8 deals in the preceding week. Pertinent to note that funding trends have remained volatile in the final quarter of 2024.

Note: This week’s funding galore also includes deals from the preceding week

Funding Galore: Indian Startup Funding Of The Past Two Weeks [ Oct 28 – Nov 9 ]

| Date | Name | Sector | Subsector | Business Model | Funding Round Size | Funding Round Type | Investors | Lead Investor |

| 29 Oct 2024 | Finova Capital | Fintech | Lendingtech | B2B-B2C | $135 Mn | Series E | Avataar Venture Partners, Sofina, Madison India Capital, Norwest Venture Partners | – |

| 29 Oct 2024 | Vridhi Home Finance | Fintech | Lendingtech | B2C | $36.9 Mn | Series B | Norwest Venture Partners, Elevation Capital, Sunku Ram Naresh, Sandeep Arora, Sunil Mehta | Norwest Venture Partners |

| 28 Oct 2024 | Udaan | Ecommerce | B2B Ecommerce | B2B | $35.6 Mn | Debt | Lighthouse Canton, Stride Ventures, InnoVen Capital, Trifecta Capital. | – |

| 6 Nov 2024 | Easy Home Finance | Fintech | Lendingtech | B2C | $35 Mn | Series B | Claypond Capital, Sumitomo Mitsui Banking Corporation, Xponentia Capital, Finsight Ventures, Harbourfront Capital, Pegasus India | Claypond Capital, Sumitomo Mitsui Banking Corporation |

| 29 Oct 2024 | Zinc | Fintech | Investment Tech | B2C | $25.5 Mn | Seed | Nexus Venture Partner, Quona Capital, EDBI, Global Ventures, Saison Capital | Nexus Venture Partner |

| 31 Oct 2024 | Country Delight | Ecommerce | D2C | B2C | $23.8 Mn | Debt | Alteria Capital | Alteria Capital |

| 6 Nov 2024 | MODIFI | Fintech | Payments | B2B | $15 Mn | – | Sumitomo Mitsui Banking Corporation, Maersk, Intesa SanPaolo, Heliad | Sumitomo Mitsui Banking Corporation |

| 7 Nov 2024 | Boldfit | Ecommerce | D2C | B2C | $13 Mn | – | Bessemer Venture Partners | Bessemer Venture Partners |

| 7 Nov 2024 | GalaxEye | Deeptech | Spacetech | B2B | $10 Mn | Series A | MountTech Growth Fund – Kavachh, Mela Ventures, Speciale Invest, iDeaForge, Smarthya Investment Advisors, Infosys | – |

| 5 Nov 2024 | CynLr | Deeptech | Robotics | B2B | $10 Mn | Series A | Pavestone, Athera Venture Partners, Speciale Invest, RedStart Labs | Pavestone, Athera Venture Partners |

| 7 Nov 2024 | Zoomcar | Travel Tech | – | B2C | $9.1 Mn | Debt | – | – |

| 5 Nov 2024 | Marut Drones | Deeptech | Dronetech | B2B-B2C | $6.2 Mn | Series A | Lok Capital | Lok Capital |

| 4 Nov 2024 | Hala Mobility | Travel Tech | Transport Tech | B2C | $6 Mn | pre-Series A | Srikanth Reddy, Snehith Reddy, Phani Ramineni, Sarthy Angels, Bestvantage | – |

| 7 Nov 2024 | The Hosteller | Travel Tech | Accommodation | B2C | $5.7 Mn | – | V3 Ventures, Blacksoil, Real Time Angel Fund, Ice Venture Capital, Synergy Capital Partners, Unit-e Consulting, Harsh Shah, Vedang Patel | – |

| 8 Nov 2024 | C2i Semiconductors | Deeptech | IoT & Hardware | B2B | $4 Mn | – | Yali Capital | Yali Capital |

| 7 Nov 2024 | Thesys | Enterprisetech | Horizontal SaaS | B2B | $4 Mn | Seed | Together Fund, 8VC | Together Fund |

| 7 Nov 2024 | Nexstem | Deeptech | IoT & Hardware | B2B-B2C | $3.5 Mn | – | InfoEdge, Gruhas, Zupee, Smile Group | InfoEdge, Gruhas, Zupee, Smile Group |

| 7 Nov 2024 | Pulse | Enterprisetech | Vertical SaaS | B2B | $1.4 Mn | Seed | Endiya Partners, Zluri, Yellow.ai | Endiya Partners |

| 5 Nov 2024 | Induz | Enterprisetech | Horizontal SaaS | B2B | $780K | – | YourNest Venture Capital, SanchiConnect | YourNest Venture Capital |

| 7 Nov 2024 | 30 Sundays | Travel Tech | Travel Planning & Activities | B2C | $770K | pre-Seed | Infoedge Ventures, First Cheque, Eximius, Misfits | Infoedge Ventures |

| 6 Nov 2024 | Wholeleaf | Ecommerce | D2C | B2C | $356K | – | ah! Ventures | ah! Ventures |

| 7 Nov 2024 | Enlog | Deeptech | IoT & Hardware | B2C | $207K | – | Vinners | Vinners |

| 29 Oct 2024 | Coox | Consumer Services | Hyperlocal Services | B2C | $125K | Seed | Inflection Point Ventures | Inflection Point Ventures |

| 4 Nov 2024 | Viraa Care | Healthtech | Fitness & Wellness | B2C | $108K | pre-Seed | – | – |

| 29 Oct 2024 | Mithron | Deeptech | Dronetech | B2B-B2C | – | – | – | – |

| 30 Oct 2024 | FlavingredProducts | Ecommerce | D2C | B2C | – | – | ah! Ventures | ah! Ventures |

| 5 Nov 2024 | Anubal Fusion | Cleantech | – | B2B | – | pre-Seed | Speciale Invest | Speciale Invest |

| Source: Inc42 *Part of a larger round Note: Only disclosed funding rounds have been included | ||||||||

Key Startup Funding Highlights Of The Week

- While a mega deal materialised in the form of NBFC Finova Capital’s Series E funding round in the final week of October, no deals worth over $100 Mn took place in the first week of November.

- Fintech startup Easy Home Finance secured $35 Mn in its Series B funding round on November 6, making it the biggest cheque secured by a startup in the past week.

- On the back of Easy Home Finance and MODIFI’s funding rounds of $15 Mn, fintech topped the sectorial list with heaviest capital influx of the week.

- At a sectoral level, deeptech was close on the heels of fintech in the past week. Startups in the space cumulatively raised $33.9 Mn via the highest six deals in the week.

- Seed funding in the week stood at $5.4 Mn.

Mergers & Acquisitions From The Past Two Weeks

- Gladiators Esports bough gaming company Gods Reign for what the startup claims to be the biggest acquisitions in the Indian esports space. However, no details of the financial details of the transaction were disclosed.

- Marking its fourth acquisition in the fiscal year 2024-25, listed fintech company Veefin Solutions picked up a 50% stake in Singapore-based GenAI startup Walnut in an all-cash deal.

- Continuing its purchase streak, gaming major Nazara bought UK-based growth marketing agency Space & Time for around INR 52.3 Cr in a cash and stock deal via its subsidiary Datawrkz.

- Wealth management startup Wealthzi was acquired by Nivesh for INR 9 Cr.

- In what could be one of the biggest startup mergers in the insurance space, Inc42 learnt that InsuranceDekho and RenewBuy are looking at finalising a merger that would value the combined entity at $1 Bn.

Funds Launched In The Last Two Weeks

- Bipin Shah, who previously served as a managing partner for VC firm Titan Capital, floated his micro VC firm Zeropearl. The firm will look to back 12-15 high-stakes investments in a year.

- VC firm Inflexor Ventures announced the first close of its Opportunities Fund at $33.7 Mn on November 6.

- Listed NBFC Northern Arc disclosed that it has secured debt commitments of $65 Mn for its maiden climate focused fund.

Updates On Indian Startup IPOs

- Foodtech major Swiggy’s IPO closed with an oversubscription of 3.59X on November 8. The startup is scheduled to get listed on November 13.

- Logistics unicorn BlackBuck filed its RHP for an IPO consisting of fresh issuance of equity shares worth INR 550 Cr and an offer for sale of 2.06 Cr shares by several existing shareholders. The startup’s IPO will open on November 13 and close on November 18.

- NBFC Avanse Financial Services received approval from the SEBI for its INR 3,500 Cr public issue on October 23.

Other Developments Of The Weeks

- VC firm First Cheque will likely back 15-20 startups with investments of up to $500Kapiece from its third cohort over the next 18 months.

- Agritech startup Arya.ag secured a debt commitment of $19.8 Mn from US International Development Finance Corporation (DFC) to extend a debt facility for its agri commerce subsidiary Aryatech. The funding commitment is for .a period of seven year.

By Inc42 Media

Source: Inc42 Media

Discover more from FundingBlogger

Subscribe to get the latest posts sent to your email.