While net loss narrowed on a YoY basis, it widened 43% from INR 347 Cr in Q1 FY25

Operating revenue zoomed 39% YoY to INR 1,214 Cr in Q2 FY25. However, it slumped 26.1% from INR 1,644 Cr in Q1 FY25

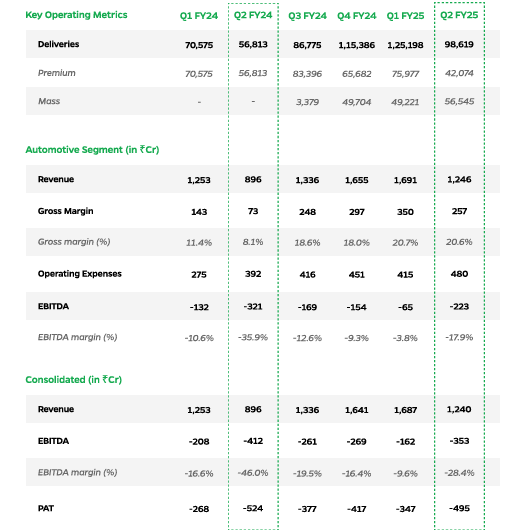

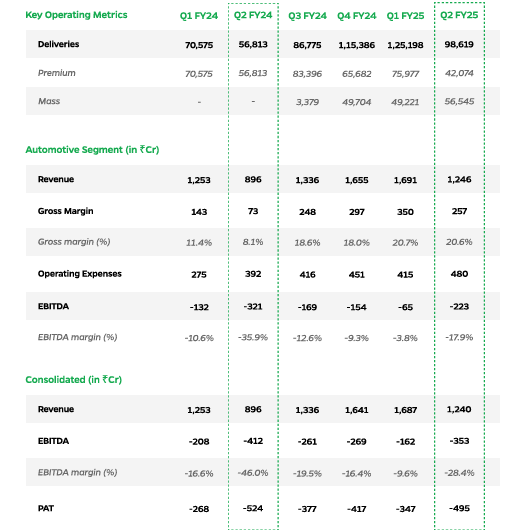

Ola Electric said that despite a reduction in the government subsidies, its gross margin in the auto segment improved 12.5 percentage points YoY to 20.6% in Q2 FY25

Bhavish Aggarwal-led electric mobility startup Ola Electric

However, its loss widened almost 43% from INR 347 Cr posted in the preceding June quarter amid a decline in EV sales.

As an electric two-wheeler manufacturer, Ola Electric currently earns all its revenue from sales of escooters. Till FY24, its Ola S1 Pro model earned it the highest amount of revenue.

The startup’s operating revenue zoomed almost 39% to INR 1,214 Cr during the quarter under review from INR 873 Cr posted in Q2 FY24. However, it slumped 26.1% from INR 1,644 Cr in Q1 FY25.

As per the company’s Q2 filings, it delivered 98,619 escooters in the quarter under review as against 1.25 Lakh units of EVs delivered in the previous quarter. However, escooter deliveries shot up by more than 73% on a year-on-year (YoY) basis.

“We have maintained our market leadership with 33% market share during Q2 FY25 despite aggressive competitive action… Our mass market portfolio (sub-INR 1 Lakh) continues to drive momentum and has grown 15% QoQ driving EV penetration while our premium portfolio continues to be majority of revenue,” said Ola Electric in its filing.

However, as the startup pointed out, there is an “aggressive competitive action” in the electric two-wheeler market, and Ola Electric began losing some of its market share from July this year as its rivals TVS Motor, Bajaj Auto, and Ather Energy picked pace.

As per Vahan data, Ola Electric held 46% market share in the two-wheeler EV space in June.

However, Ola Electric said that despite a reduction in the government subsidies for the EV sector, the gross margin in the auto segment improved 12.5 percentage points YoY to 20.6% in Q2 FY25 due to lower input cost driven by its Gen 2 platform.

“Over Q1 FY25 we had a 3% improvement in gross margins led by the reduction in BOM (bill of materials) cost, offset by 1% investment in growth and a 1.5% impact of partial accrual of PLI due to a difference in timing. Due to our platform approach our gross margins across mass and premium portfolios are broadly in the same range,” said the startup.

Where Did Ola Electric Spend In Q2?

The EV startup’s total expenses jumped almost 22% YoY to INR 1,593 Cr in Q2 FY25. However, it declined almost 14% from INR 1,849 Cr in the preceding June quarter.

Ola Electric posted a consolidated EBITDA margin of -28.4% during the quarter, which it attributed to an exceptional cost to the tune of INR 64 Cr towards warranty and IPO expenses and other one-off costs of INR 36 Cr.

“Excluding one-off costs, operating expenses are marginally lower by 1% QoQ. We’re focusing on cost efficiency and should be able to keep operating expenses constant or even slightly lower as we grow top line, thereby improving operating leverage,” it said.

Its auto segment EBITDA margin, excluding the one-off costs, stood at -12.8%.

Cost Of Materials Consumed: The company spent INR 1,072 Cr under this head as against INR 1,311 Cr in Q1 FY25. However, this spending more than doubled from INR 731 Cr in Q2 FY24.

Employee Cost: Ola Electric’s employee benefit expenses increased 13% QoQ and 23% YoY to INR 139 Cr in Q2 FY25.

Inventories: The company’s change in inventories of finished goods, stock-in-trade and work-in-progress stood at negative INR 108 Cr in the quarter under review, which suggests the company managed to sell fewer escooters than it produced.

Shares of Ola Electric have witnessed a sharp decline in the last three months. The stock fell 2.5% to INR 72.74 on Friday (November 8) ahead of its Q2 earnings announcement. The shares also hit an all-time low at INR 72.53 during today’s trading session.

The Roadmap Ahead

Ola Electric said in its filing that it started trial production of its cells in March 2024 and is on track to use the in-house cells in its EV products starting Q1 FY26.

“We should see continued improvements over the next few quarters with ramp up of Gen 3 and vertical integration of our in-house cell,” it said.

Despite the volatility in its sales, the startup is planning to launch 20 products over the next two years, with at least one new product launch every quarter. Following the recent launch of its electric motorcycles in August this year, the company said that it expects EV penetration to increase at a faster pace in motorcycles compared to scooters since the infra and awareness for EVs have grown.

“Our focus on technology and vertical integration has a roadmap to take steady state margins to above 30% even after incentives fall away… And since Gen 3 ramp-up is starting in January, we should see consistent improvement in gross margin over next few quarters,” it said in its commentary on the path to profitability.

By Inc42 Media

Source: Inc42 Media

Discover more from FundingBlogger

Subscribe to get the latest posts sent to your email.