Startup funding is the life force that turns innovative ideas into thriving businesses. Starting a new business venture requires more than just a groundbreaking idea; it often necessitates adequate funding to transform that idea into a successful reality. In the world of startups, securing funding is a crucial step towards growth and sustainability. So let’s explore the various types of funding for startup businesses.

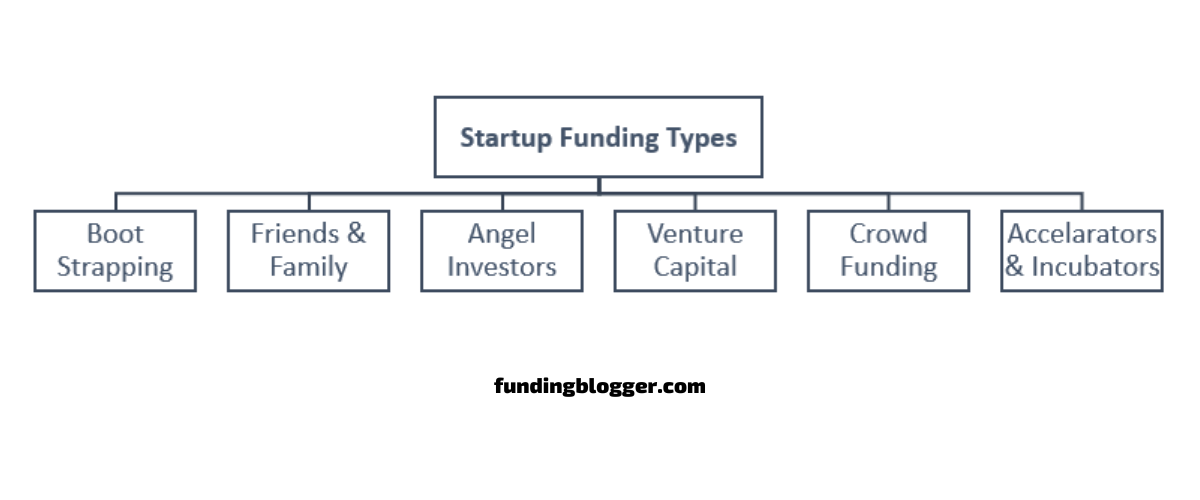

Startup Funding Types:

1.) Bootstrapping:

Bootstrapping is the practise of self-financing a startup with money from personal accounts or by depending on sales generated by the company itself. Bootstrapping gives entrepreneurs complete control and ownership of their business, even though it may restrict the initial scope of operations. Founders who appreciate independence and are prepared to assume the financial risk frequently favour this approach.

2.) Friends & Family:

Entrepreneurs occasionally seek out initial funding from friends and family. The people participating in this form of investment often have personal links and a certain level of trust. Despite the fact that it can be a useful source of early-stage funding, it is crucial to approach such arrangements with clear agreements and reasonable expectations to prevent potential pressures on personal ties.

3.) Angel Investors:

High-net-worth individuals known as angel investors finance enterprises in exchange for stock ownership. These people, who are frequently seasoned business owners themselves, not only contribute money but also mentorship, subject-matter knowledge, and useful networks. Angel investors are frequently involved in a startup’s early phases and can play a key role in boosting growth.

4.) Venture Capital:

Firms that specialise in venture capital finance high-growth enterprises using institutional financing. VCs often make investments in return for shares and take an active role in management and decision-making at the company. They frequently contribute more than just money since they add expertise, experience, and strategic direction in the sector. Startups looking for quick growth and scaling will benefit from venture finance.

5.) Crowd Funding:

Through the use of online platforms, crowdfunding enables business owners to obtain finance by seeking small contributions from a large number of people. With the help of this technique, which taps into the crowd’s collective strength, creators may test their concepts, get input, and raise money. The types of crowdfunding include reward-based, equity-based, and donation-based models, each with their own set of rules and restrictions.

6.) Accelarators & Incubators:

Startups can get investment, mentorship, and resources from accelerators and incubators to help them develop and flourish. In exchange for equity or a set price, these programs frequently provide a defined curriculum, office space, and networking possibilities. Startups that participate in accelerator programs or incubator programs have access to helpful advice, contacts, and investor exposure.

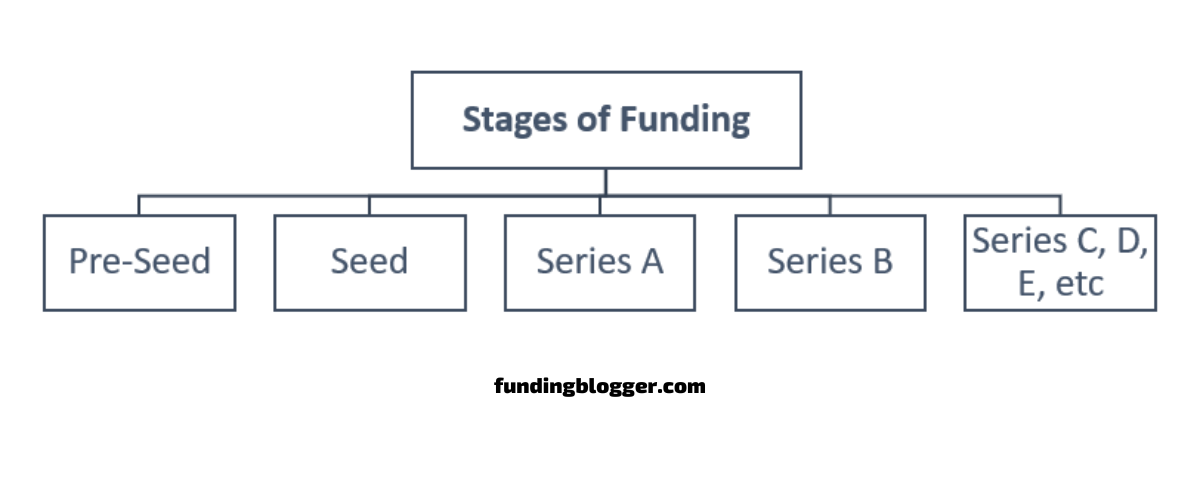

Now that we understood the types of funding, you must be thinking what about Seed funding, Series A funding, etc etc which you might have seen or heard every where. So let me tell you these are stages of funding or you can say funding rounds. So lets see the stages of funding-

Funding Stages / Funding Rounds:

1.) Pre-Seed Funding:

The pre-seed funding round, which often takes place in the ideation or concept phase, is the initial step of investment. It focuses on assisting business owners as they develop their concepts, carry out market research, and create a minimum viable product (MVP). The founder’s personal resources, close friends and family, or angel investors who are eager to invest in promising early-stage firms are common sources of pre-seed investment.

2.) Seed Funding:

After the pre-seed stage, the seed investment round enables firms in moving from the concept stage to the initial stages of product development and market launch. Building a working product, validating the business concept, and luring the first customers all require seed money. Angel investors, early-stage venture capital firms, crowdsourcing websites, and other sources are frequently used to raise funds.

3.) Series A Funding:

The next level of startup funding, known as Series A funding, focuses on growing the company. The firm has probably attained product-market fit at this time, developed traction, and has a growing customer base. Venture capital firms are the main sources of Series A funding, which is used to grow operations, hire key personnel, create marketing plans, and further penetrate the market.

4.) Series B Funding:

Following the Series A round, Series B capital often aims to further accelerate expansion. The firm has probably already shown a considerable increase in sales and a clear route to profitability. The purpose of Series B fundraising is to grow the workforce, upgrade the technology and infrastructure, put money into marketing and sales initiatives, and even look into new markets or acquisition prospects.

5.) Series C, D, E, and Beyond:

Series C, D, E, and other subsequent funding rounds take place as the firm continues to grow and mature. These funding rounds frequently include participation from a combination of venture capital firms, private equity firms, and strategic investors, as well as bigger investment sums. These later-stage investment rounds are used to promote international growth, finance more expansion, streamline operations, and even get ready for an IPO or acquisition.

While there is a broad progression to these funding rounds, it’s crucial to keep in mind that depending on the market, the startup’s growth trajectory, and the industry, the specific stages and funding amounts may change. Every funding round also typically entails negotiations about the company’s value and the proportion of equity that investors will get in return for their participation.