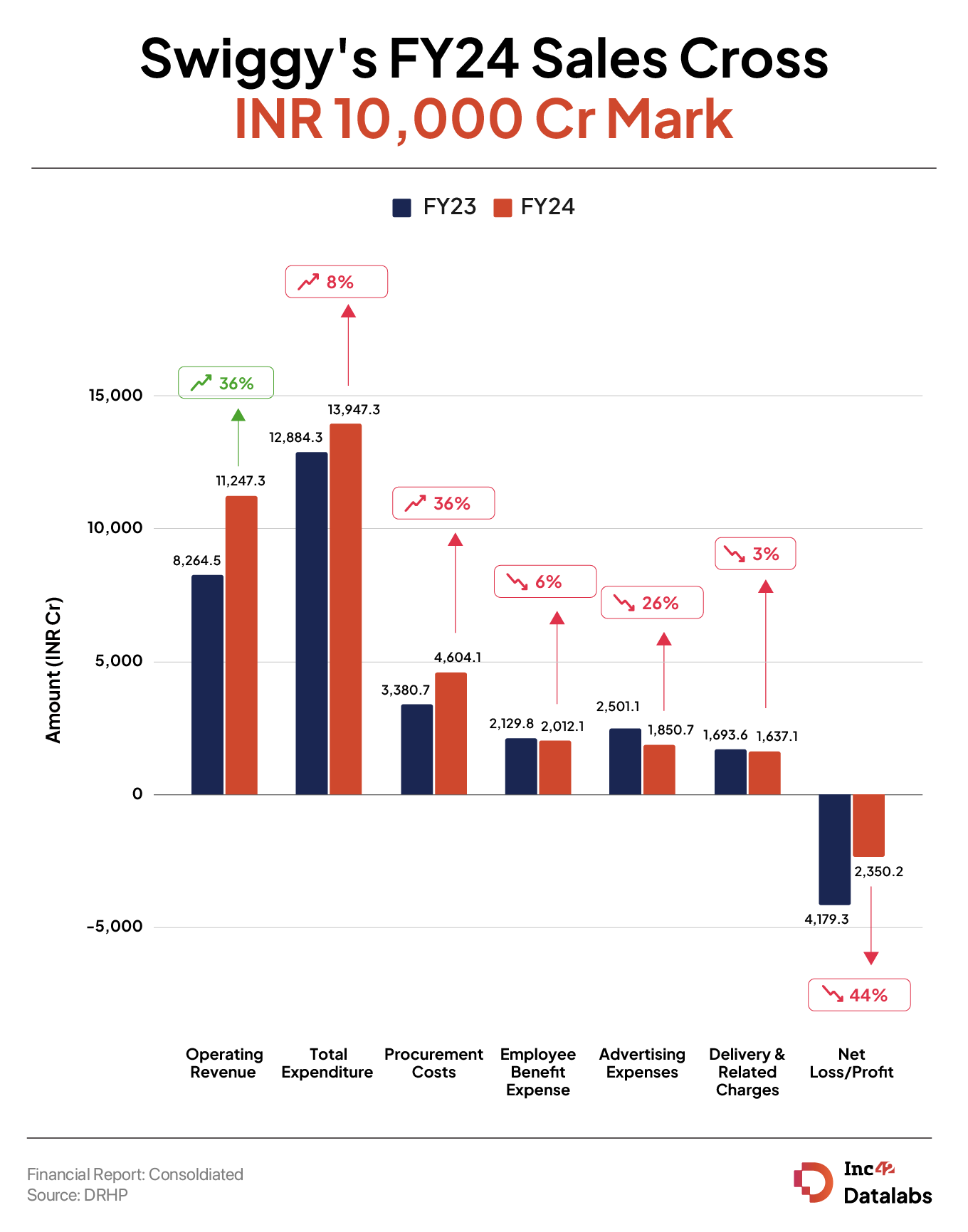

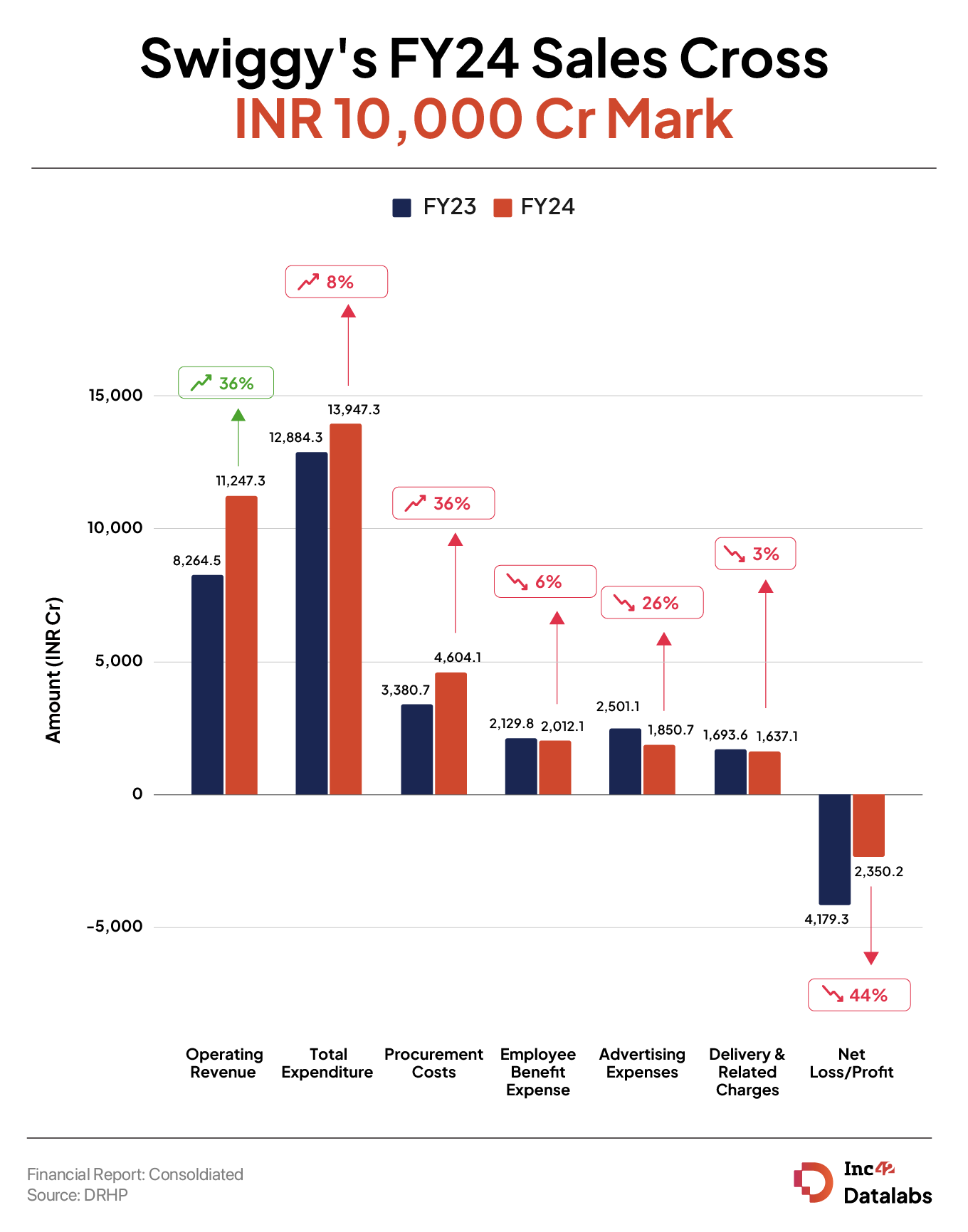

Swiggy incurred a net loss of INR 2,350 Cr in FY24 as against a loss of INR 4,179.3 Cr in the previous year

Operating revenue zoomed 36% to INR 11,247.3 Cr from INR 8,264.5 Cr in FY23

The startup’s EBITDA margin improved to -16.2% in FY24 from -46.4% in FY23

IPO-bound Swiggy

In the first three months of the ongoing financial year – FY25, the Prosus-backed startup reported a loss of INR 611 Cr.

Meanwhile, Swiggy’s operating revenue zoomed 36% to INR 11,247.3 Cr in FY24 from INR 8,264.5 Cr in the previous year, on the back of growth of its quick commerce business – Swiggy Instamart.

Swiggy earns revenue from its food delivery business, quick commerce business, restaurant reservation and events ticketing platform – DineOut and SteppingOut, and supply chain services provided to wholesalers among others.

- The food delivery business generated a total operating revenue of INR 5,160 Cr in FY24, a 25% increase from INR 4,129.9 Cr a year ago

- The quick commerce business reported an operating revenue of INR 978.5 Cr in FY24, almost 2X growth from INR 451.3 Cr in the previous fiscal year

- The out of home consumption business, which comprises DineOut and SteppingOut, posted an operating revenue of INR 157.1 Cr, an increase of 102% from INR 77.6 Cr in FY23

- Swiggy’s platform innovation business, which includes Swiggy Minis, Swiggy Genie, and its private labels, contributed INR 171.9 Cr in revenue, a 46% drop from INR 319.2 Cr in the previous fiscal year

Including other income, the startup reported a total revenue of INR 11,634.3 Cr in FY24, up 33% higher from INR 8,714.3 Cr in the previous fiscal.

In comparison, Swiggy’s listed rival Zomato reported a net profit of INR 351 Crin FY24 on an operating revenue of INR 12,114 Cr.

Where Did Swiggy Spend?

The IPO-bound company managed to control the rise in its expenses. Total expenditure rose a mere 8% to INR 13,947.3 Cr in FY24 from INR 12,884.3 Cr in FY23. In the first three months of FY25, the startup’s total expenses stood at INR 3,907.9 Cr

Procurement Cost: As the startup doubled down on its quick commerce business, Swiggy’s procurement cost was the biggest expenditure in FY24. It accounted for almost 33% of the total expenditure. Procurement cost stood at INR 4,604 Cr in FY24, up 36% from INR 3,380.7 Cr in FY23.

Employee Cost: This was the second largest cost head for Swiggy. However, employee benefit expenses declined 6% to INR 2,012.1 Cr in FY24 from INR 2,129.8 Cr in FY23. Cost of share-based payments stood at INR 596 Cr, a slight increase from INR 533.9 Cr in FY23.

Advertising and Sales Promotion: Like any other startup trying to curb its losses, Swiggy also reduced its advertising expenses by 26% to INR 1,850.7 Cr in FY24 from INR 2,501 Cr in the previous fiscal year.

The startup’s EBITDA margin improved to -16.2% in FY24 from -46.4% in FY23. Adjusted EBITDA loss almost halved to INR 1,835.5 Cr in FY24 from a loss of INR 3,910.3 Cr in the previous year.

Founded in 2014 by Sriharsha Majety, Nandan Reddy, Phani Kishan Addepalli, and Rahul Jaimini, Swiggy started off as a food delivery startup but later forayed into the quick commerce segment with Instamart.

After much anticipation, Swiggy publicly filed its IPO papers or draft red herring prospectus (DRHP) on Thursday (September 26). The public offer will comprise a fresh issue of shares worth INR 3,750 Cr ($450 Mn) and an offer for sale component of around 18.53 Cr shares..

Investors such as Accel, Coatue, Alpha Wave, Elevation, Norwest and Tencent will sell shares as part of the OFS. While Accel India IV (Mauritius) Ltd will offload 1.05 Cr shares, Alpha Wave Ventures will sell 55.73 Lakh shares.

The company plans to utilise the IPO proceeds for marketing and promotion, investing in technology and cloud infrastructure, funding inorganic growth through acquisitions and for general corporate purposes.

By Inc42 Media

Source: Inc42 Media