By Inc42 Media

“We will try everything possible to get your pending salaries, even if it requires liquidating assets,” Kumar Sangeetesh, cofounder and CEO of 1K Kirana said in the last week of May 2024.

Just 30 odd employees were left in the kirana tech startup, which just in August last year had over 1,000 employees. Several of these employees told Inc42 that this was the day when 1K Kirana all-but shut shop.

Sources say that the startup which began operations in 2019 — at the peak of the kirana tech wave — is on the verge of shutting its operations and is currently staring at possible bankruptcy. To avoid one of these outcomes, 1K Kirana is also said to have held talks with other startups in the kirana tech space. Following these talks, Info Edge-backed ShopKirana is close to acquiring 1K Kirana, multiple sources claimed.

CEO Sangeetesh confirmed that the startup has had to halt supply chain operations to save costs, but insisted that the tech platform is operational. He further claimed that the startup is exploring all the potential options and “will not need to file for bankruptcy.”

But Inc42 found that 1K Kirana’s website isn’t functional, and its Android and iOS apps seemed to be malfunctioning and remain unusable. For instance, the app didn’t allow new user sign-ups and returned an error when we tried to register.

The company did not respond to questions about the acquisition deal with ShopKirana or other startups. Incidentally, Info Edge is also an investor in 1K Kirana.

The tale of 1K Kirana mirrors what we have seen unfold in the Indian startup ecosystem throughout 2022 and 2023. Products and models born during the pandemic soon became irrelevant. This is most evident in the consolidation and pivots within the kirana tech space.

Plus, the entry of large B2B ecommerce players in the kirana procurement chain has made it harder for startups to compete. But this was not the case in 2020 and 2021, when many of them raised large rounds.

In the six years since inception, 1K Kirana has raised over $32 Mn (INR 250 Cr+) in funding across multiple rounds from the likes of Info Edge, Alpha Wave, Kae Capital, and a few angel investors.

The startup’s pitch was centred around modernising kiranas by solving their supply chain and financing woes. In the heyday of kirana tech, 1K Kirana managed to sign up as many as 1,000 stores before the model crumbled.

The startup is alleged to have overestimated the capabilities of its team in managing this network and recklessly invested in warehouses without an established presence in certain markets, ultimately resulting in a poor product experience for kiranas, and mass layoffs. Today, the company is looking at a stack of pending bills from vendors and salaries of employees, besides a fire sale.

Before we move ahead, let’s talk about what 1K Kirana does.

The 1K Kirana Model

Founded in 2018 By Kumar Sangeetesh, Sachin Sharma and Abhishek Halder, 1K Kirana (formerly called NiyoTail) claimed to enable kirana and mom-and-pop stores establish a presence online and expand their reach.

The primary business model involved procuring products from FMCG brands and selling them to retail stores within a 24-hour window, a concept already implemented by companies like Udaan, Dealshare, ElasticRun, Jumbotail, among others.

Where 1K Kirana differentiated itself was in onboarding retail stores primarily in Tier-II cities using a franchise model. The startup’s key offerings included onboarding these stores to its platform then renovating and rebranding them entirely with 1K Kirana’s branding.

Under this model, the startup also covered fixed costs for running these stores, including up to 50% of rent and electricity expenses. Furthermore, the startup provided a point of sale (PoS) device to accept digital payments and managed inventory for these stores.

On the consumer side, 1K Kirana’s app allowed buyers to keep an eye on the products available in the neighbourhood partner or franchise store.

Besides, the startup claimed it could drive demand and foot fall to these stores through marketing and promotional campaigns.

While 1K Kirana maintained complete control over the supply chain and pricing, the store owners earned commissions from 1K Kirana after selling products to consumers.

1K Kirana earned through the margin between buying from FMCG brands and selling to kiranas.

With that said, 1K Kirana realised that making money in the grocery business is challenging due to razor-thin margins. However, the startup realised the only way to increase its topline was to expand its operations to enter new markets, which required funding.

2022: The Year Of Scaling Up

It’s easy to forget the mania around kirana tech in 2020. Four years later, many of the startups in this space are on the brink of irrelevance as the digital transformation wave among retailers has slowed down, and most of this market has been cornered by large scale players such as Udaan, JumboTail, and others.

1K Kirana onboarded its first store in January 2020 in Rewari, Haryana, and quickly grew to 100 franchise stores within a year. Building on this rapid growth, the startup secured $7 Mn in Series A funding in August 2021. Soon after the funding, it launched private labels for wheat, mustard oil and flattened rice (poha) under the Farm Gold brand and ventured into non-grocery items through 1K Mall to add to its topline.

Building on this proposition, in 2022, the startup raised a much larger $25 Mn in Series B funding round. “After April 2022, the startup was growing on steroids. It hired aggressively, set up new warehouses, and entered new regions to capture market share,” according one of our sources who was with the company till September 2023.

The workforce shot up by roughly 4x in 2022 to around 1,000-1,200 payroll employees. It also hired hundreds of off-roll or contractual employees to look after their warehouses.

By 2022, the company claimed to have 1,000 stores across 25 districts in the Delhi NCR region and Harayana, which grew to around 1,400 stores soon after the Series B round. The startup wanted to cover over 100 districts and make inroads into Punjab, Rajasthan, and parts of Uttarakhand.

To support these plans, the startup established additional warehouses. From a single warehouse in Gurugram, 1K Kirana established a 1 Lakh sq ft warehouse near Sonipat, followed by another in Punjab with double the capacity, and then another in Jaipur. Backing these were 10 distribution centres to streamline last-mile deliveries.

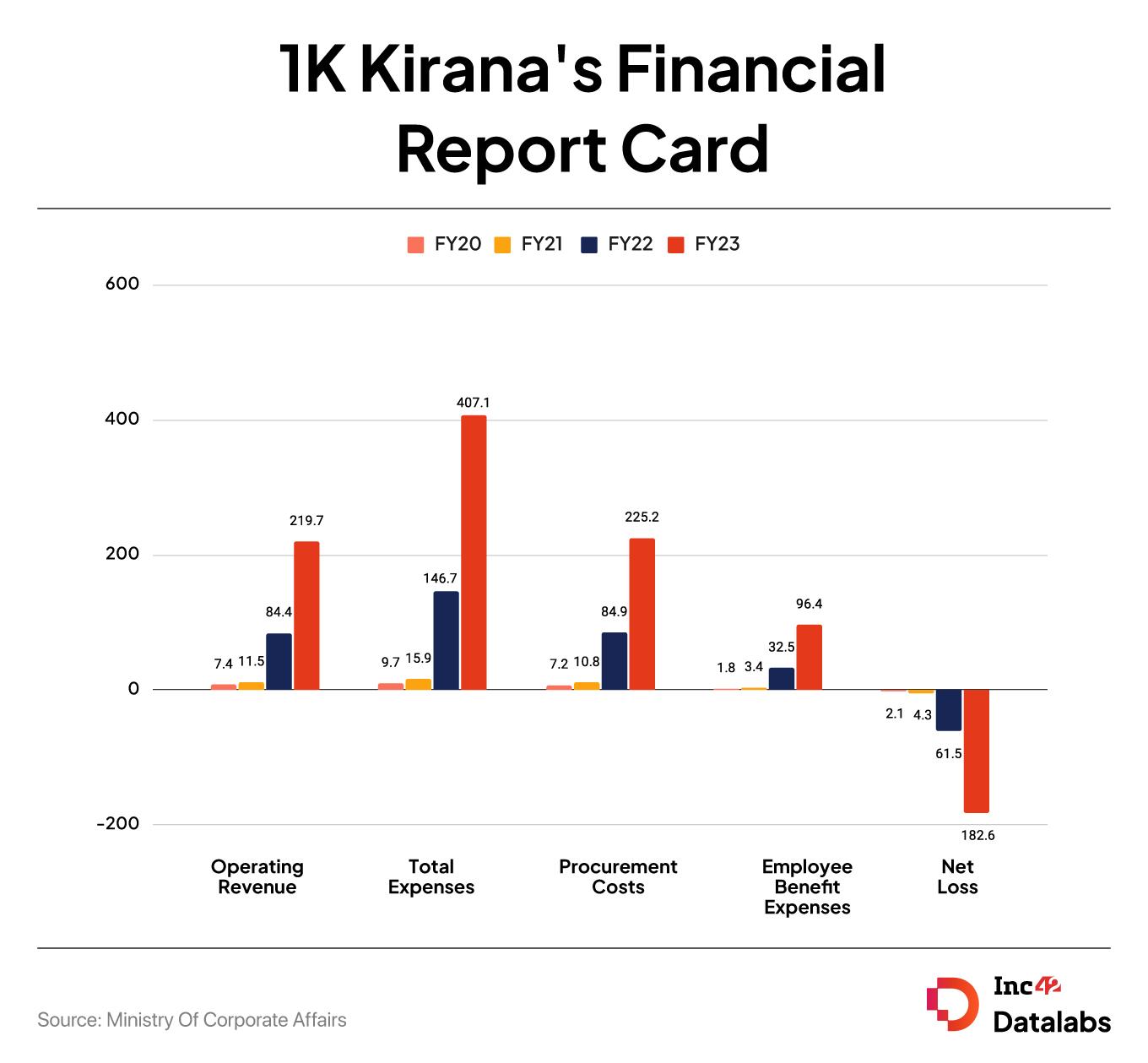

In a 2022 interview, Sangeetesh said that warehouse capacity had grown from 2 lakh sq ft in to 6 lakh sq ft in the year, and the expansion paid off when it comes to the FY23 financial performance:

Despite the healthy revenue growth, 11 months after raising $25 Mn, 1K Kirana made the decision to scale back.

Despite the healthy revenue growth, 11 months after raising $25 Mn, 1K Kirana made the decision to scale back.

By the end of Q1 FY24, the startup delisted around 200-250 stores, shut operations in several areas, and underwent a massive layoff impacting hundreds of employees. So what went wrong?

2023: The Year Of Regression

To answer what went wrong, we must first answer the question of what went right. From our conversations with sources — former employees of the company — it’s clear that the company was only growing rapidly because it had the funds to acquire new kiranas and expand its network.

As soon the funding tap went dry, 1K Kirana was in a spot of bother. It had built up massive warehousing capacity, but all of a sudden without the capital base to set up new franchise stores, growth hit a wall.

“The entire organisation knew about the second tranche of investment,” said one source, who added that the $25 Mn raised in Series B was just the first tranche for a full round of $50 Mn. This was supposed to come in at the end of 2022, but never materialised. Instead it received a much smaller cheque of around $4 Mn in August 2023. Existing shareholders invested in the company at a $45 Mn valuation, 60% marked down valuation from $110 Mn in 2022.

Without the full second tranche, the company immediately looked to save costs and control its negative contribution margin. Sources indicated that the startup brought on new customers on occasion at a loss, hoping to retain them in the long run.

However, this model only works if the company is able to continually offer low procurement rates to kiranas, which 1K Kirana did not achieve.

The company’s management opted for larger warehouse space in anticipation of future demand, which never came, and so the company began scaling back and downsizing its warehouse capacity.

“1K was working to build supply before it had the demand. Without studying the market or leveraging data, the startup set up warehouses, and then looked to partner with stores, hoping that this way it would capture the market eventually. But most other companies would have only set up a warehouse after establishing a distribution centre first,” added a former employee who looked at the logistics operations in the startup.

Besides this, there were high operational costs that ultimately forced the company to delist some stores. As previously mentioned, the startup had to cover the marketing expenses for these stores, while also paying rent, utility bills and other costs to keep the stores running.

“There were instances where the stores were inside residential premises. So 1K Kirana was spending money to grow these stores without getting any revenue in return,” added another source.

Former employees also allege that warehouses were also not established in the right zones, leading to higher service and supply costs. Several stores quit the platform due to unsatisfactory service, sources claimed.

By early 2023, the company had delisted around 200 stores from its platform after shutting down warehouses and distribution centres. It was also forced to lay off 70% of its workforce or nearly 800 employees en masse in March-April 2023.

Cofounder Sangeetesh confirmed the scaling back of the business, “We received the first tranche and we started growing very fast leading to high burn which was brought under control by the end of Dec ’23. But, by that time funding winter had already set in, leading to the second tranche not coming in. Hence, business was cut by 75%, leading to layoffs and valuation was cut in the bridge [round] that we raised in August 2023.”

There were other challenges in terms of collections from franchise stores. Many of them paid sales representatives directly instead of the company, as per our sources. Some stores existed only on paper or did not have the capacity to actually sell products they procured.

Products were also dispatched to non-existent stores, and the company covered electricity and rent expenses for addresses where no stores existed. Inc42 couldn’t verify several of these allegations independently.

However, CEO Sangeetesh vehemently denied these allegations and said that rumours of corporate governance lapses are unfounded. He also claimed that the company was audited by one of the Big Four firms and it received a clean “due diligence” report.

He further stressed that the store onboarding process was done with proper KYC documents and geo-tagging of stores.

Meanwhile, several hundreds of employees are awaiting severance pay and final settlement. Other employees asked to take pay cuts last year are awaiting ESOPs which were promised as compensation for the lower pay.

Sources claim not all employees received the ESOPs, and even when they did, it was 10 months after the pay cut. With the company staring at a distress sale, will these ESOPs even be worth anything?

Questions sent to 1K Kirana’s investors didn’t elicit any response at the time of publishing this story.

Desperate Times Call For Desperate Pivots

It was only after the layoffs, that 1K Kirana reassessed its strategy and made several significant changes.

First, it reduced the number of new stores in the franchising model and only brought them on after greater scrutiny. Secondly, it raised the minimum order value for kiranas when they placed a procurement order.

Thirdly, it limited the number of SKUs it was offering significantly, so that it could get the best pricing from manufacturers by restricting demand to specific products.

And finally, most importantly, it expanded beyond the franchise model to start selling products to stores that were outside the 1K Kirana network. Moreover, the startup also onboarded wholesalers to its platforms to clear out inventory.

“We just became another B2B grocery delivering startup in the space. We were trying to differentiate from Udaan and others in the space, but ended up becoming just like them,” said another person on the condition of anonymity.

The downsizing of the network meant 1K Kirana’s procurement volume fell and it couldn’t get the best pricing possible from FMCG companies. Consequently, it couldn’t offer the discounted rates for procurement which it relied on to woo kiranas.

Many of the kiranas switched to other players with deeper pockets who could bear the costs of discounts or who had better leverage in price negotiations with FMCG companies.

The cost saving measures sent 1K Kirana on a spiral of deteriorating service quality and attrition of stores, leading to the startup looking for saviours in any shape or form.

Inc42 learnt that 1K Kirana held discussions with Indore-based ShopKirana, which operates in the same industry. Questions sent to ShopKirana didn’t elicit any response.

Given the situation at 1K Kirana, it’s looking like a distress sale where some investors in the startup might recover some portion of their investment. Info Edge is an investor in both these companies.

CEO Sangeetesh acknowledged that 1K Kirana is up for sale, but didn’t specify any other details. The CEO told Inc42 that in a bid to raise capital after lowering the expenses, the startup signed a share subscription agreement with its investors in August 2023. However, an unnamed investor backed out, causing the deal to collapse.

“Sangeetesh tried everything to make this work. But it is unfortunate that it had to end,” said another source who left the company earlier this year.

The End Of Kirana Tech?

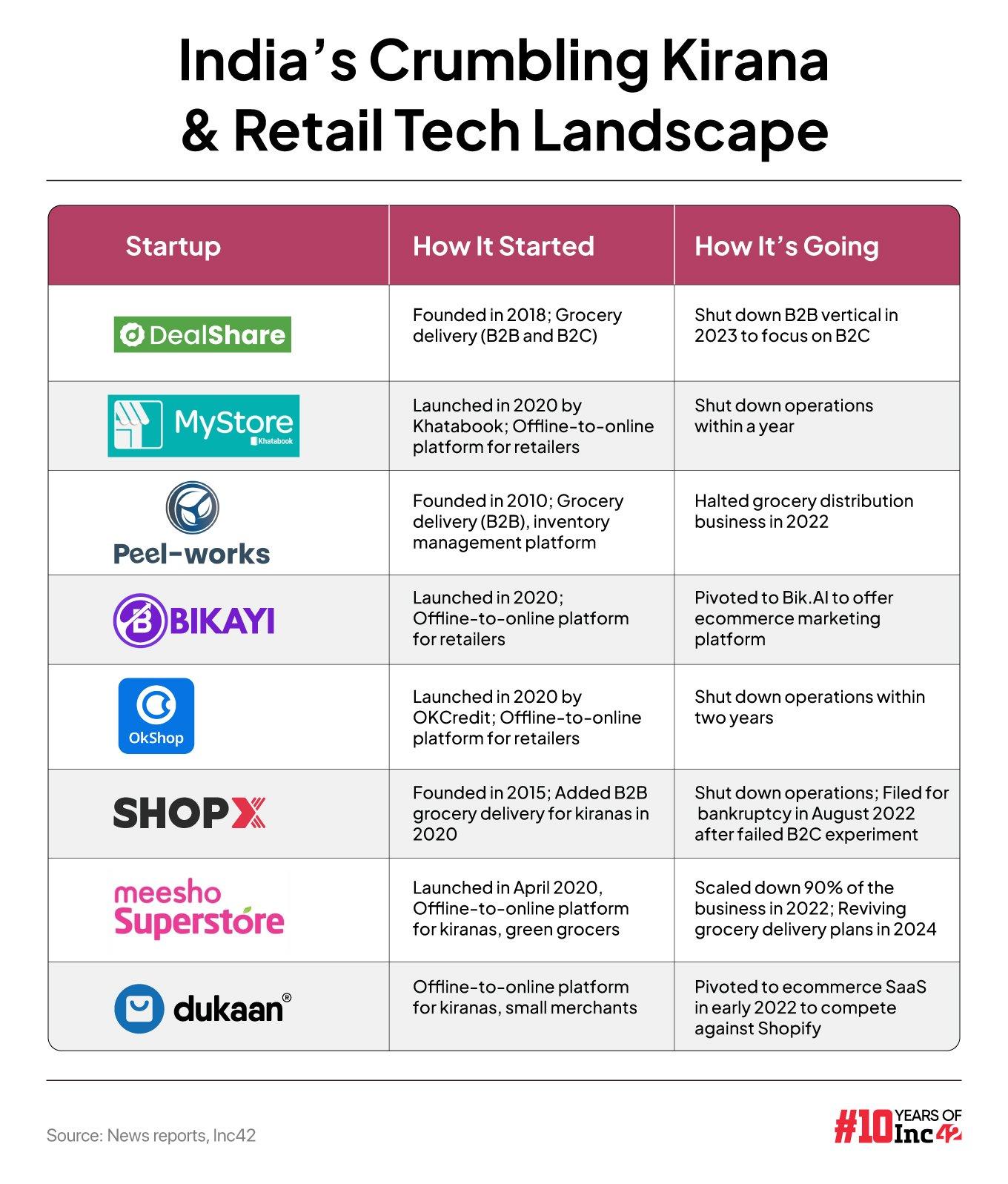

Even during the peak of the pandemic, it was clear that some business models would fall by the wayside once the worst of Covid is over. The end of kirana tech mirrors the pain suffered by edtech, where a number of startups emerged whose business models only seemed to have PMF during the pandemic.

The shutdowns and pivots in edtech from online to offline business models, is also similar to how kirana tech players have morphed from supply chain models to ecommerce SaaS in many cases.

Even B2B ecommerce unicorn Udaan, which launched in 2016 and has raised over a $1Bn in funding is yet to break even.

Tiger Global-backed unicorn Dealshare, which has raised nearly 10X of 1K Kirana’s funding, is in hot soup and has already shut its B2B vertical.

Besides 1K Kirana, the kirana tech peak created the likes of Dukaan, Aarzoo, Kirana King, ShopKirana, Peel-Works, Khatabook’s MyStore, Dotpe’s DigitalDukaan, OkCredit, Bikayi, Magicpin and many more. Many of these have either pivoted to other models — including Dukaan, Aarzoo, Bikayi — while the likes of Peel-Works have scaled down, as per reports.

Moreover the entry of giants like JioMart and Tata into the retail supply space has made it even more challenging for players such as Udaan, Dealshare, 1K Kirana, among others. The emergence of quick commerce has also destabilised kirana businesses in many metro and Tier 1 locations.

In such a market, it’s not surprising that kirana tech’s long tail is falling away. Unfortunately for 1K Kirana, the depth in the market means that growth expectation will always remain high, but in the current climate, this has to be demonstrated without too much reliance on VC funding.

As things stand, it seems next to impossible for any investor to pump in significant capital to revive the startup. The founders and investors can only hope to find an acquirer as a saviour for the company, but will that mean employees will get paid the salary backlog?

Another complication is whether 1K Kirana has a tech stack that will attract the right bids. RIght now, there is no talent left in the startup, so it is more likely going for a brand or tech-led acquisition.

[Edited by Nikhil Subramaniam]

Discover more from FundingBlogger

Subscribe to get the latest posts sent to your email.